That sinking feeling when you realize your crypto is gone is something I wouldn't wish on anyone. It's a gut punch. But what you do in the next few moments can make all the difference between a bad day and a catastrophic loss. Panic is your enemy; a clear head is your best asset.

Your First Steps After Losing Crypto Access

Before you start frantically trying recovery methods, take a deep breath. Your first job is to play detective and figure out exactly what happened. The path to getting your funds back is completely different depending on the situation, so a proper diagnosis is non-negotiable.

Your goal right now is to move from a state of panic to a state of clarity. Once you know what you're up against, you can build a solid plan of attack.

Differentiating Loss Scenarios

First things first, you need to pinpoint the type of loss you're dealing with. This is the most critical distinction because it dictates your entire strategy to recover lost cryptocurrency. Broadly, these fall into two buckets:

- Access Loss: This is when your crypto is still safely in your wallet, but you just can't get to it. Think forgotten passwords, a misplaced seed phrase, or a hardware wallet that decided to die.

- Theft or Scam: This is far more serious. It means your funds have been moved out of your wallet without your permission. Phishing attacks, malware on your computer, or a hacked exchange all fall into this category.

If you’ve simply lost access, the recovery process is about restoring your control over keys you already own. If it’s theft, you're in a race against time to trace the funds and get the right people involved.

Initial Assessment and Information Gathering

Now that you've identified the scenario, it’s time to gather evidence. Document everything you can remember about the wallet, the transactions, and the events that led to the loss. Don't change or delete anything—you might accidentally wipe out a key piece of the puzzle.

To help you get started, here's a quick look at common situations and their recovery outlook.

Initial Assessment of Lost Crypto Scenarios

| Scenario | Primary Cause | Initial Recovery Potential |

|---|---|---|

| Forgotten Wallet Password | User error, memory lapse | High. Recovery is possible if you have access to the wallet file. |

| Lost Seed Phrase | Misplaced physical/digital backup | Low to None. The seed phrase is the master key. Recovery is nearly impossible without it. |

| Malfunctioning Hardware | Device failure, physical damage | Moderate. Depends on whether the seed phrase was backed up. If not, specialized hardware recovery may be needed. |

| Phishing Scam | Deceived into giving away keys/phrase | Low to Moderate. Recovery is a race to trace funds before they are laundered. |

| Malware/Hack | Compromised device or network | Low to Moderate. Similar to phishing, requires immediate blockchain tracing and law enforcement involvement. |

| Exchange Hack | Centralized exchange security breach | Varies. Depends entirely on the exchange's response, insurance, and recovery efforts. |

This table should give you a realistic idea of what you're facing based on your specific situation.

The numbers don't lie: while the crypto world sees staggering theft, recovery is far from impossible.

The crypto industry is projected to lose over $4.3 billion to theft and scams this year alone. But it's not all bad news. For certain types of fraud, dedicated recovery efforts have seen success rates averaging around 70%.

This is why acting fast and collecting the right information is so critical. If you think you've been hacked, your first move should be to get on a public ledger. Learning what is a blockchain explorer and how to use one is an essential skill. You can instantly confirm if your funds have been moved and grab the transaction ID (also called a hash). That string of characters is the digital fingerprint of the theft—and it's the first clue you'll need for any serious recovery attempt.

Alright, let's ditch the robotic tone and get real about finding those lost keys. Here’s how you can tackle this yourself before calling in the cavalry.

Your Playbook for Wallet and Seed Phrase Recovery

That sinking feeling when you can't access your crypto is something no one wants. But before you panic, remember that a calm, methodical approach is your best friend here. Many "lost" seed phrases and passwords aren't gone forever—they're just hiding in plain sight.

Let's start by retracing your steps. Think way back to when you first set up your wallet. Did you follow the golden rule and write your recovery phrase down? Where would you have put something that important?

The Search for Your Lost Keys

First things first: be systematic. This isn't just a quick look around; it's a forensic investigation of your own life. Grab a notebook and start brainstorming every possible place you might have stashed that critical piece of paper or a saved file. Don't rule anything out, no matter how silly it seems now.

Check these common (and not-so-common) hiding spots:

- Old notebooks and journals: Did you jot it down on a random page of a work notebook or a personal diary from that time?

- Important documents: Think safes, file cabinets, or those folders where you keep passports, birth certificates, and other "do not lose" paperwork.

- Books: It sounds like something from a movie, but a surprising number of people tuck a sticky note with their seed phrase inside a favorite book.

- Old tech: Don't forget the digital trail. Search old hard drives, dusty USB sticks, and even the photo gallery on your phone. You might have saved a text file or snapped a quick picture.

I once worked with a client who found their seed phrase scribbled on the back of a router manual they'd tossed in the attic five years earlier. You never know. The key is to be persistent and search every physical and digital corner you can think of.

Your private key is the only thing standing between you and your assets. Losing it can mean they're gone for good, so this initial search is by far the most critical step you can take.

The scale of this problem is staggering. Estimates suggest that between 2.3 million and 3.7 million bitcoins are lost forever, mostly because of forgotten keys. That’s a huge chunk of the total supply, and it’s why a thorough, methodical search has to be your first move. You can find more insights about lost Bitcoin on Ledger's Academy.

Trying Software and Hardware Wallet Recovery Tools

If your physical search turns up nothing, don't lose hope. The next step is to see what the wallets themselves can do to help. Both software and hardware wallets have built-in recovery options, assuming you have at least some of the pieces of the puzzle.

H3: Software Wallets (MetaMask, Trust Wallet, etc.)

For software wallets, it all comes down to that seed phrase. If you find it, you're golden. Just install the wallet on a new device, choose the "import" or "recover" option, and type in your phrase. Your funds will pop right back up.

What if you lost the password but still have access to the computer where the wallet is installed? In some cases, you might have a wallet file (like a .dat or JSON file). You can use brute-force recovery tools to try and crack it. These programs run through millions of password combinations, but they're really only effective if you have a decent idea of what the password might be—its length, some of the characters, a common pattern you use.

H3: Hardware Wallets (Ledger, Trezor, etc.)

The process is totally different if your hardware wallet is malfunctioning—maybe it won't turn on, or the screen is smashed. This is where hardware wallets really shine.

Here's the crucial thing to remember: your crypto isn't actually on the device. It's on the blockchain. The little gadget in your hand is just the key that unlocks it.

Educational hubs from manufacturers are great for reinforcing this concept. As long as you have your seed phrase, your assets are safe. For a deeper dive, check out the educational materials available for hardware wallet users.

As long as you have that 24-word seed phrase you wrote down when you first set it up, you're in complete control. You can simply buy a new device—even from a different compatible brand—and use that phrase to restore full access to your funds. It’s a beautifully simple and secure system. But without that phrase, your options are basically zero.

How to Respond to Scams and Hacks

If you think your crypto has been stolen, you need to act fast. Every second is critical. This isn't just about damage control; it's a race against the clock, and what you do in the first few minutes can make or break your chances of getting your funds back.

The second you suspect a hack, your first move is to stop the bleeding. Forget denial—it's a waste of precious time. Immediately transfer any crypto you still have out of the compromised wallet and into a brand-new, secure one. Make sure this new wallet has never interacted with any suspicious addresses or platforms. This one step could save you from being completely wiped out.

Once you’ve secured what's left, it's time to put on your detective hat.

You need to collect every shred of digital evidence you can find. This means grabbing transaction IDs (also called hashes), the scammer's wallet address, and screenshots of any chats, emails, or fake websites involved in the scam. This is your case file.

Notifying Exchanges and Authorities

Next up, you have to report the theft. Again, time is your enemy here. Scammers almost always move stolen funds to big exchanges like Binance or Coinbase to cash out into fiat currency. Reporting the incident quickly gives you a fighting chance to have the assets frozen before they vanish for good.

Start with the support teams of any exchanges involved. Send them a clear, to-the-point summary of what happened, along with all the evidence you gathered. No, they can’t reverse a transaction on the blockchain, but they can flag and freeze accounts tied to the theft if the funds land on their platform.

At the same time, file a police report. If you're in the US, this means contacting the FBI's Internet Crime Complaint Center (IC3) and your local law enforcement. Your local police might not be crypto experts, but an official police report is non-negotiable—exchanges often require it, and you'll need it for any future legal action or tax purposes.

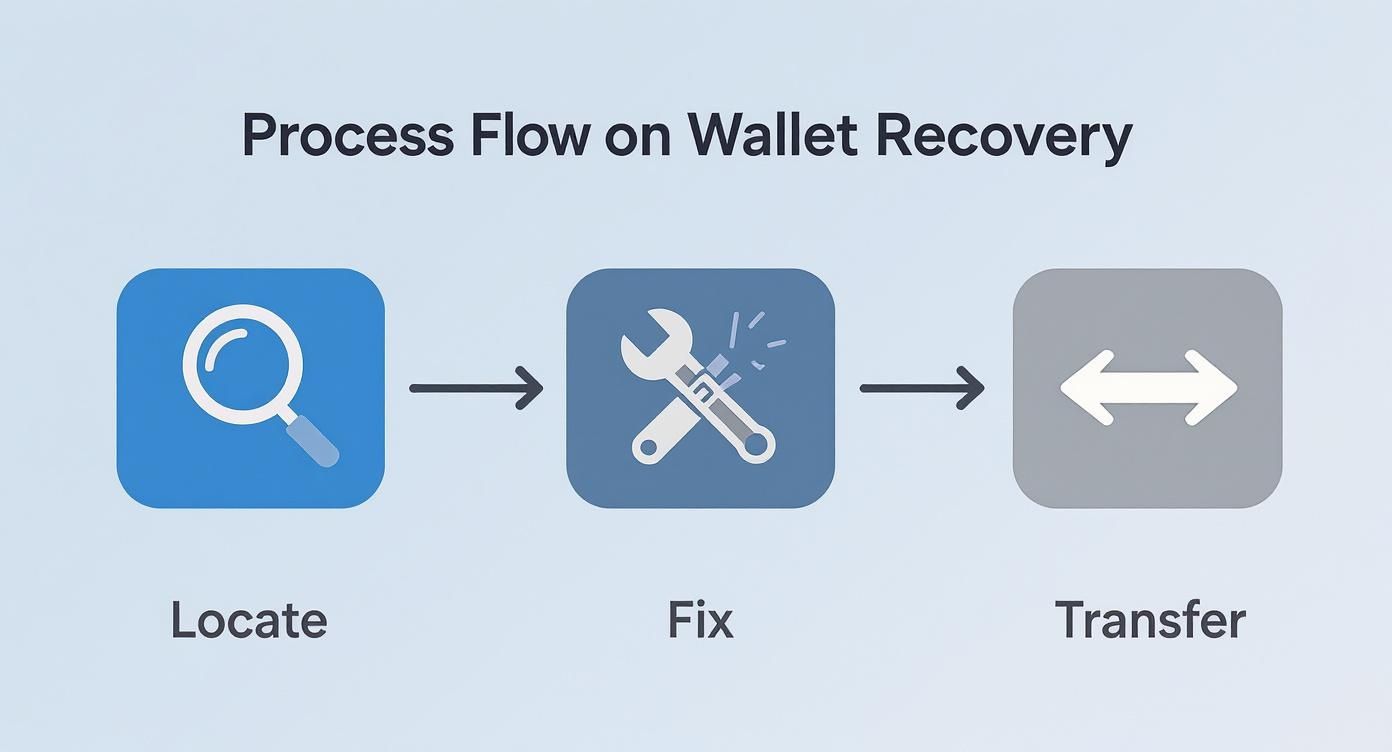

This visual flow shows the core stages of a recovery attempt, starting with identifying the problem and working toward a resolution.

It’s all about a methodical approach: assess what happened, take action, and secure what you can.

Tracing Your Funds on the Blockchain

While you're waiting on law enforcement and exchanges, you can start tracking the money yourself. This is where blockchain explorers become your best friend. For anything on Ethereum (like ETH or ERC-20 tokens), Etherscan is your go-to. For Bitcoin, you can use an explorer like Blockchain.com or Blockstream.

These tools let you follow the digital breadcrumbs in real-time. Just paste the thief's wallet address into the search bar, and you’ll see every single transaction they make. Your goal is to follow the trail until the crypto lands in a wallet you can link to a centralized exchange. That's the criminal's weak point, since those platforms require identity verification (KYC) and are subject to the law.

This isn't just about watching your money disappear. You're building a case. Document every single hop the funds make with screenshots and detailed notes. This evidence is gold when you bring in law enforcement or a professional recovery service.

A Quick Note on Taxes: When you're dealing with the fallout of a crypto scam, proper documentation is crucial for more than just recovery. Under current IRS guidelines, victims of investment-related scams may be able to claim a theft loss deduction. But there's a catch: you have to provide solid proof of the crime and show there's no reasonable chance of getting the money back.

This makes your diligent evidence-gathering doubly important. Even if you can't get the crypto back, you might get some financial relief come tax time.

Finally, try to figure out how you were attacked. Was it a classic phishing scam where they tricked you into revealing your private keys? Or was it a rug pull, where a project’s developers took the money and ran? Pinpointing the method gives professionals a better idea of the attacker's playbook and helps them anticipate their next move—a key part of any strategy to recover lost cryptocurrency.

When you've hit a wall trying to recover your funds on your own, turning to a professional can feel like the only option left. But be warned: the world of crypto recovery is a minefield. For every genuine expert, there are a dozen scammers waiting to take advantage of your desperation.

Your first and most important job is learning how to tell them apart. It usually starts with one simple question.

The biggest, brightest red flag you will ever see is a demand for a large upfront payment. Legitimate firms almost always work on a contingency basis, meaning they only get paid if you do. Their fee is a percentage of the recovered crypto, taken after they’ve successfully returned it to you. This model aligns their interests with yours.

Anyone asking for thousands of dollars before they’ve done a thing is almost certainly running a scam. End the conversation right there.

What a Genuine Recovery Expert Looks Like

Once you’ve filtered out the upfront-fee scammers, you can start looking for the hallmarks of a truly credible service. It all comes down to transparency, verifiable proof, and a professional, no-nonsense approach.

A real expert will never, ever give you a 100% guarantee of success. They know that crypto recovery is incredibly complex and unpredictable. Anyone promising a sure thing isn't being honest; they're just telling you what you want to hear.

Instead, a legitimate firm will:

- Walk you through their methodology in plain English.

- Openly discuss the forensic software and blockchain analysis tools they use.

- Talk about their working relationships with law enforcement agencies and major exchanges.

These are the signs of a team that's confident in their abilities, not just their ability to cash your check.

Key Questions to Ask During Your Consultation

Think of your first call with a recovery service as an interview—and you’re the one hiring. Don’t be timid. This is your money on the line, so you need to ask pointed questions and expect clear, detailed answers.

Here’s a checklist to bring to that conversation:

- "Can you outline your exact process for a case like mine?" They should be able to map out their strategy from the initial investigation all the way to fund retrieval.

- "What specific tools and technologies do you use?" Vague answers won't cut it. Look for mentions of specific blockchain forensics and tracing software.

- "Can you share any anonymized case studies or references that are similar to my situation?" This helps prove they have a track record with your type of problem.

- "How do you secure my data and maintain my privacy?" Protecting your information is paramount.

- "What is your complete fee structure, and when exactly is payment due?" Get this confirmed in writing. If they pivot back to needing money upfront, it's a hard pass.

A reputable service will welcome this scrutiny. They want to build trust, not pressure you. For a more detailed breakdown of what to expect, our guide on professional cryptocurrency recovery services offers some great additional context.

The most effective firms combine deep technical knowledge with established legal and exchange-level contacts. They understand that recovering lost cryptocurrency is often a multi-faceted effort that goes beyond just watching transactions on a block explorer.

The technology these teams use is getting more sophisticated every day. Take Puran Crypto Recovery (PCR), for example. This firm, with operations in Finland and the US, has reported a stunning 94% success rate, having recovered around $420 million for its clients. Their edge comes from proprietary tech that can trace funds through complex tumblers and cross-chain swaps—two of the biggest headaches in this field.

This level of specialization is what separates the real pros from the amateurs.

Comparing Crypto Recovery Service Models

Not all legitimate recovery services operate the same way. Understanding their business models can help you spot red flags and choose a partner whose incentives are truly aligned with yours.

| Service Model | How It Works | Pros | Cons / Red Flags |

|---|---|---|---|

| Success-Based Fee (Contingency) | The firm takes a pre-agreed percentage of the funds only after they are successfully recovered. No recovery, no fee. | Risk-Free for You: Their success is directly tied to yours. Highest Incentive: They are highly motivated to recover the maximum amount. | The percentage can be high (10-30%). Be wary of "processing" or "network" fees added on top. |

| Hybrid Model (Small Retainer + Success Fee) | Requires a small, non-refundable retainer to cover initial investigation costs, plus a smaller success fee upon recovery. | Shows a mutual commitment. The retainer can filter out non-serious cases for the firm. | The retainer is non-refundable, even if recovery fails. Scammers may disguise a large upfront fee as a "retainer." A legitimate retainer should be modest. |

| Upfront Fee / Flat Rate | You pay the full fee before any work begins. | You know the total cost from the start. | EXTREME RED FLAG: This is the preferred model for scammers. There is zero incentive for them to actually recover your funds once they have your money. Avoid this model. |

| Consulting / Hourly Rate | You pay an hourly rate for their time and expertise, regardless of the outcome. | Can be useful for complex corporate cases or legal investigations. | Very expensive and unpredictable costs. Not suitable for most individual recovery cases. |

Ultimately, the Success-Based Fee model is the gold standard for consumer crypto recovery. It provides the best protection and ensures the firm is fully invested in a positive outcome for you. Any deviation from this should be met with extreme caution.

Of course. Here is the rewritten section, crafted to sound like an experienced human expert and match the provided style examples.

Building a Fortress Around Your Digital Assets

Going through a crypto recovery process is something I wouldn't wish on my worst enemy. It’s a gut-wrenching mix of stress, uncertainty, and often, heartbreak. Honestly, the best recovery strategy is making sure you never need one in the first place. It's time to build a fortress around your digital wealth.

This isn't just about a strong password. It's about creating layers of defense that account for everything—technical glitches, simple human error, and sophisticated attacks. Think of it as an insurance policy where the premium is your diligence, and the payout is priceless peace of mind.

Level Up Your Security with Multi-Signature Wallets

One of the most powerful tools you can use is a multi-signature (multisig) wallet. Imagine a bank vault that needs two or three different people to turn their keys at the same time to open it. That’s the basic idea behind multisig. Instead of one private key controlling everything, a multisig setup requires multiple keys to sign off on any transaction.

Let's say you create a "2-of-3" multisig wallet. It could look like this:

- Key 1: Stored on your main laptop.

- Key 2: Kept safely on your hardware wallet.

- Key 3: Held by a trusted family member or stored in a bank safe deposit box.

This setup makes your funds incredibly resilient. If a hacker gets into your computer and nabs Key 1, they're stuck. They can't move anything without Key 2. If you happen to lose your hardware wallet, no sweat—you can still access your crypto using Key 1 and Key 3. It completely changes the game by eliminating that single point of failure.

Don’t Put All Your Crypto in One Basket

Keeping all your assets in a single wallet is like betting your entire life savings on one horse. A much smarter approach is to spread your holdings across different types of wallets, each with a specific job. This strategy dramatically minimizes your risk if one of them gets compromised.

A solid storage plan should include a mix of these:

- Hot Wallets: These are connected to the internet, like MetaMask or a mobile app. They're great for small, daily transactions, but they're also the most vulnerable. Only keep "spending money" in them.

- Cold Wallets: Hardware wallets from companies like Ledger or Trezor are the gold standard for long-term HODLing. Because your keys are kept offline, they’re basically immune to remote hacks. The vast majority of your crypto should live here.

- Custodial Solutions: Using a reputable, insured exchange can be a valid part of your strategy, especially if you trade often. You don't hold the keys, but they provide their own security and convenience.

By splitting up your funds, you make sure that a breach of your most-used wallet doesn't wipe you out completely. It's a simple, effective way to contain the damage.

Create a Rock-Solid Succession Plan

What happens to your crypto if something happens to you? It’s a morbid thought, but a necessary one. Without a clear plan, your digital assets could be lost forever, locked away from your loved ones. A crypto succession plan isn't just for whales; it's a critical responsibility for any serious investor.

This plan needs to be more than a line in your will. It has to provide clear, secure instructions for your heirs to access your funds without exposing your security today. This might involve using a specialized digital asset inheritance service or setting up a detailed "dead man's switch" with a trusted attorney.

Just picture a real-world scenario: an investor passes away suddenly. Their family knows they owned Bitcoin but has no clue where the seed phrases are. Those assets become another sad statistic, part of the estimated $140 billion in crypto that’s permanently lost in the wallets of deceased owners.

Your plan should detail the types of wallets you use, where to find the seed phrases (without writing them down directly!), and who to call for help. A little bit of thoughtful preparation today ensures your legacy is passed on, not locked on the blockchain forever.

Common Questions About Crypto Recovery

When you're staring down the barrel of lost crypto, it feels like a million questions are hitting you at once. The internet is full of conflicting advice, and it’s tough to know who to trust. Let's cut through that noise and give you some straight answers to the questions we hear every single day.

Getting your facts straight is the first real step toward making a plan that actually works.

Can Stolen Cryptocurrency Really Be Recovered?

The honest answer? Yes, but it’s a long shot and you have to be realistic. Recovering stolen crypto is incredibly difficult and almost always comes down to two things: speed and traceability. The game plan involves meticulously tracking the stolen funds on the blockchain as they move from wallet to wallet, hoping they eventually land at a centralized exchange.

Once the funds hit an exchange, there's a chance their Know Your Customer (KYC) data could link the thief to a real-world identity. This requires getting law enforcement and the exchange’s compliance team involved immediately. Professionals use sophisticated tracing software to follow the money trail, even through complex "mixers" designed to obscure it, but success is never a sure thing.

Time is everything. The faster you report the theft and get the tracing process started, the better your odds of freezing the funds before the thief can cash out and disappear.

What Does a Professional Crypto Recovery Service Cost?

The cost can vary, but here's a major tell: reputable services almost always work on a success-fee basis. This is a critical point. It means you don't pay them unless they actually get your funds back. That fee is typically a percentage of whatever they recover, usually somewhere between 10% and 30%.

Some might ask for a small upfront fee for the initial investigation, but you need to be extremely careful here.

- The Legit Model: They take a percentage after they successfully recover your assets.

- The Giant Red Flag: They demand a large payment before they even start.

Always, always get a clear, written agreement that spells out the entire fee structure. Any service that promises you the moon for a hefty upfront payment is almost certainly a recovery scam trying to kick you while you're down.

I Lost My Seed Phrase—What's the First Thing I Should Do?

If you've misplaced your seed phrase but you still have access to your wallet on one of your devices, the absolute priority is to move your assets. Right now. Don't log out, don't update the app, and don't clear your browser cache. That active session is the only thing keeping your funds secure.

Here’s your immediate action plan:

- Create a New Wallet: Grab a separate, trusted device and set up a brand-new wallet with a fresh seed phrase.

- Secure That New Phrase: Write down the new phrase and store it in several safe, offline places. Don't skip this.

- Transfer Everything: Go back to your old wallet (the one you're still logged into) and send every last bit of your crypto to the public address of your new, secure wallet.

Once that transaction is confirmed on the blockchain, you can breathe. Your funds are safe again. The old wallet is now just an empty shell without its backup phrase, but your assets are protected by a new set of keys that you control.

Can I Get Back Crypto I Sent to the Wrong Network?

Sometimes, yes. It's a gut-wrenching mistake that happens more often than you'd think, but it's not always a complete loss. Whether you can get it back depends entirely on where you sent it and if you control the private key for that same address on the destination network.

For example, let's say you sent BEP-20 tokens (which live on the Binance Smart Chain) to your Ethereum address in MetaMask. You might be in luck. Since both networks use the same address format, you can often recover them by simply adding the Binance Smart Chain network to your MetaMask wallet. Poof, your funds should appear.

But if you sent funds to a completely unrelated address you don't own, or to a smart contract that isn't built to handle them, those assets are probably gone for good. This is exactly why you have to double-check the network and address before hitting "send" on any transaction.

If you're facing the stress of a locked wallet, Wallet Recovery AI offers a secure path forward. We use specialized techniques to help you regain access to your digital assets without compromising your privacy. Submit your case online to start the confidential recovery process.

Leave a Reply