When it comes to crypto wallets, the most important question is a simple one: *Who holds your private keys?When it comes to crypto wallets, the most important question is a simple one: Who holds your private keys? This single detail is the dividing line in the custodial vs. non-custodial debate. A custodial wallet means a third party—like a crypto exchange—holds your keys for you. This offers a ton of convenience and familiar recovery options. A non-custodial wallet, however, puts you in the driver's seat, making you the sole guardian of your digital assets.

Understanding the Core Wallet Differences

Choosing between custodial and non-custodial is one of the first, and most critical, decisions you’ll make on your crypto journey. This isn’t just a technical choice; it’s a philosophical one about what ownership really means in a digital world. Your decision directly impacts your security, your autonomy, and how much personal responsibility you need to take on.

Think of a custodial wallet like your bank account. You trust the institution to keep your money safe, and if you forget your password, you can call them up to reset it. This approach is a huge draw for beginners who want a straightforward experience without the headache of managing complex private keys.

On the other side of the coin, a non-custodial wallet is the purest expression of crypto's core principle: self-sovereignty. You hold the private keys, which serve as the ultimate, undeniable proof of ownership. This gives you censorship-resistant control over your funds, but it comes with a serious catch—if you lose your keys or your seed phrase, your crypto is likely gone forever. No customer support line can save you.

Ultimately, the choice comes down to a trade-off between control, security, convenience, and your own level of expertise. As you can find out in this deep dive on custodial vs. non-custodial wallets, the right answer depends entirely on your needs.

To really nail this down, let’s get into the specifics.

At-a-Glance Custodial vs Non-Custodial Wallet Differences

This table breaks down the fundamental distinctions between the two wallet types, giving you a clear snapshot of what you gain and what you give up with each option.

| Attribute | Custodial Wallet (e.g., Exchange) | Non-Custodial Wallet (e.g., Hardware) |

|---|---|---|

| Private Key Control | Held by a third party (the custodian) | Held exclusively by the user |

| User Control | Limited; user requests transactions | Absolute; user signs all transactions directly |

| Security Responsibility | Custodian is responsible for security | User is fully responsible for security |

| Recovery Process | Password reset via customer support | Relies on user-safeguarded seed phrase |

| Best For | Beginners, active traders, convenience-seekers | Long-term holders, privacy advocates, DeFi users |

Looking at the table, the trade-offs become crystal clear. Custodial wallets offer a safety net and ease of use, while non-custodial wallets provide ultimate control and freedom. Your choice will depend on what you value most.

How Custodial Wallets Prioritize Convenience

For most people dipping their toes into crypto for the first time, custodial wallets are the go-to. It's easy to see why—they're designed to be dead simple. Think of the wallets offered by big exchanges like Coinbase or Binance; they work a lot like the online banking apps you already use. Getting started is a breeze, usually just needing an email and a password.

This simplicity is their biggest selling point. All the intimidating technical stuff is stripped away. Instead of wrestling with a complex private key, you just log in with a username and password. If you ever forget it, there's usually a straightforward recovery process, like getting a reset link emailed to you. That familiarity provides a huge sense of relief for newcomers.

The Trade-Off Between Simplicity and Control

Here’s the catch. With a custodial wallet, a third party is holding your private keys for you. While that makes managing your crypto easier, it introduces the fundamental trade-off at the heart of the custodial vs. non-custodial debate: you're trusting someone else with your money.

This reality is captured perfectly by the old crypto adage:

"Not your keys, not your coins."

It’s a blunt reminder that with a custodial wallet, you don't have absolute, final ownership of your assets. You’re holding an IOU from the exchange. And while the big players have institutional-grade security, the risk never truly hits zero.

This setup means you're exposed to several risks that are completely out of your hands. These aren't just hypothetical what-ifs; we've seen them play out in the real world, affecting thousands of users.

Understanding the Inherent Risks

The convenience of a custodial service comes with very real counterparty risks. Your ability to access your funds is tied directly to the custodian's stability, security, and legal status.

Let’s break down what can go wrong:

- Exchange Hacks: Centralized platforms are a honeypot for hackers. A breach could mean your funds are gone, and getting them back is never a sure thing.

- Account Freezes: Your account could get locked for all sorts of reasons—a suspicious activity flag, a regulatory order, or even an accidental terms of service violation. When that happens, you’re cut off from your assets.

- Platform Insolvency: If the exchange goes bankrupt, your funds could be treated as company assets and get tied up in court for years. The odds of a full recovery in that scenario are slim.

Custodial wallets are brilliant at creating a smooth on-ramp into crypto. But it's vital to understand that this convenience is bought by giving up direct control. Using one means you're placing your trust in a third party and accepting the vulnerabilities that come with it.

Why Non-Custodial Wallets Offer True Ownership

A non-custodial wallet is really the purest form of what crypto was meant to be: total self-ownership. When you use one, you—and only you—are in possession of the private keys. This gives you absolute, undeniable control over your assets.

This simple fact completely removes the risks that come with leaving your funds on an exchange, like the platform failing or your account suddenly being frozen. You're in the driver's seat.

These wallets generally come in two main flavors. You've got software wallets like MetaMask, which are super accessible as browser extensions or mobile apps. Then there are hardware wallets like Ledger, which take security to the next level by keeping your keys entirely offline.

The Power and Responsibility of Self-Custody

Choosing a non-custodial wallet essentially means you've decided to be your own bank. It’s an incredibly powerful feeling, but it’s not a responsibility to take lightly. The safety of your funds boils down to how well you can protect one thing: your seed phrase.

This secret recovery phrase is the master key to everything. If you lose it, your crypto is gone forever. There's no customer support line to call and no "forgot password" link to click.

This is the core trade-off you have to accept. You get complete immunity from third-party blunders and censorship. In return, you accept the harsh reality that a mistake on your part could lead to a permanent loss. You can learn more about how to properly secure your wallet recovery phrase in our detailed guide.

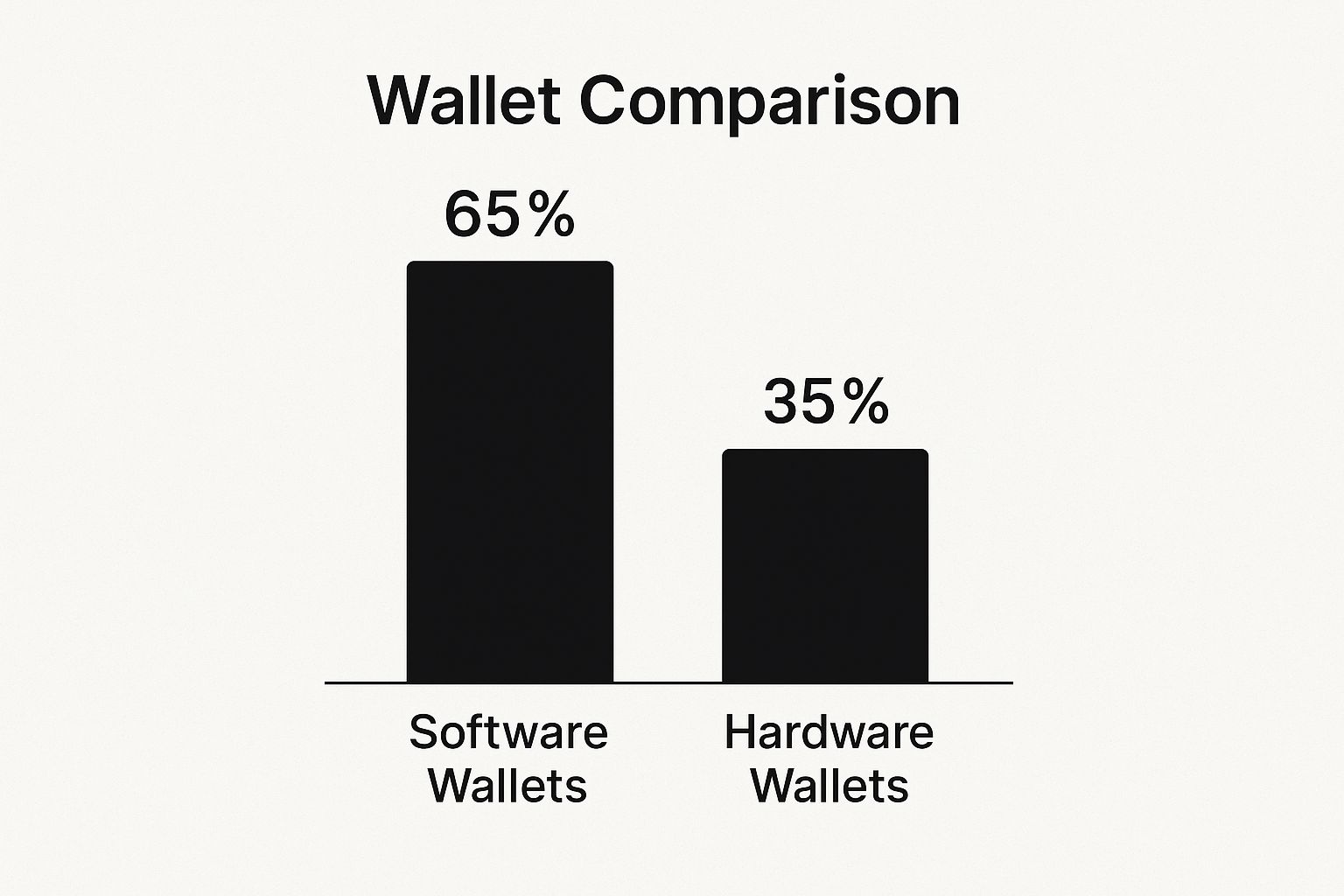

This chart gives a good snapshot of where the market stands on the two main types of non-custodial wallets.

As you can see, most people lean toward the convenience of software wallets, but a solid chunk of users still prioritize the iron-clad security that only hardware devices can offer.

Financial Implications of True Ownership

Beyond just control, there's a financial angle to consider. While non-custodial wallets give you that complete ownership and eliminate counterparty risk, they demand serious personal security discipline.

There's usually an upfront cost for hardware, somewhere in the range of $60 to $200. After that, though, you're only paying standard network transaction fees. For anyone who's active in the space, this often means your total costs over time will be lower.

At the end of the day, taking the self-custody route provides a level of freedom and security against outside threats that nothing else can match. It just requires a disciplined mindset toward protecting your own keys. The real question is whether you're ready to take on that responsibility for true digital ownership.

Security and Recovery: Where the Real Battle Is Fought

When we talk about custodial vs. non-custodial wallets, we're really talking about two fundamentally different philosophies on security and responsibility. It's a clash of ideas: do you trust a company to protect your assets, or do you take on that burden yourself? This choice is the single most important one you'll make.

With a custodial wallet, security is centralized. You're trusting that the provider—like a major exchange—has invested in teams of cybersecurity pros, multi-signature protocols, and deep cold storage to keep funds safe. This setup is designed to shield you from your own mistakes, as the heavy lifting of key management isn't on you.

A non-custodial wallet flips that script completely. The responsibility for security is 100% yours. You are the sole keeper of your private keys and seed phrase. This is powerful because it removes counterparty risk; no exchange hack can ever directly touch your funds. But it also opens you up to personal threats, from malware on your PC to someone physically finding your written-down seed phrase.

Understanding the Threats You'll Face

The attack vectors you need to worry about are worlds apart depending on your choice. Each one demands a different mindset to stay safe.

For custodial users, the game is about protecting your account access, not the keys themselves. The primary threats are:

- Phishing Scams: These are everywhere. Deceitful emails and copycat websites are constantly trying to trick you into handing over your login details.

- SIM Swapping: A terrifyingly effective attack where a scammer convinces your mobile provider to port your number to their device. Once they have it, they can intercept 2FA codes and lock you out.

- Platform-Level Hacks: You have zero control here. If the exchange itself gets breached, your funds could be at risk, regardless of how strong your password is.

Non-custodial users face much more direct attacks that target their private keys:

- Malware and Keyloggers: Sneaky software that can record everything you type, waiting to capture your password or seed phrase the moment you enter it.

- Physical Theft: This is as low-tech as it gets. Someone could steal the hardware wallet from your desk or find the piece of paper where you wrote down your recovery phrase.

- Dusting Attacks: A more advanced technique where attackers send tiny, worthless amounts of crypto to your wallet. The goal is to track your transaction activity and de-anonymize you for a more targeted attack later on.

It’s worth noting that the vast majority of wallets—both custodial and non-custodial—are "hot wallets," meaning they're connected to the internet. Hot wallets make up about 78% of the market because they're convenient. The more secure offline "cold wallets" account for the other 22%, preferred by those who put security above all else. For more wallet statistics, Coinlaw.io is a great resource.

The Brutal Reality of Recovery

Nowhere is the difference between these two models more obvious than when something goes wrong. One offers a familiar safety net; the other is completely unforgiving.

With a custodial wallet, losing your password is a headache, not a disaster. You just click a "forgot password" link, prove your identity through email or ID verification, and you're back in. It works just like your bank account. If you're in a more complex bind, our guide on how to find lost passwords can offer some additional strategies.

Let's be crystal clear about the alternative.

With a non-custodial wallet, there is no "forgot password" button. There is no customer support line to call. Your seed phrase is the only key to the kingdom. If you lose it, your funds are gone forever.

This isn't an exaggeration. There is no one to appeal to and no technical way to get your crypto back. While custodial platforms offer recovery through a central authority, non-custodial wallets give you a decentralized recovery tool that only you control. Fumbling that responsibility means losing everything.

To put these differences into practical terms, here’s a look at how each wallet type handles common security and recovery challenges.

Security Threat and Recovery Scenario Comparison

| Scenario | Custodial Wallet Response | Non-Custodial Wallet Response |

|---|---|---|

| Forgot Your Password | Easy fix. Use the "Forgot Password" link and verify your identity via email or 2FA to reset it. | Catastrophic. Without the password to decrypt the wallet file, you must use your seed phrase to restore the wallet on a new device. |

| Lost Your Seed Phrase | Not applicable. Custodians manage your keys, so there's no seed phrase for you to lose. | Game over. Your funds are permanently and irretrievably lost. There is no backup or recovery option. |

| Device is Lost or Stolen | Low risk. You can log in from a new device after verifying your identity. Enable 2FA for an extra layer of protection. | Moderate risk. You can restore your wallet on a new device using your seed phrase. The thief can't access funds without your password. |

| Victim of a Phishing Attack | High risk. If you give away your login credentials and 2FA code, an attacker can drain your account. Contact support immediately. | High risk. If you enter your seed phrase into a fake website, your wallet will be drained instantly. Your funds are gone. |

| The Platform Gets Hacked | High risk. Your funds are pooled with others, and a major breach could lead to a total loss. Your only hope is that the company has insurance. | Zero risk. Since you hold the keys, a hack on a wallet provider's website or servers cannot impact your funds. |

Ultimately, this table shows there's no single "best" option—only the one that's best for your situation and your tolerance for risk. Each model forces you to protect against a different set of threats.

Alright, let's break down which wallet actually makes sense for what you're trying to do. The technical jargon and endless "pro vs. con" lists only mean something when you apply them to your own crypto habits. It’s not about finding the best wallet, but the right wallet for your specific goals.

Choosing the right wallet is probably the single most important strategic decision you'll make. So, let's move past the theory and look at a few real-world scenarios. See which one sounds most like you.

For the Active Trader

If you're in the trenches trading multiple times a day, speed is everything. You need instant access to liquidity to jump on market moves. This is where custodial wallets on exchanges like Binance or Kraken really shine. They let you move funds instantly within their ecosystem, often with zero fees, which is a must for high-frequency trading.

Imagine having to pull out a hardware wallet, connect it, and sign a transaction every single time you want to make a trade. The friction and gas fees would kill your profits. For a trader, the convenience and raw speed of a custodial wallet for their active capital just makes sense, even with the added counterparty risk.

For the Long-Term HODLer

Now, let's flip the script. If your strategy is to buy and hold for years—the classic HODL—your priorities are completely different. Security is your one and only concern. For this, a non-custodial hardware wallet is the undisputed king. Nothing beats the peace of mind of knowing your private keys are completely offline, period.

A HODLer isn't transacting daily, so the slightly slower process of using a hardware device is a complete non-issue. The entire game is about wealth preservation, and that means taking absolute control of your keys.

The whole point for a long-term investor is to shrink your attack surface. A non-custodial hardware wallet does this perfectly by taking the single biggest target—a centralized exchange—out of the picture entirely.

For the DeFi Power User

Are you someone who lives on-chain? Interacting with dApps, staking on new protocols, or chasing yield farms? You absolutely need a non-custodial software wallet like MetaMask or Trust Wallet. These wallets are your passport to the decentralized web, letting you connect and sign transactions directly with any protocol you want.

Custodial wallets simply can't do this. They're walled gardens. To truly participate in DeFi, you need the sovereignty that only a non-custodial wallet can provide.

For the Crypto Beginner

On the other hand, if you’re just dipping your toes in and making your first purchase, the idea of managing a 12-word seed phrase can be terrifying. This is where a custodial wallet provides a much friendlier on-ramp. The familiar username-and-password login, complete with a "forgot password" link, lowers the barrier to entry significantly.

We're seeing a fascinating trend where even self-custodial wallets are becoming easier to use, which is why they now handle about 68% of all crypto transactions. The industry is getting better at blending top-notch security with a user-friendly experience. You can read more about this shift toward self-custody solutions on ainvest.com to see where things are headed.

The Future of Wallet Technology

For years, the crypto world has been split by the custodial vs. non-custodial debate. It’s always been framed as a trade-off: do you want convenience or control? But that rigid line is starting to blur, and fast. The next wave of wallet technology isn't about picking a side; it's about getting the best of both.

New approaches like smart contract wallets and Multi-Party Computation (MPC) are completely changing the game. They're designed to eliminate the single biggest point of failure—that dreaded seed phrase—without forcing you to hand over control of your assets.

The future isn't about one model winning out over the other. It's about a spectrum of hybrid solutions where you can dial in the exact level of security and convenience that makes sense for you and your risk tolerance.

The Rise of Hybrid Solutions

We’re finally seeing a push toward self-custody that’s more flexible and, frankly, a lot more forgiving. This isn't just theory; it's happening right now through a few key innovations:

- Smart Contract Wallets: Think of these as programmable wallets that live on the blockchain itself. They unlock powerful features like setting daily spending limits, freezing your account if a device is lost, or even setting up a "social recovery" system.

- Social Recovery Mechanisms: Instead of etching a seed phrase into a steel plate and burying it, you can designate trusted friends, family, or other devices as "guardians." If you lose access, they can help you get it back. It’s a safety net, built for real life.

- Multi-Party Computation (MPC): This is a clever bit of cryptography that splits your private key into multiple pieces, or "shards," and stores them in different places. To sign a transaction, the shards work together without ever being reassembled into a full key. You get the security of a distributed system with the simple experience of a single-signature wallet.

And it’s not just individual users who benefit. These advancements are also propping up the institutional side of crypto. We're seeing top-tier custodians like Anchorage and BNY Mellon offer services backed by over $320 million in insurance, all while sticking to tough regulatory standards.

If you want to dig deeper, you can learn more about how these institutional-grade solutions are shaping the market. What's clear is that the future of custody isn't a one-size-fits-all solution. It’s an ecosystem of smarter, stronger, and more user-focused options.

Wallet FAQs

It's natural to have questions when you're navigating the ins and outs of crypto wallets. Let's tackle some of the most common ones that come up when comparing custodial and non-custodial options.

Can I Move Crypto From a Custodial to a Non-Custodial Wallet?

Yes, and it’s a smart move once you're ready for more control. Think of it like moving cash from a bank account to a safe you own. The process is pretty straightforward.

First, you'll need to set up your non-custodial wallet and—this is the most important part—securely back up your seed phrase. Once that's done, find and copy your new wallet's public address (the one for receiving funds).

Then, just log into your custodial account on an exchange, find the "withdraw" or "send" option, and paste your new wallet's address into the destination field. I always recommend sending a tiny test amount first. It’s a small step that gives you peace of mind before you move the rest of your funds.

Are Non-Custodial Wallets Completely Anonymous?

They offer a much higher degree of privacy, but they aren't truly anonymous. Your real name isn't directly attached to your wallet, but every single transaction is publicly visible on the blockchain, tied to your wallet's address.

If that address ever gets linked back to your real-world identity—maybe through an exchange where you completed KYC—your entire transaction history becomes traceable. For genuine anonymity, you'd need to look into specialized privacy coins or tools.

What Happens to My Crypto If a Custodial Exchange Fails?

This question gets to the heart of the risk with custodial services. If an exchange goes bankrupt, your assets are often treated as part of the company's estate. This can mean your funds get frozen and tied up in lengthy, complicated legal proceedings.

The unfortunate reality is you could lose a significant portion of your crypto, or even all of it. This is exactly what the saying "not your keys, not your coins" is all about, and it’s the single biggest reason why so many people choose to take control with their own non-custodial wallet.

If you've lost access to your funds and need expert help, Wallet Recovery AI offers a secure and confidential service to help you regain control. Using advanced, AI-driven techniques, our team can assist with forgotten passwords, corrupted files, and other access issues across a wide range of wallets. Learn how Wallet Recovery AI can help you restore access to your assets.

Leave a Reply