So, you've lost access to your crypto wallet. It’s a gut-wrenching feeling, like watching a safe slam shut with no way to get back in. Your first move is probably a frantic search for help, but that's where things get tricky.

You’re about to step into the Wild West of crypto recovery, a space filled with both genuine forensic wizards and scammers just waiting to prey on your desperation.

Navigating the High-Stakes World of Crypto Recovery

Telling the good guys from the bad guys is your most important job right now. A real crypto recovery expert—usually someone with a serious background in cybersecurity or blockchain forensics—will never promise you the moon. They deal in facts, not fantasy.

Instead, they’ll give you a straight, honest assessment of your situation. They use sophisticated tools to trace transactions, identify where things went wrong, and often work directly with law enforcement. It's a methodical process, not magic.

What Are the Real Odds? Setting Realistic Expectations

Let’s be clear: not all lost crypto can be found. It’s a hard truth, but an important one. The chances of success swing wildly depending on what happened. Was your wallet emptied in a phishing scam? Or did you just forget a password? The answers matter.

The industry has gotten a lot better, but the threat is bigger than ever. Losses from crypto scams are expected to rocket past $15 billion in 2024. Despite that grim number, there's reason for cautious optimism. Reputable recovery firms often report success rates between 30% and 50% for the cases they agree to take on. And across the board, the average recovery rate is now hovering around 70%, a huge leap forward driven by better teamwork between private firms, law enforcement, and blockchain analytics companies. If you want to dig deeper into the data, you can discover more insights about the state of crypto recovery from i-ric.org.

Here's the most important thing to remember: A genuine expert is transparent. They'll walk you through their methods, explain the legal roadblocks, and give you realistic odds without hitting you with a massive upfront fee.

What a True Professional Actually Does

A real expert’s work is far more than just a lucky guess. They follow a clear, repeatable process that usually involves a few key things:

- Deep Blockchain Analysis: They become digital bloodhounds, tracing the stolen funds across public ledgers to pinpoint where they ended up.

- Legal Coordination: They team up with lawyers and law enforcement to get court orders that can freeze your assets if they’re sitting on a centralized exchange.

- Evidence Compilation: They meticulously gather every piece of the puzzle—transaction IDs, chat logs, scammer communications—to build a rock-solid case.

Their entire goal is to follow a verifiable digital paper trail and use official channels to apply pressure. It’s a world away from the empty promises of scammers offering instant, too-good-to-be-true solutions.

How to Properly Vet a Crypto Recovery Service

When you're desperate to get your crypto back, it's easy to fall prey to a scammer. They’re masters at targeting people in stressful situations. The trick is to slow down, take a breath, and vet any potential "expert" with a healthy dose of skepticism. Don't let panic push you into a decision you'll regret.

Right off the bat, if anyone promises 100% guaranteed success, run the other way. That's a massive red flag. Real crypto recovery is complex, and no honest professional can make that kind of promise. They'll give you a realistic assessment, not a fairy tale. The same goes for anyone demanding a huge upfront fee before they've even touched your case.

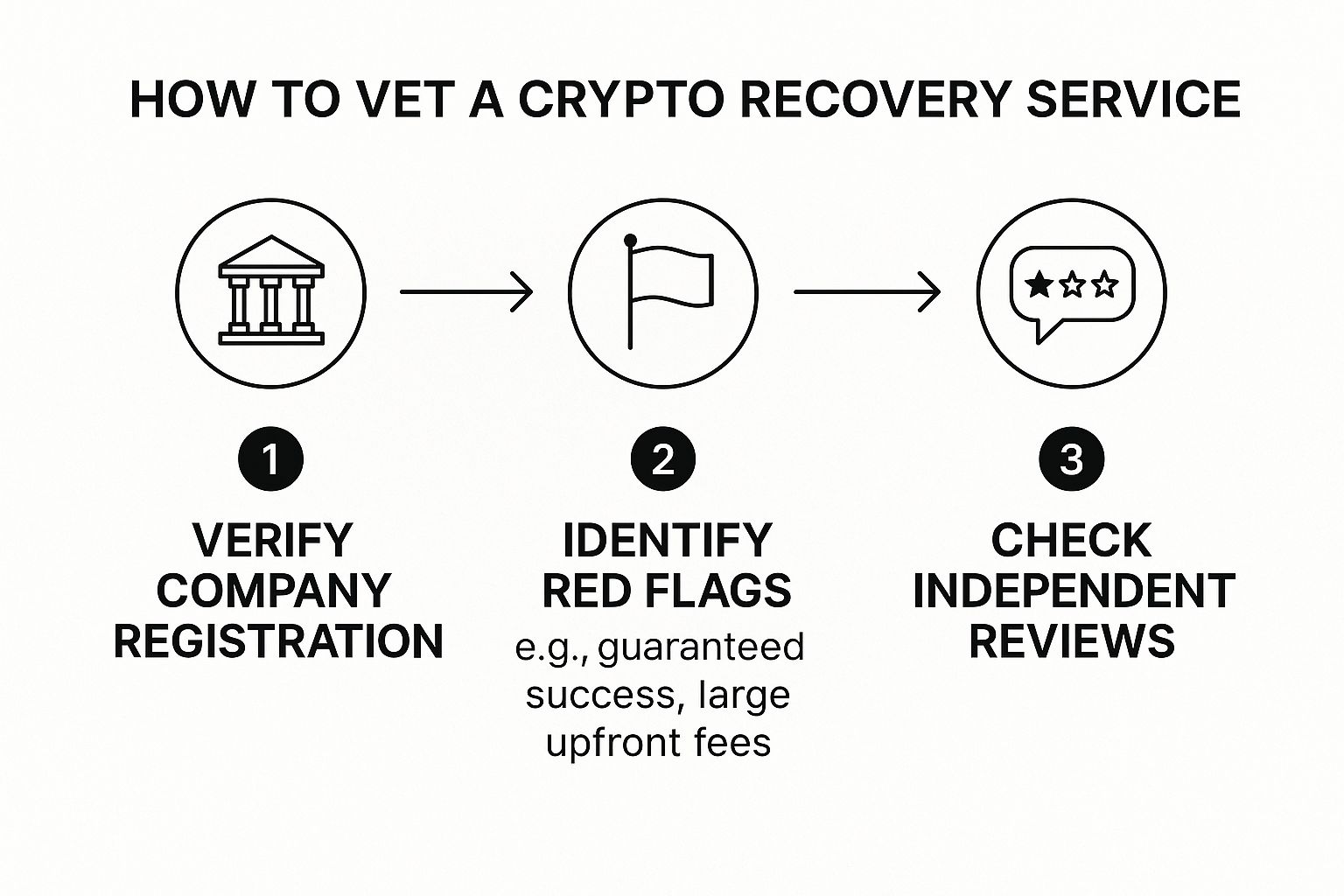

This infographic breaks down a simple, three-step process for vetting a service to keep yourself safe.

Think of it as a funnel: you start by verifying their legitimacy, then you actively look for warning signs, and finally, you confirm they have some real-world social proof. Following these steps helps you weed out the bad actors before you waste your time—or worse, your money.

Digging Deeper Than the Website

A slick website is just that—a website. It means nothing if there's no substance behind it. Start by looking for a registered business and a physical office address. While plenty of legitimate services work remotely, a total lack of a physical footprint is a huge warning sign. It’s a basic first step to separate a real company from some anonymous person on the internet.

Next, you need to go hunting for independent reviews. Ignore the glowing testimonials plastered all over their own site; they're probably fake. Instead, search for them on places like Trustpilot, Reddit, or other crypto forums. What are actual customers saying? Do you see a pattern of complaints about hidden fees, ghosting after payment, or just plain incompetence?

A genuine service will have a verifiable digital footprint beyond its own marketing materials. The absence of independent discussion or a history of negative feedback are clear signals to walk away.

Key Differences Between Legitimacy and Scams

To help you tell the good guys from the bad, I've put together a quick checklist. It boils down to a few key operational differences. For instance, a professional will want to understand the specifics of your situation before even mentioning a price. A scammer, on the other hand, will pressure you for payment almost immediately. You can see how a legitimate process should work by reviewing how a professional recovery service on walletrecovery.ai is structured.

Here’s a simple table to help you spot the differences at a glance.

Legitimate Expert vs. Recovery Scam Checklist

This table highlights the stark contrast between a professional service and a common scam. Keep these points in mind during your evaluation.

| Attribute | Legitimate Recovery Expert | Common Recovery Scam |

|---|---|---|

| Payment Model | Usually contingency-based ("no win, no fee") or a small diagnostic fee. | Demands a large, non-refundable payment upfront. |

| Success Claims | Provides a realistic, transparent assessment of the recovery odds. | Guarantees 100% success or promises impossibly fast results. |

| Communication | Professional, transparent, and offers consistent updates on progress. | Vague, uses high-pressure sales tactics, or disappears after payment. |

| Identity | Operates as a registered company with a verifiable address and history. | Anonymous operators with no physical presence or verifiable credentials. |

Ultimately, a legitimate expert operates like any other professional service—with transparency, clear communication, and a realistic approach. A scammer will try to exploit your desperation with big promises and pressure tactics. Trust your gut. If it feels off, it probably is.

What the Crypto Recovery Process Actually Looks Like

So you've done your homework and picked a crypto recovery expert you trust. What happens next? This isn't about pushing a button and getting your funds back; it's a methodical investigation, and it starts with you gathering every shred of evidence you can find.

This first step is absolutely crucial. Your specialist will need everything you've got: transaction IDs (hashes), the wallet addresses involved, exact timestamps, and any messages you have, like emails or chat logs. Think of yourself as building a case file. The more detail you can provide, the better the odds of a successful trace.

Following the Digital Breadcrumbs

Once you've handed over the evidence, the real forensic work begins. The expert will fire up specialized blockchain analysis tools to start tracing where your stolen funds went. This goes way beyond just plugging an address into a public block explorer. They're mapping out complex transaction chains, spotting intermediary wallets, and searching for patterns that could point to the culprits.

The goal is to follow the money until it hits a dead end or, ideally, an identifiable service like a centralized exchange. But criminals have gotten smarter. By Q2 2025, only 15% of illicit funds were sent directly to exchanges. That's a huge drop from 40% in previous years, mostly because thieves now use mixers and chain-hopping to muddy the waters. This is exactly why you need a professional, as you can see in this detailed report about seizable crypto assets from Chainalysis.

Constant communication is the hallmark of a legitimate recovery process. You should expect regular, transparent updates on what’s been found, what the next steps are, and any roadblocks encountered. Silence is a significant red flag.

Bringing in the Law

If the trace leads to an exchange or another regulated entity, the process shifts from technical to legal. Your recovery expert, often alongside their legal partners, will package the evidence and present it to the appropriate law enforcement agencies.

This collaboration is what gets the ball rolling on subpoenas or court orders, which can legally compel an exchange to freeze the assets. It's a delicate dance that takes time and a solid grasp of different jurisdictional laws. You can learn more about how this works by checking out our guide on comprehensive crypto asset recovery. A successful seizure is the final major hurdle before the funds can be returned to their rightful owner—you.

So, Can You Actually Get Your Crypto Back? A Reality Check

First things first: you need to understand how you lost access to your crypto. The way it disappeared completely changes the odds of ever seeing it again.

Let's be blunt: a forgotten password for a wallet file gathering dust on an old laptop is a world away from a sophisticated phishing attack. One is a technical puzzle waiting to be solved; the other is a crime that likely involves international money laundering. Knowing the difference sets your expectations straight from the start.

Locked Out vs. Stolen: The Two Sides of Crypto Loss

Technical problems, as infuriating as they are, generally have a much better prognosis. In these cases, your crypto isn't gone—it's just locked in a digital safe, and you've misplaced the key. A recovery expert is essentially a master locksmith.

This bucket includes situations like:

- Corrupted Wallet Files: Sometimes, the data is just jumbled, not destroyed. An expert can often piece it back together.

- Forgotten Passwords: This is where brute-force software shines, methodically trying millions of combinations.

- Broken Hardware Wallets: If you have your seed phrase, you're golden. If not, it's a long shot, but sometimes a hardware specialist can work some magic on the physical device.

Outright theft, on the other hand, is a frantic race against the clock. The second your funds are swiped, the criminals start "chain hopping"—a fancy term for jumping between different blockchains and using mixers to muddy the waters. Here, a recovery expert’s job is less about locksmithing and more about digital forensics.

The type of scam is everything. A compromised account on a major exchange that requires ID verification (KYC) leaves a paper trail for law enforcement. An anonymous romance scammer who convinces you to send Monero is a ghost in the machine.

Unfortunately, these scams are everywhere. The US has been hit particularly hard, with the FBI reporting that Americans lost a mind-boggling $9.3 billion to crypto scams in 2024 alone. The usual suspects are investment fraud, phishing links, and romance scams. As you might guess, your chances of recovery plummet with every hour that passes. You can see the full breakdown of crypto scam trends at elliptic.co for more on this.

Ultimately, the only way to know where you stand is to get a professional assessment. Be ready to spill every single detail of what happened. Trust me, it all matters.

Your First Moves After Realizing Your Crypto Is Gone

It’s a feeling I wouldn’t wish on anyone. That gut-punch realization your crypto is gone. Your mind starts racing, and it's easy to panic. But what you do in these first few minutes is absolutely critical.

You have to understand, the thieves are already working against you. They're likely moving your funds through a complex web of transactions—a technique called "chain hopping"—to muddy the trail. Every second counts. Your first job is to shift from victim to evidence collector.

Assemble Your Evidence Dossier

Before you even think about contacting a recovery specialist, you need to get your house in order. Any legitimate cryptocurrency recovery expert is going to ask for this information right away, and having it ready saves precious time.

Think of it as building a case file. You need to gather:

- All wallet addresses involved—yours, the scammer's, any intermediary ones.

- The transaction IDs (hashes) for every single transfer.

- Precise timestamps of when the transactions occurred.

- Every shred of communication you had with the scammer. I’m talking emails, chat logs, social media DMs, everything.

Don't dismiss anything as unimportant. A single detail could be the key that a forensic investigator needs to trace your funds. Take screenshots of everything, because scammers are notorious for deleting their accounts and messages to cover their tracks.

Critical Warning: Whatever you do, do not contact the scammer again. Re-engaging them only opens the door to more manipulation or further losses. It also tips them off that you're on to them, which might make them launder the funds even faster.

Who to Report the Theft To

Once your evidence is organized, it's time to sound the alarm. Making official reports creates a paper trail and gets the incident on the radar of authorities who have the power to freeze assets if they land on a centralized exchange.

File reports with these agencies as soon as possible:

- Law Enforcement: If you're in the United States, your first stop is the FBI’s Internet Crime Complaint Center (IC3). People in other countries should report to their national cybercrime agency.

- Crypto Exchanges: If the stolen funds came from or were sent through an exchange like Coinbase or Binance, notify their fraud department immediately. They can often freeze accounts involved in illicit activity.

- Financial Regulators: It’s also wise to report the scam to agencies like the Federal Trade Commission (FTC) or the Commodities and Futures Trading Commission (CFTC).

Getting these initial steps right is foundational. It provides the documentation and legal groundwork you’ll need before you start the process of vetting a professional recovery service.

Common Questions About Crypto Recovery

When you realize your crypto might be gone, your mind races. It's a gut-wrenching feeling, and you're suddenly flooded with questions. Before you make any moves, you need clear, honest answers. Let's walk through some of the most common things people ask when they're thinking about hiring a recovery expert.

What's This Going to Cost Me?

This is usually the first question on everyone's mind, and for good reason. You don't want to throw good money after bad.

Legitimate services almost always work on a contingency fee basis. Simply put, they don't get paid unless you get your crypto back. This fee is a percentage of whatever they recover, typically falling somewhere between 10% and 30%.

Some pros might ask for a small, flat fee upfront to cover an initial deep-dive analysis of your case. That’s reasonable. What’s not reasonable is someone demanding thousands of dollars before lifting a finger. That’s a massive red flag and often the sign of another scam.

Can You Actually Get Stolen Crypto Back?

The honest answer? It's possible, but there are absolutely no guarantees. Anyone who promises a 100% success rate is lying.

Success really boils down to a few critical factors: what kind of scam it was, how fast you act, and where the funds ended up. If the thief moved your crypto to a major, regulated exchange that requires KYC (Know Your Customer) verification, your chances are significantly better.

The truth is, blockchain tracing can follow the money trail, but getting it back requires quick legal intervention. Freezing the assets before they hit a crypto mixer or get swapped for a privacy coin is the whole ballgame. This is where cooperation from exchanges and law enforcement becomes essential.

How Long Does This Whole Process Take?

There's no simple answer here. The timeline can be anything from a few weeks to well over a year.

- Simple Cases: If we trace the funds to a cooperative exchange and the legal path is clear, things can move relatively quickly.

- Complex Cases: If we're dealing with international jurisdictions, funds funneled through privacy coins, or sophisticated laundering tactics, you're looking at a much longer, more involved fight.

Patience is your best friend here. A proper, thorough investigation can't be rushed. Cutting corners just leads to mistakes and dead ends.

What Info Do I Need to Hand Over?

The more evidence you have, the better. Think of it as building a case file. Your cryptocurrency recovery expert will need a complete picture to even begin their forensic work.

Get ready to provide:

- Transaction IDs (hashes) for every single transfer involved.

- Wallet addresses for both you and the scammer.

- Exact timestamps for the transactions.

- Every piece of communication you had with the scammer—emails, chat logs, text messages, everything.

This information is the bedrock of the entire investigation. It's what allows a professional to build a solid case to take to financial institutions and law enforcement agencies.

If you're facing a locked wallet and need professional, discreet assistance, Wallet Recovery AI uses advanced, AI-driven techniques to help you regain access. Find out how we can help you at https://walletrecovery.ai.

Leave a Reply