The moment you realize your crypto is gone or locked away, your stomach drops. It’s a gut-wrenching feeling, whether you've forgotten a password, your hardware wallet is on the fritz, or you’re staring at an empty account that’s been drained. Panic is the natural reaction, but it’s also the most expensive mistake you can make.

Those first few hours are absolutely critical. This isn't the time for frantic clicking or desperate password guesses. It's time for calm, methodical evidence gathering.

Your job is to switch from a victim in shock to the lead detective on your own case. Every little piece of information you can find—no matter how insignificant it seems—is a breadcrumb. This "case file" becomes the foundation for everything that follows, whether you tackle the recovery yourself or bring in the pros.

Building Your Recovery Case File

First things first: start documenting everything. Don’t delete messages, don't alter files, and please, don't try to brute-force a password. You could end up corrupting the data or getting locked out for good.

Instead, just collect. Open up a secure, offline document and start logging every detail you can remember or find.

- Wallet Addresses: Jot down every address involved, both sending and receiving.

- Transaction IDs (TXIDs): Find and copy the unique hash for every single transaction related to the loss.

- Timestamps: Note the exact date and time the suspicious activity occurred.

- Communication Records: Screenshot everything. Any chats, emails, or messages with scammers, phony support agents, or exchanges are vital evidence.

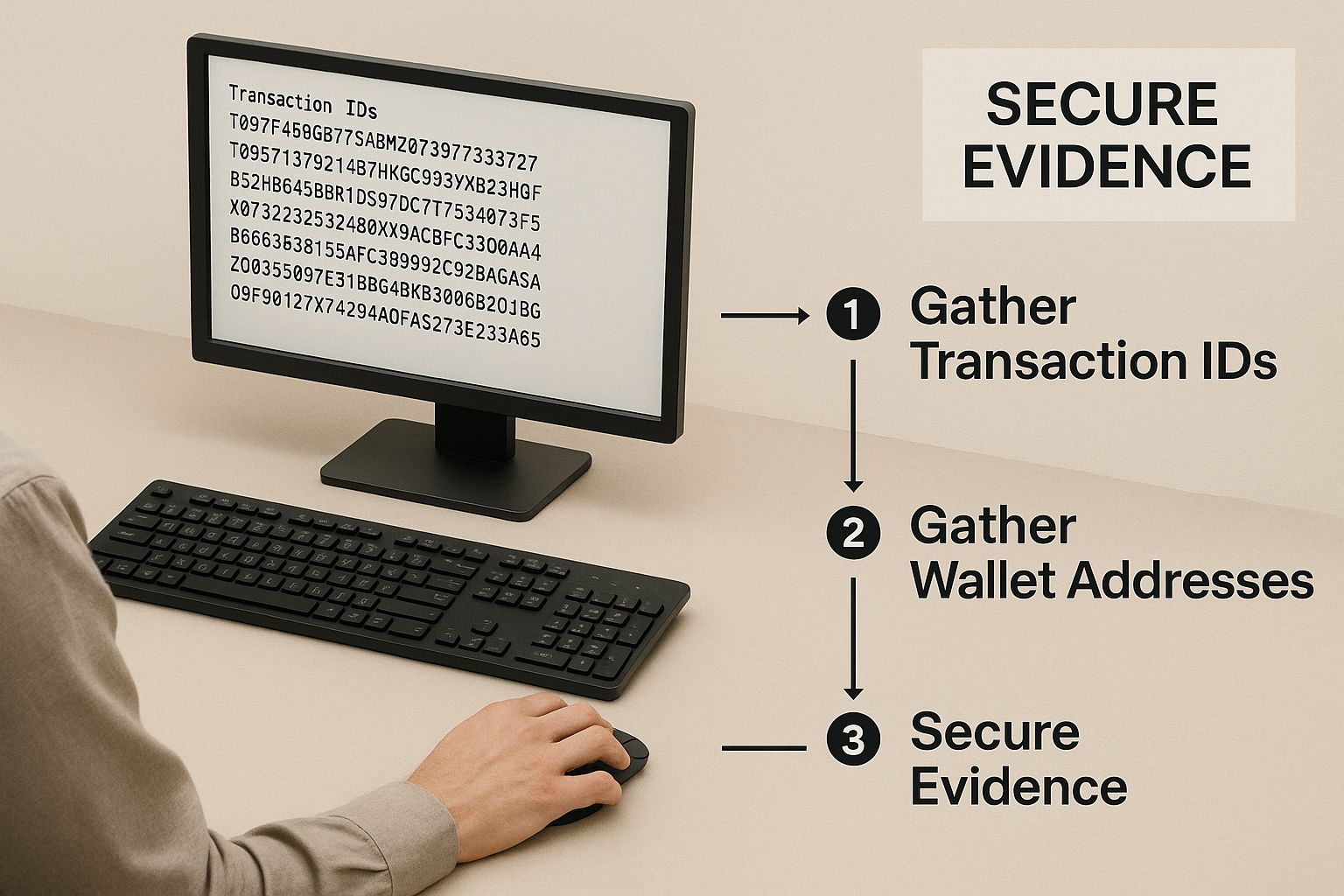

This infographic lays out the crucial first steps for securing your evidence right after you notice a problem.

The visual here really drives home the process: start by gathering transaction data and wallet addresses. This builds a solid base for any real recovery attempt.

Securing Remaining Assets

If you even suspect a hack, your next move is damage control. If you have other funds on that same exchange or in wallets tied to the compromised seed phrase, move them. Now. Get them into a brand-new, secure wallet with a fresh seed phrase that has never, ever been typed into a computer or stored digitally.

The rule of thumb is simple: if one account is compromised, assume everything connected to it is also at risk. Isolating your remaining assets prevents a bad situation from becoming a catastrophic one.

This isn’t just about protecting what's left of your money; it’s about containment. By moving your funds, you cut the attacker off from the rest of your portfolio and create a crystal-clear timeline of the breach for anyone investigating.

To put the problem in perspective, as of 2023, it's estimated that up to 3.8 million Bitcoins are gone forever, locked away in inaccessible wallets. That's nearly 19% of the total supply. It highlights a strange paradox of crypto: as the market grows, so does the risk of losing access. If you're in this boat, you can learn more about specific tactics on how to recover lost Bitcoins and other crypto.

To help you stay focused during a high-stress moment, here’s a quick checklist of what to do immediately.

Immediate Action Checklist for Lost Crypto

When you first suspect a loss, every second counts. This table outlines the critical first steps to secure your assets and preserve evidence. Acting quickly and methodically can make all the difference.

| Action Item | Why It's Critical | Example/Tool |

|---|---|---|

| Isolate the Device | Disconnect the potentially compromised computer or phone from the internet to prevent further unauthorized access or data theft. | Unplug the ethernet cable; turn off Wi-Fi and cellular data. |

| Move Safe Funds | Immediately transfer any remaining assets from related wallets or exchanges to a new, secure, and uncompromised wallet. | Create a new wallet on a clean device using Exodus or a Ledger hardware wallet. |

| Document Everything | Create a detailed log of all transaction IDs, wallet addresses, amounts, dates, and times related to the loss. | Use a blockchain explorer like Etherscan or Blockchain.com to gather TXIDs. |

| Preserve Communications | Take screenshots of all interactions with potential scammers, fake support, or malicious websites. Do not delete anything. | Use your phone or a tool like Snipping Tool/Snip & Sketch on your computer. |

| Change Passwords | Change passwords for your email account and any crypto exchanges you use. Prioritize the email linked to your accounts. | Use a password manager like 1Password to generate strong, unique passwords. |

Following these steps methodically will put you in the best possible position for what comes next.

Once your remaining assets are safe and you’ve gathered your initial evidence, you can finally take a breath and start analyzing what happened. This deliberate approach brings clarity to a chaotic situation and dramatically increases the odds of a successful crypto asset recovery. It gives you—and any experts you bring in—the best possible starting point.

Figuring Out How Your Crypto Went Missing

Before you can even think about getting your crypto back, you have to play detective. The very first step—and honestly, the most critical one—is to figure out exactly how you lost access. Why? Because the strategy for a forgotten password is a world away from tracking down funds stolen in a hack.

Not all crypto losses are the same. They really boil down to two main buckets: user error or malicious activity. Knowing which one you're dealing with will sharpen your focus and save you from chasing dead ends.

User Error vs. Malicious Attacks: What's the Difference?

Let's be real, user error is the most common reason people lose their crypto. It's self-inflicted, which makes it all the more frustrating, but it happens to the best of us. This is everything from forgetting a password to dropping your hardware wallet in a lake.

Malicious attacks, on the other hand, mean someone actively took your funds. These situations are a lot more complicated and often pull you into the world of blockchain forensics, and sometimes, even law enforcement.

Here are a few of the classic scenarios you might be up against:

- Forgotten Password or Passphrase: The age-old problem. You technically still own the crypto, but you've lost the key to the lockbox. Recovery here is all about password cracking or, if you have it, using your mnemonic seed phrase.

- Lost or Damaged Hardware Wallet: Those little Ledger or Trezor devices are tough, but they're not invincible. If yours gets fried or crushed, that seed phrase becomes your only lifeline.

- Misplaced Seed Phrase: Your 12 or 24-word seed phrase is the master key to everything. If you lose it and lose access to your wallet device, your crypto is effectively gone unless you can dig up that phrase somewhere.

- Funds Sent to the Wrong Address: This one hurts. A single typo in a long wallet address can send your funds into the digital abyss. Blockchain transactions are final, making this one of the toughest situations to fix.

Here's the bottom line: if you lost access because of a mistake, your assets are probably still sitting safely in your wallet, just waiting for you to unlock it. If you were hacked or scammed, the funds are gone, and the game changes from access recovery to asset tracing.

Breaking Down Common Thefts and Scams

If you have a sinking feeling that your crypto was stolen, the type of attack is your first clue. Phishing scams, exchange hacks, and shady investment schemes all leave different digital breadcrumbs. Recognizing the pattern is the key to building a recovery plan.

A phishing attack, for instance, is when a scammer tricks you into handing over your private keys. You might get an email that looks like it’s from MetaMask, click a bad link, enter your seed phrase on a convincing but fake site, and poof—your wallet is empty minutes later.

An exchange hack is a different beast entirely. Here, the security at a major platform like Binance or Coinbase was breached, and your funds were stolen while in their care. The exchange usually leads the recovery effort, and your job is to file a claim and provide all the proof you can.

Then you have rug pulls and DeFi scams, which have exploded in recent years. This is where a project looks legit, sucks in investor money, and then the developers vanish, taking all the funds with them and leaving a worthless token behind.

The scale of this problem is just staggering. Crypto theft from rug pulls and scams has skyrocketed, with losses jumping from $1.3 million in 2022 to a whopping $94.8 million in 2024. That’s an increase of over 7,260%. The year 2021 was a bloodbath, with $5.06 billion lost to rug pulls alone. You can read the full research about these crypto crime trends to get a better sense of just how bad it is.

By nailing down whether you're dealing with a simple mistake or a calculated crime, you can start moving forward with a plan that actually makes sense. This initial diagnosis is the foundation for any successful recovery attempt.

Trying Your Hand at Crypto Recovery

Before you even think about bringing in a professional, you should know that some recovery methods are completely within your grasp. This is especially true if your funds aren't stolen but just… stuck. If you’re careful and have the right tools, you might just be able to get back in on your own.

The image above is from the GitHub page for BTCRecover, a well-known open-source tool for getting into locked wallets. Yeah, the command-line interface looks a little scary, but it shows that there are powerful, accessible options out there if you're willing to get your hands dirty.

Your Seed Phrase is Your Master Key

Your seed phrase—sometimes called a mnemonic phrase—is the most powerful tool in your arsenal. It's the skeleton key that can regenerate all your private keys and bring your entire wallet back to life on a brand-new device. If you have those 12 or 24 words, recovery is usually pretty simple.

All you need to do is download a reputable wallet app (like Trust Wallet, Exodus, or the official one for your hardware wallet) onto a clean, secure device. When you set it up, look for an option like "I already have a wallet" or "Import wallet" and just type your phrase in carefully.

Crucial Safety Tip: Never, ever type your seed phrase into a random website or give it to anyone claiming to be from "support." Legitimate wallet providers will never ask for it. This is the #1 way people get their crypto stolen while trying to recover it.

Dealing With Common Hardware Wallet Hiccups

Hardware wallets from Ledger or Trezor are fantastic for security, but they’re not perfect. More often than not, when they act up, it's just a connection issue that a little troubleshooting can solve.

- Swap the USB cable and port: You'd be surprised how often a faulty cable is the culprit.

- Update everything: Make sure your device's firmware and the desktop app (like Ledger Live or Trezor Suite) are on the latest versions.

- Turn off VPNs and firewalls: Sometimes your own security software can block the connection. A temporary disable can fix it.

And if your device is lost or physically broken? Don't panic. As long as you have that seed phrase, you can just buy a new one from the same company and restore your wallet like nothing ever happened.

Using Tools to Crack Your Own Password

Okay, what if you have the wallet file but the password is a total blank? This is where it gets more technical, but it’s far from impossible. Open-source tools like BTCRecover and John the Ripper were built specifically for this situation—brute-forcing your own password.

These programs work by rapidly testing thousands of password combinations based on hints you give them. The more you can remember—the approximate length, any weird characters you used, or words you always fall back on—the better your odds.

For instance, with BTCRecover, you'd create a simple text file with all the words or characters you think might be in the password. The tool then runs that list against your encrypted wallet file. A successful crack can take hours or even days, depending on how complex the password was and how powerful your computer is. You can explore more on the challenges and solutions for a lost cryptocurrency wallet in our complete guide.

But going down this road comes with some serious risks.

The Dangers of DIY Password Cracking

- Malware: Downloading recovery tools from sketchy websites is a great way to infect your computer with malware designed to steal your wallet file and any recovered passwords. Always get the software directly from the official GitHub page or developer's website.

- File Corruption: One wrong move or a bug in the software could corrupt your

wallet.dator keystore file, making things even worse. Work on a copy of your original wallet file. Never, ever touch the original. - Data Exposure: Running these tools on an internet-connected computer is asking for trouble. The safest way is to use a totally offline, or "air-gapped," machine for the entire recovery attempt.

Trying to recover your own crypto can be incredibly rewarding and save you a lot of money, but it demands your full attention to security. Once you understand the tools and the risks, you can make a clear-headed choice about whether to tackle it yourself or call in the experts.

How to Choose a Legitimate Recovery Service

When your own recovery attempts hit a dead end, especially after a theft, bringing in a professional is the logical next move. But here's the harsh reality: the moment you become a victim, you also become a target. The crypto recovery space is absolutely swimming with scammers ready to prey on your desperation.

These bad actors will exploit your anxiety, promise you the moon, and often vanish the second they get a hefty upfront fee. Learning to spot the difference between a real expert and a fraudster isn't just a good idea—it's the single most important thing you can do to avoid getting burned a second time.

The Upfront Fee Red Flag

Let’s get right to it. The biggest, most glaring giveaway of a scam is a demand for a large payment upfront. Any reputable crypto recovery firm I've ever dealt with works on a success-based model. Their pay is tied directly to their ability to get your money back.

This is usually called a contingency fee. They’ll take a pre-agreed slice of the recovered assets, typically somewhere between 10% and 40%, depending on how messy the case is. This setup means their interests are perfectly aligned with yours. They only make money if you do.

You should be extremely skeptical of anyone asking for thousands of dollars before a single thing has been done. While a small, reasonable fee for a consultation or case setup might be legitimate, a massive non-refundable deposit is a deal-breaker.

Verifying Their Process and Claims

A real service won't be cagey about its methods. They should be able to walk you through their process in a way that makes sense, even if you’re not a blockchain wizard.

When you get them on the phone, ask some direct questions:

- What’s your exact methodology? They should be able to clearly explain how they use blockchain analytics, open-source intelligence (OSINT), and legal strategies without just throwing jargon at you.

- Can you show me some verifiable case studies? Client confidentiality is key, of course, but they should have anonymized examples of successful recoveries they can point to.

- Do you work with law enforcement? Established firms often have relationships with agencies like the FBI or Interpol, which is a huge mark of credibility.

If their answers are vague or they try to brush off your questions, it’s a sign they might not have a real process at all. True experts are also educators; they want you to understand the path forward.

A legitimate recovery specialist will never, under any circumstances, ask for your seed phrase or private keys. Their work is done "on-chain" by tracing transactions, not by getting into your wallet. Anyone who asks for your keys is trying to rob you. Period.

The scale of this problem is staggering. In 2024, global losses to crypto scams blew past an estimated $15 billion. Despite that, the legitimate recovery industry has matured, with top-tier firms now seeing success rates between 30% and 50%. It proves that recovery is possible, but only with genuine expertise. You can get a clearer picture of the current state of crypto recovery and success rates in 2025 to better understand the landscape.

Spotting Common Recovery Scams

Scammers aren't very creative; they tend to follow the same playbook. Knowing their tactics is your best defense.

| Red Flag | Why It's a Problem |

|---|---|

| Guaranteed Success | No legitimate crypto recovery is 100% guaranteed. The process is complicated and hinges on factors completely outside the recovery team's control. Anyone promising a sure thing is just using a cheap sales tactic. |

| Unsolicited Contact | Did someone slide into your DMs on Telegram or X (formerly Twitter) moments after you posted about your loss? Scammers are vultures who monitor social media for victims and pounce with unsolicited "help." |

| Pressure Tactics | They'll create a false sense of urgency, telling you to pay right now or the funds will be gone forever. A real professional will give you the time and space you need to make a decision. |

| Vague Online Presence | A legitimate company has a professional website, a physical address (even if it's a remote-first company), and a history of public engagement. A flimsy, anonymous digital footprint is a huge warning. |

Choosing the right partner for your crypto recovery is a high-stakes decision. Don’t rush it. Do your homework, ask the tough questions, and trust your gut. A methodical, skeptical approach is the best way to filter out the con artists and find an expert who can genuinely help you get back what’s yours.

When your crypto is gone because of a major hack, a clever scam, or outright fraud, you're suddenly playing in a different league. This is often the point where handling it yourself is no longer enough. Bringing in law enforcement and legal professionals isn't just a good idea—it's usually the only way forward.

But let's be real: this process can be slow and feel overwhelming. You have to shift your mindset. The crypto world moves at light speed, but government agencies and legal systems operate on a timeline measured in months, sometimes even years. Your best tools in this fight are patience and incredibly detailed records.

Who to Call and How to Report the Crime

Your first official move is to file a report with the right people. In the U.S., your main destination is the FBI's Internet Crime Complaint Center (IC3). Think of this as the central station for all things cybercrime. Filing a report here gets your case into a system that federal, state, and local law enforcement can access.

This is where all the meticulous note-taking you did earlier pays off. When you file with the IC3, you need to hand over everything from your "case file." Be ready with:

- Transaction IDs (TXIDs) for every single fraudulent transfer.

- Wallet addresses—both yours and the ones the funds were sent to.

- Precise dates and times for all suspicious activity.

- Screenshots of chats, emails, or any other communication with the scammer.

The more organized and thorough you are, the better. A clean, well-documented report is much more likely to get a serious look from investigators. It gives them a solid starting point to work from.

It's critical to set your expectations straight from the beginning. Law enforcement's main goal is usually to take down the entire criminal operation, not just to get your specific funds back. Getting your crypto back can happen, but it’s often a fortunate byproduct of a much larger investigation.

The Power of Blockchain Analytics Firms

Law enforcement agencies aren't combing through the blockchain by hand. They rely heavily on specialized private firms like Chainalysis and TRM Labs. These companies are the digital bloodhounds of the crypto world. Their powerful software can trace the flow of stolen funds, even through complex laundering services like mixers, and connect anonymous wallet addresses to real-world entities like crypto exchanges.

This partnership is the key. Once an analytics firm identifies that your stolen funds have landed at an exchange, law enforcement can step in with subpoenas or seizure warrants to have those assets frozen. This public-private collaboration is the backbone of nearly every successful crypto recovery operation today.

For anyone who's lost a significant amount, understanding how to recover stolen cryptocurrency means getting familiar with this complex world of high-tech investigation and legal maneuvering.

Reporting Crypto Theft to Authorities

Knowing who to contact can make all the difference. The table below breaks down the key agencies and what they'll need from you.

| Agency/Entity | When to Contact | Information to Prepare |

|---|---|---|

| FBI (IC3) | Immediately for any cybercrime, fraud, or scam originating in the U.S. or involving U.S. citizens. | Transaction IDs (TXIDs), wallet addresses, dates, times, amounts, and all communications with the perpetrator. |

| Local Police Department | If you have information about the perpetrator's physical location or if the theft involved a physical threat. | A copy of your IC3 report, along with any local-specific details like names, addresses, or phone numbers you might have. |

| SEC (TCR Complaint) | If the theft involved an unregistered security, ICO, or investment fraud. | Details about the investment offering, promotional materials, websites, and names of individuals/companies involved. |

| FTC (ReportFraud.ftc.gov) | For general consumer fraud, romance scams, or business imposters involving crypto payments. | A narrative of what happened, contact information for the scammer, payment details, and any websites or social media profiles used. |

Filing reports can feel redundant, but each agency has its own jurisdiction and focus. The more official reports you file, the wider the net you cast.

Do You Need a Digital Asset Lawyer?

While law enforcement tackles the criminal investigation, you might need someone in your corner fighting for your financial interests. That's where a lawyer specializing in digital assets comes in. They can be a game-changer in a few key situations.

You should seriously consider hiring an attorney if:

- Your stolen crypto gets frozen at an exchange. A lawyer can work directly with the exchange’s legal team to formally stake your claim to the funds.

- You need to take civil action. If the investigation uncovers the identity of the person who stole from you, a lawyer can help you file a lawsuit to get your money back.

- The theft involves multiple countries. Crypto crime is global. A lawyer who understands international law is essential for navigating the legal complexities.

A good crypto lawyer can draft preservation letters to exchanges, file court injunctions to freeze assets, and make sure your case doesn't fall through the cracks. They become your personal advocate. This two-front approach—official law enforcement reports combined with private legal action—gives you the strongest possible chance of seeing your assets again.

Common Questions About Crypto Recovery

Losing crypto is stressful enough. The last thing you need is a bunch of confusing or misleading answers when you're trying to figure out what to do next. Let's cut through the noise and tackle some of the most pressing questions we hear from people in your exact situation.

Getting straight answers is the first step toward making a smart move. A little bit of knowledge here goes a long way in avoiding bigger headaches down the road.

How Much Does a Legitimate Crypto Recovery Service Cost?

This is usually the first question on everyone's mind, and for good reason—the answer tells you a lot about who you're dealing with.

Reputable crypto recovery firms almost always work on a contingency basis. This means they only get paid if they successfully recover your funds. Their fee is a percentage of what they get back for you, typically ranging from 10% to 40%, depending on how complex the case is.

This success-based model is critical because it aligns their interests with yours. If you don't get your crypto back, they don't get paid. Simple as that. You should be immediately suspicious of anyone demanding a large, non-refundable upfront fee. It's one of the oldest tricks in the scammer's playbook. A small, reasonable fee for an initial consultation might be okay, but the real payment should always be tied to success.

Can I Get Back Crypto Sent to the Wrong Address?

This is, unfortunately, one of the toughest situations to be in. Blockchain transactions are designed to be final and irreversible. There's no "undo" button or "cancel payment" feature like you might find with your bank. Once a transaction is confirmed, it's set in stone.

Your chances of getting the funds back hinge on one thing: your ability to identify and contact the owner of the wallet you sent them to.

- If you know the owner: The only path forward is to reach out and ask them to send the funds back. It's entirely up to their goodwill.

- If you made a typo: If the address was a simple mistake and doesn't belong to an active wallet, those funds are likely gone for good, locked in a digital black hole.

- If you sent it to an exchange: If the destination address belongs to a major exchange like Coinbase or Binance, contact their support team immediately. Give them the transaction ID and every detail you have. There are absolutely no guarantees, but they might be able to help if the funds landed in a wallet they control.

How Do I Spot and Avoid Recovery Scams?

The moment you lose crypto, you become a magnet for another type of predator: the recovery scammer. These people patrol social media and forums, looking for victims to exploit with hollow promises.

The golden rule is simple: If an offer of 100% guaranteed success sounds too good to be true, it is. No legitimate recovery professional can guarantee a specific outcome. There are just too many variables at play.

To keep yourself safe, you need to be methodical and skeptical.

- Never Pay a Big Fee Upfront: We've said it before, but it's the most important red flag. Legitimate firms operate on a success-based fee model.

- Never Share Your Private Keys or Seed Phrase: A real expert will never ask for the keys to your kingdom. Their work is done through on-chain analysis and tracing, not by logging into your wallet. Anyone who asks for your seed phrase is trying to rob you, period.

- Be Wary of Unsolicited Offers: Did some "recovery expert" just slide into your DMs on Telegram or X moments after you posted about your loss? It’s a scam. Ignore them.

- Do Your Homework: A real recovery service will have a professional website, a clear process, and verifiable results or testimonials. Look for a track record and a presence in the security community.

By knowing what to look for—and what to run from—you can navigate this difficult process with a much clearer head and avoid making a bad situation even worse.

At Wallet Recovery AI, we provide specialized, AI-enhanced assistance to help you regain access to your lost or locked wallets. Our process is secure, discreet, and designed to maximize your chances of success without compromising your privacy. If you need help with a forgotten password or an inaccessible wallet, submit your case for a confidential assessment.

Leave a Reply