That sinking feeling in your stomach when you realize you've been scammed is something I wouldn't wish on anyone. It's a gut-wrenching mix of panic, anger, and confusion. In those first few hours, your instincts might scream at you to do something—anything—but the most powerful response is a calm, methodical one. Acting fast, but smart, is absolutely crucial for any hope of cryptocurrency scam recovery.

Your First 24 Hours After a Crypto Scam

Forget about confronting the scammer or trying to reverse the transaction—that ship has sailed. The name of the game now is damage control and evidence preservation. This isn't about placing blame; it's about building a case and protecting what you have left.

Your number one priority is to stop the bleeding. If the scam involved compromising a wallet or giving someone remote access to your computer, you have to assume everything connected to it is tainted. Don't hesitate. Immediately create a brand-new, secure wallet on a completely different, clean device and move any funds you still have access to. Scammers are notorious for coming back to drain any remaining dust, so every second really does count.

The Immediate Action Checklist

To make this less overwhelming, here’s a quick-reference table of what to do right now. Think of this as your emergency checklist—print it out, save it, do whatever you need to, but follow these steps methodically.

| Action | Why It Is Critical | Real-World Example |

|---|---|---|

| Move Remaining Funds | To prevent further losses. The scammer might still have access to the compromised wallet or device. | You were tricked by a fake staking site. Immediately move your remaining ETH from that MetaMask wallet to a new one on a secure computer. |

| Collect Transaction IDs | The TxID is the non-negotiable proof of the transaction on the blockchain. It's the starting point for any trace. | In your wallet history, find the outgoing transaction to the scammer. Copy the long alphanumeric string labeled "TxID" or "Hash." |

| Screenshot All Chats | Scammers often delete their accounts or messages. Screenshots are permanent proof of their promises and threats. | The scammer contacted you on Telegram. Screenshot the entire conversation, including their username and profile picture, before they block you. |

| Save All Scammer Details | Wallet addresses, website URLs, and social profiles are vital clues for investigators to link cases. | You fell for a phishing email. Save the email itself, the sender's address, and the URL of the fake exchange it linked to. |

Taking these steps turns a chaotic situation into a structured evidence-gathering process, which is exactly what you need to begin any formal recovery attempt.

Document Everything Like a Detective

Once your remaining assets are safe, it's time to become an obsessive record-keeper. Open up a document and start logging every single detail you can remember. This isn't just for your own peace of mind; this collection of evidence is the foundation for any report you file with law enforcement or a recovery service.

Here's the evidence that truly matters:

- Transaction IDs (TxIDs): I can't stress this enough—this is the most important piece of evidence. It's the public receipt on the blockchain that proves where your money went and when.

- Scammer's Wallet Addresses: Make a clean list of every single address you sent funds to.

- Communication Records: Gather every screenshot from Telegram, WhatsApp, emails, or social media DMs. Do not delete anything.

- Websites and Profiles: Save the links to any fake websites, social media accounts, or fraudulent platforms you interacted with.

It feels like a painful chore when you're reeling from the loss, but this meticulous documentation is what separates a vague complaint from a credible case that investigators can act on. For a more detailed breakdown of the evidence you'll need, check out this guide on how to recover lost cryptocurrency.

“The transaction ID is your digital paper trail. Without it, tracing stolen funds is nearly impossible. Preserving this, along with every message and wallet address, is the first and most critical step toward any chance of recovery.”

Identify the Scam's Fingerprint

Now, take a step back and try to categorize what happened. Was it a too-good-to-be-true investment platform? A "pig butchering" scam where the con artist built a fake relationship with you over weeks or months? Understanding the scam's playbook helps authorities connect the dots between your case and potentially larger, organized criminal operations.

The scale of this problem is staggering. In 2024 alone, crypto scams have siphoned off over $15 billion from victims worldwide. And let's be realistic—the odds of getting it back through traditional means are tough, with recovery rates often dipping below 10%. That grim reality is precisely why your actions in these first 24 hours are so incredibly important. They set the stage for everything that comes next.

When you’ve been scammed, the last thing you feel like doing is filling out paperwork. It's tempting to just write it off and try to move on, but filing an official report is one of the most powerful things you can do. This isn't just about going through the motions; it’s about creating the official paper trail you’ll need for any future action and contributing to a much larger fight.

Reporting accomplishes two critical things. First, it gets your case on the radar of law enforcement, allowing them to spot patterns, connect your experience to others, and maybe even build a case against a larger criminal network. Second, having an official report—like one from your local police or the FBI—is often a non-negotiable requirement if you need to involve banks or take legal action later.

Who to Contact and Why

Knowing who to report to is half the battle. Don't just pick one agency. Reporting to multiple organizations casts a wider net and gives your case more visibility. Each one has a slightly different focus.

I always advise clients to start with these key agencies:

- The FBI's Internet Crime Complaint Center (IC3): This is the go-to in the U.S. for any internet-based crime, especially crypto scams. The IC3 acts as a central hub, collecting and analyzing data before passing intelligence to law enforcement agencies around the world.

- The Federal Trade Commission (FTC): Think of the FTC as the consumer watchdog. Your report helps them identify fraud trends, issue public warnings, and shut down scams.

- Your Local Police Department: Don’t skip this. A local police report gives you an official case number, which is invaluable. Even if your local officers aren’t crypto experts, this document formalizes your loss for the record.

It’s easy to wonder, "What can they really do?" But your report is rarely looked at in a vacuum. Investigators are searching for connections—the same scammer wallet addresses, identical website templates, or similar scripts used to lure victims. Your report might just be the piece that connects the dots.

Building a Compelling Report

Just saying "I was scammed" won't get you very far. You need to hand investigators a clear, organized, and convincing case file that they can actually work with. Your job is to make their job easy.

Before you start typing, pull together all the evidence you gathered in those first 24 hours. Lay it all out chronologically. Explain how you were first contacted, what they promised you, and exactly how the fraudulent transactions unfolded.

A rock-solid report needs specific evidence:

- Transaction Details: The exact date, time, amount, and type of crypto for every single transfer.

- Key Identifiers: A clear list of all transaction IDs (TxIDs) and the scammer's wallet addresses.

- Communication Records: All your screenshots of chats, emails, and social media DMs.

- Scammer Profile: Any names, usernames, phone numbers, email addresses, and website URLs you have.

Your report should tell a story backed by undeniable proof. A well-documented case with clear transaction hashes and chat logs is far more likely to get a second look from investigators than a vague complaint with missing details.

Don't hold back any part of the story, even if it feels embarrassing. Scammers are masters of emotional manipulation, and how they built trust or created a false sense of urgency is a key part of their playbook. Describing their tactics gives investigators valuable insight into how these criminal groups operate. Every little detail could be the one that links your scammer to a known network and helps stop them from victimizing someone else.

Getting to Know the Modern Crypto Scam Playbook

If you have any chance of getting your crypto back, you first have to understand who you're up against. The game has changed. While you still see the occasional old-school phishing email, today’s scammers are playing a whole different sport, one that blends psychology and tech to fool even the sharpest investors.

Pinpointing the exact type of scam you fell for isn't just for curiosity's sake—it gives investigators the critical first clues they need to start tracing your stolen assets.

The tactics we're seeing in 2025 are getting scarily sophisticated. For instance, AI-driven deepfake scams are on the rise, making it incredibly tough to tell what's real and what's fake. These scams use AI to clone the voice and video of people you trust, tricking you into sending crypto or giving up information. You can get a deeper dive into these and other threats from this great overview of crypto scams.

The New Face of Fraud: AI and Deepfake Scams

Picture this: you get a video call from a crypto influencer you follow, or maybe even a colleague. It looks and sounds exactly like them. They’re pitching you an urgent, can't-miss private sale. That's a deepfake. Scammers take public videos and audio of a real person and use AI to create a digital puppet.

They do this to get past your gut instinct. When you think you're talking to someone you know and trust, you're far more likely to send funds to the wallet address they give you. By the time you figure out you were talking to a digital ghost, your money is gone.

Key Takeaway: The real danger with deepfakes is how they hijack trust. No matter how real a video call or voice note sounds, always use a separate, known channel (like a phone number you already have) to confirm any urgent request for money.

DeFi's Dark Side: Rug Pulls and Honeypots

Decentralized Finance (DeFi) is full of incredible innovation, but it's also a breeding ground for scams. The rug pull is one of the most common and damaging. Here’s how it works: developers launch a new token, hype it up to attract investors and build liquidity, and then—poof. They drain the entire liquidity pool, run off with the real money, and leave everyone else holding worthless tokens.

A similar, equally nasty trick is the honeypot. In this scam, a smart contract is written to look legitimate, letting you deposit your crypto without a problem. But there’s a hidden catch in the code that makes it impossible to withdraw. You can watch your investment "grow" on the screen all day long, but you'll never be able to touch it.

Both of these scams bank on investor FOMO (fear of missing out) and the fact that most people can't audit complex smart contract code.

The Long Con: Romance and Pig Butchering Scams

Not every scam is a smash-and-grab. Some are slow, methodical operations that prey on your emotions. Romance scams usually start on dating apps. A scammer will spend weeks, even months, building what feels like a genuine, deep connection with you. Once they have your complete trust, they'll casually bring up a "life-changing" crypto investment.

This has evolved into a particularly cruel tactic called pig butchering. The name says it all: they "fatten the pig before the slaughter." Posing as a new friend or romantic partner, the scammer slowly coaxes you into making larger and larger investments on a fake platform they control. To build your confidence, they’ll even let you make a few small, successful withdrawals at first. Once you've put in a significant amount, they lock you out and vanish with everything.

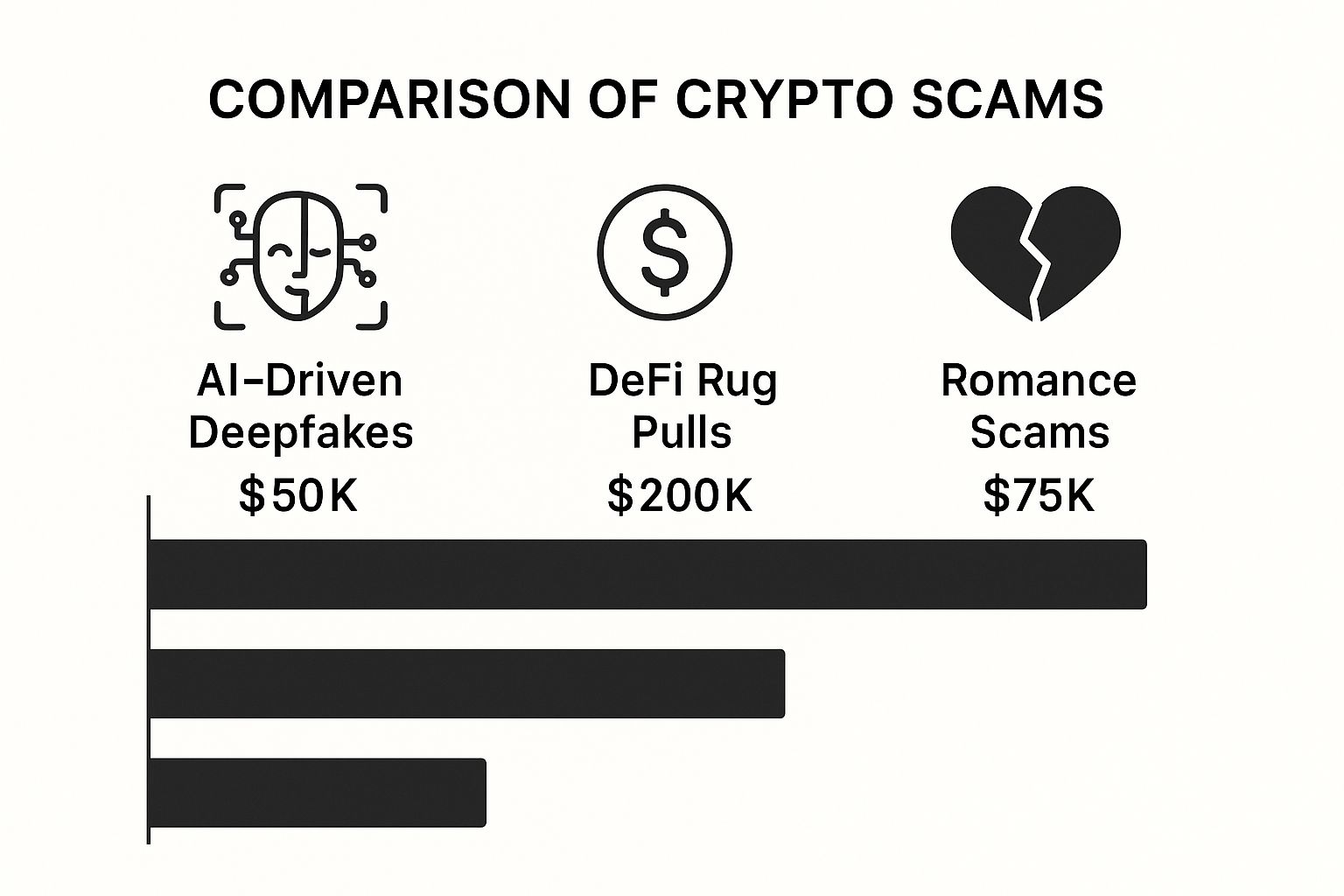

This infographic shows just how financially damaging these modern scams can be.

The numbers make it clear: while they’re all devastating, DeFi rug pulls often cause the biggest financial hit because of how much money gets pooled together. Knowing which trap you fell into is the first real step toward building a recovery plan, as the methods for tracing the funds are different for each one.

Finding a Legitimate Recovery Service

After the shock of a scam wears off, desperation kicks in. You start searching for a way—any way—to get your money back. This is an incredibly vulnerable moment, and unfortunately, it's exactly what a second wave of predators is waiting for.

The world of cryptocurrency scam recovery is a minefield. For every legitimate expert, there are dozens of scammers eager to exploit your hope, promising the world while planning to take what little you have left.

Your job is to find the needle in the haystack. The key is knowing what a real recovery operation looks like.

The Key Players in Asset Recovery

First, understand that not all recovery services are created equal. Real, professional operations fall into a few distinct categories, and knowing which one you need is half the battle.

- Blockchain Intelligence Firms: Think of these as the digital forensic investigators. They use highly sophisticated tools to trace the path of your stolen crypto across the blockchain, untangling complex transactions through mixers and obscure wallets. They don't recover the funds directly, but their detailed reports are the foundation for any legal or law enforcement action.

- Specialized Legal Teams: If your stolen assets end up on a regulated exchange (like Coinbase or Binance), a lawyer who specializes in digital assets is your best bet. They know how to use legal instruments like subpoenas and court orders to force exchanges to freeze the scammer's account and reveal their identity. This is a game-changer.

- Asset Recovery Firms: These are often the full-package deal. They combine the investigative firepower of a blockchain intelligence firm with the strategic muscle of a legal team. They’ll manage the whole process, from the initial trace to coordinating with international law enforcement.

The right choice really depends on the specifics of your case. A smaller theft that went straight to a decentralized exchange requires a different game plan than a massive heist that was laundered through a major, US-based platform. You can learn more about how to find the best crypto recovery service for your situation in our in-depth guide.

Spotting the Scammer in Disguise

Recovery scammers have a playbook, and once you know it, they become much easier to spot. They love to hang out on social media platforms like Telegram, Reddit, and X, lurking in the comments of posts where people are pleading for help.

Their promises are tailored to sound like the answer to your prayers. But there’s always a catch.

The biggest, brightest red flag is the upfront fee. No legitimate, professional recovery firm is going to ask you for thousands of dollars before they’ve done a thing. Real pros work on a contingency basis—they take a percentage of the funds after they successfully recover them. Their success is tied to yours.

If anyone asks you for an upfront payment—whether they call it a "tax," a "wallet synchronization fee," or a "software activation cost"—you are talking to a scammer. End the conversation immediately.

Keep your eyes peeled for these other dead giveaways:

- Guarantees of Success: The recovery process is messy and unpredictable. Anyone promising a 100% recovery rate is flat-out lying to get your money.

- They Contact You First: Real professionals don't slide into your DMs. If a "recovery agent" messages you out of the blue after you post about being scammed, it's a trap.

- Vague, "Hacker" Language: They'll talk a big game about "hacking back" the funds or using "secret blockchain exploits." Legitimate recovery is a slow, methodical process of tracing and legal action, not vigilante hacking.

Your Vetting Checklist

Before you ever consider hiring a service, you need to vet them thoroughly. Treat it like the most important job interview of your life, because it just might be. Ask tough questions and don't accept fuzzy answers.

To help you out, here’s a quick comparison of what separates the good guys from the bad guys.

Legitimate vs Scam Recovery Services

This table should help you quickly distinguish between a credible expert and a fraudulent operator trying to take advantage of your situation.

| Characteristic | Legitimate Service | Scam Operation |

|---|---|---|

| Payment Model | Works on a contingency fee (a percentage of recovered funds). | Demands large upfront fees, taxes, or software costs. |

| Success Claims | Provides realistic expectations and explains the challenges. | Guarantees 100% success and a quick, easy process. |

| Methods | Explains their process of blockchain tracing and legal action. | Uses vague, technical-sounding jargon like "reversing the hash." |

| Identity | Has a public team, a registered business, and a professional website. | Uses anonymous social media profiles and refuses video calls. |

| Track Record | Can provide case studies or references from legal professionals. | Offers fake testimonials and screenshots of "successful" recoveries. |

Making a calm, informed decision is your best defense against being victimized a second time. Slow down, do your homework, and listen to your gut. If an offer sounds too good to be true, it always is.

Taking Legal Action to Get Your Crypto Back

When your funds disappear into the digital wild, the thought of taking legal action can feel both essential and completely overwhelming. It's a serious option, but let's be clear: it's not the right move for every situation. Suing a crypto scammer isn't like a standard lawsuit; it demands a lawyer who gets the tech and knows how to follow a digital evidence trail.

Deciding to go down this road means you're taking your cryptocurrency scam recovery efforts out of the blockchain and into a physical courtroom. The whole point of a lawsuit is to use the power of the judicial system to make entities—like crypto exchanges—cooperate in ways they simply won't otherwise.

Knowing When to Call a Lawyer

The decision to bring in a lawyer who specializes in digital assets usually comes down to one critical detail: where your stolen crypto ended up. If a blockchain analyst traces your funds to a wallet on a major, regulated exchange—especially one that operates in your country—that's your green light.

These big, centralized exchanges have to follow the law. They can't just ignore a properly served subpoena or a court order to freeze an account.

This is exactly where a good lawyer becomes your most important asset. They can:

- Fire off a Subpoena: This legal document can compel an exchange to hand over the Know Your Customer (KYC) info tied to the scammer's account, potentially giving you a real name and address.

- Get a Temporary Restraining Order (TRO): A TRO can freeze the scammer's account on the exchange, stopping them from moving or cashing out your stolen crypto while the legal battle unfolds.

- File a Civil Lawsuit: Suing for theft or fraud puts the crime on the official record and opens up a path to recovering your assets through a legal judgment.

On the other hand, if your crypto was sent straight to a decentralized exchange or laundered through a mixer like Tornado Cash, the legal path gets incredibly steep. There's no central company to serve with a court order, which makes freezing the assets or identifying the thief next to impossible.

What the Civil Lawsuit Process Really Looks Like

Brace yourself—a civil lawsuit is a marathon, not a sprint. Your first move is to find a law firm that has actually won crypto cases before. They'll begin by digging into all the evidence you've gathered, from transaction IDs and chat logs to any reports you've filed with the police.

Next, your legal team will bring in blockchain investigators to create a detailed forensic report. This document becomes the foundation of your entire case, giving the court a clear, verifiable map showing exactly where your funds went.

The heart of any crypto lawsuit is connecting a real-world person to a digital wallet address. A subpoena forcing an exchange to release KYC data is often the make-or-break moment that makes recovery a real possibility. Without that link, you’re essentially suing a ghost.

Once an identity is potentially linked to the wallet, the lawsuit can be filed. This kicks off a long process involving discovery, motions, and maybe even a full trial. You need to be prepared for a long haul—often many months, sometimes years—and it won't be cheap.

Setting Realistic Expectations for a Legal Fight

Going the legal route requires a sober look at the costs, timelines, and chances of success. This is not a fast or inexpensive solution. Legal fees for this kind of specialized work are significant, and there's never a 100% guarantee you'll win.

Before you sign anything, have a very direct conversation with any lawyer you're considering. Make sure you ask about:

- Costs: Get a crystal-clear breakdown of their fees. Is it hourly, or do they take a percentage (a contingency fee) of whatever they recover for you?

- Timeline: Ask for a realistic estimate of how long this whole process could drag on.

- Probability of Success: A good lawyer will give you an honest take on your chances based on the evidence you have and the specific laws in play.

Ultimately, legal action is a powerful tool for cryptocurrency scam recovery, but its power is greatest in specific situations where the stolen money has passed through a regulated financial gatekeeper. It’s an intense, costly, and slow process, but for victims who have lost a substantial amount, it might just be the only real path to getting it back.

Your Crypto Recovery Questions, Answered

When you’ve been scammed, your head is spinning with questions. The shock and uncertainty can be overwhelming, and it’s hard to know what to do next. Let's cut through the noise and get straight to the answers you need most.

This isn’t about theory; it’s about giving you the information I’ve seen make a real difference for victims trying to find their footing.

Can Stolen Cryptocurrency Actually Be Recovered?

This is the big one, and I'll be direct: it’s tough, but not impossible. The honest truth is that your chances hinge on a few critical factors—how fast you act, the sophistication of the scam, and where your money went.

If your crypto ends up in an account on a major, regulated exchange, we have a fighting chance. With the right legal orders, those platforms can sometimes be compelled to freeze the funds. But if the scammer was clever and immediately funneled the money through a mixer or a series of decentralized protocols, the trail can go cold in a hurry. The industry-wide recovery rate is sobering, often below 10%, which is precisely why your first moves are so important.

How Much Does a Legitimate Recovery Service Cost?

This is where you need to be incredibly careful. Real, professional recovery services nearly always work on a contingency basis. What does that mean? Simple: they only get paid if they successfully get your money back.

There should be no massive upfront fees. A typical contingency fee will run you anywhere from 15% to 40% of whatever is recovered. The exact percentage usually depends on how complex your case is and the resources needed to pursue it.

Watch out for this. If anyone asks you for "taxes," "software fees," or "wallet synchronization costs" before a single dollar is back in your possession, you are dealing with a recovery scam. It's the biggest red flag in the book.

What’s the Single Most Important Piece of Evidence?

Hands down, it's the transaction ID (also known as a TxID or hash). Think of it as the permanent, unchangeable receipt for your transaction stamped onto the blockchain. For any investigator trying to trace your funds, this is ground zero.

But don't stop there. You need to build a complete case file. Be meticulous and gather everything.

- All your conversations with the scammer (screenshots of chats, emails, DMs—everything).

- The scammer's wallet addresses where you sent the funds.

- Any websites, social media profiles, or platform accounts they used.

Without this information, all you have is a story. With it, you have a case.

Should I Bother Reporting a Small Crypto Loss?

Yes. A thousand times, yes. Every report matters, no matter how small the amount seems. Agencies like the FBI's IC3 piece together thousands of individual reports to spot patterns, connect dots, and build massive cases against international criminal rings.

Your $500 loss might seem insignificant, but the wallet address that took it could be the missing link in a multi-million dollar investigation. Plus, having an official police report is often a non-negotiable requirement for any future legal action or for dealing with your bank. It’s the formal paper trail that proves what happened.

Navigating the aftermath of a scam is a brutal experience, but you don’t have to do it alone. If you've lost access to your funds due to a forgotten password or other access issues, Wallet Recovery AI offers a secure and discreet path to potentially regaining control. Our AI-driven techniques and expert team are here to help. Learn more about our process and submit your case for a confidential assessment at https://walletrecovery.ai.

Leave a Reply