The whole custodial vs non-custodial debate really boils down to one simple question: who holds your crypto keys? A custodial wallet means a third party is holding them for you. With a non-custodial wallet, you are the one in charge.

Think of it like the difference between putting your money in a bank versus stuffing cash in a safe at home. The bank offers convenience and a support line if you forget your PIN, but the safe gives you absolute, undeniable control.

Custodial and Non-Custodial Wallets: What’s the Real Difference?

Before we get into the weeds on security protocols and user interfaces, you have to get this one fundamental concept. It’s not about the tech—it's about who has the final say over your money. This single distinction changes everything, from how secure your funds are to what happens when you inevitably forget your password.

A custodial wallet is essentially an account managed by someone else, usually a big crypto exchange like Coinbase or Kraken. They hold your private keys on your behalf.

- The Analogy: It’s just like a regular bank account. The bank holds your cash, and you trust them to keep it safe while giving you easy access through an app or website.

- The Convenience: Forget your password? No problem. You just go through a standard recovery process, like an email reset. The custodian can verify it's you and get you back in.

- The Trade-off: Here's the catch. You're placing your trust entirely in their security and their rules. This is where the old crypto mantra, "not your keys, not your coins," comes from. You don't truly have the final say.

On the other hand, a non-custodial wallet (often called a self-custody wallet) puts you—and only you—in complete control of your private keys. You are your own bank.

- The Analogy: This is like having gold bars locked away in a personal safe. You're the only one who knows the combination, and you're the only one responsible for keeping it secure.

- The Control: With a non-custodial wallet, you have total financial sovereignty. Nobody can freeze your account, block a transaction, or tell you what to do with your funds.

- The Responsibility: This level of freedom comes with a heavy dose of personal responsibility. If you lose your private keys or your recovery phrase, that's it. There’s no customer service desk to call. Your funds could be gone for good.

Quick Comparison: Custodial vs. Non-Custodial Wallets

To make things a bit clearer, here's a quick rundown of the core differences. This table breaks down how each wallet type handles key management, user control, and overall usability.

| Feature | Custodial Wallet | Non-Custodial Wallet |

|---|---|---|

| Private Key Control | Held by a third party (e.g., exchange) | Held directly by the user |

| User Control | Limited; subject to provider's terms | Full and direct control over funds |

| Account Recovery | Standard password reset via support | User's sole responsibility (seed phrase) |

| Ease of Use | High; perfect for beginners | Moderate; requires more technical care |

| Security Model | Relies on the custodian's security | Relies on the user's security practices |

| Privacy | Lower; typically requires KYC checks | Higher; offers pseudonymous transactions |

Ultimately, this isn't about which one is "better" but which is better for you.

The choice between custodial and non-custodial wallets is a fundamental trade-off between convenience and control. Figuring out which of those you value more is the first real step in managing your digital assets the right way.

It’s completely normal for beginners to start with a custodial wallet because it’s just so much easier. If you want to understand that experience better, you can get a good feel for how services like Coinbase manage things by reading our guide that explains how Coinbase wallets work. Knowing the ins and outs of the custodial world gives you a solid foundation before you even think about jumping into self-custody.

Comparing Wallet Security and User Control

When you get down to it, the custodial vs non custodial debate really boils down to two things: security and control. These concepts are welded together, shaping your entire experience and defining the risks you’re willing to take. One approach gives you the kind of protection you’d expect from a bank, while the other hands you the keys to your own financial kingdom. It’s a classic trade-off, and every crypto user has to decide where they stand.

Custodial wallets, like the ones you get with major exchanges, treat security like a financial institution. They take on the burden of managing your private keys, locking them away in high-tech environments that blend online "hot" storage with offline "cold" storage. The whole model is built on trusting that your provider knows what they’re doing.

The Custodial Security Fortress

Let's be real—custodial platforms pour millions into security measures that are just not feasible for the average person. Their mission is to shield a massive pool of user funds from sophisticated, large-scale cyberattacks.

You'll typically see a multi-layered defense:

- Multi-Factor Authentication (MFA): This is your first line of defense, forcing you to prove your identity in multiple ways before getting in. It drastically cuts down the risk of someone simply stealing your password.

- Cold Storage Protocols: The lion's share of user funds isn't even online. It's kept in "cold" wallets, completely disconnected from the internet and safe from hackers.

- Insurance Funds: Big exchanges often have massive insurance pools (think Binance's SAFU fund or private policies) to make users whole after a hack, though the coverage isn't always a blanket guarantee.

- 24/7 Monitoring: They have dedicated security teams watching for anything suspicious, ready to jump in and stop a threat before it gets out of hand.

While this setup is incredibly robust, it creates one giant point of failure: the custodian itself. If the exchange gets hacked or goes belly-up, your funds could be in jeopardy.

Non-Custodial Wallets: You Are the Security Team

Switch to a non-custodial wallet, and the entire security operation lands squarely on your shoulders. You become the sole guardian of your private keys and that all-important 12-to-24-word seed phrase—your master backup. This gives you absolute control, but it also means you're the only one to blame if something goes wrong.

With a non-custodial wallet, you are the security team. Your diligence in protecting your seed phrase and avoiding scams is the only thing standing between you and the permanent loss of your funds.

The biggest threats here aren’t giant exchange heists; they're personal slip-ups. Phishing scams that trick you into giving up your seed phrase or malware that steals keys right off your device are the real dangers. Lose that seed phrase, and it’s game over. There’s no customer support line to call for a password reset.

A Look at the Spectrum of User Control

The difference in user control is night and day. With a custodial wallet, your control is conditional. The provider can—and sometimes is legally required to—put restrictions on your account.

Custodial Control Limitations:

- Withdrawal Limits: Most exchanges set daily or weekly caps on how much crypto you can move out.

- Account Freezes: Your account could be locked for suspicious activity, a regulatory order, or if you break the platform's rules.

- Transaction Delays: Cashing out a large amount? Expect a delay while their security team reviews it.

This idea of an outside authority having control isn't just a crypto thing. We see similar custodial vs. non-custodial models in legal systems. For example, data from England and Wales at the end of 2024 revealed that out of 651 offenders, 76% were given immediate custodial sentences. This reflects a system where a central authority—the court—controls an individual's freedom. You can discover more insights about these criminal justice trends to see how this theme plays out on a global scale.

In stark contrast, a non-custodial wallet is about complete financial sovereignty. You, and only you, have the final say over your assets.

Non-Custodial Control Advantages:

- Unrestricted Access: Send what you want, to whom you want, whenever you want. No permission needed.

- Censorship Resistance: No third party can freeze your account or block your transactions.

- Direct DeFi Interaction: You can plug straight into decentralized applications (dApps) without going through a middleman.

This absolute freedom is the heart of the "be your own bank" philosophy that drives so much of crypto. But it's a double-edged sword. It means you also bear the full weight of any mistakes, like sending funds to the wrong address—an error that is totally irreversible.

Here is the rewritten section, designed to sound completely human-written and natural, following all your provided instructions.

Key Management and Account Recovery Explained

The moment you can't access your crypto, the difference between custodial and non-custodial wallets becomes painfully clear. How you get back to your funds—or if you can get back to them at all—comes down to a single question: who holds the keys? One recovery process feels like any other online account, while the other puts the entire weight of responsibility squarely on your shoulders.

If you're using a custodial wallet, like one on a major exchange, getting locked out is a familiar problem with a familiar solution. Because the exchange holds your private keys on your behalf, they have the power to help you regain access.

The whole thing is pretty straightforward:

- You'll hit the "Forgot Password" link.

- An email with a verification code or link lands in your inbox to prove it's really you.

- You might have to enter a 2FA code from an app like Google Authenticator or answer a few security questions you set up ages ago.

- If things get complicated, you can open a support ticket. They'll likely ask for a government-issued ID to verify your identity before letting you back in.

This built-in safety net is a huge draw for anyone new to crypto. It works just like your bank or email account, which is comforting when you're not ready to manage your own keys.

The Non-Custodial Recovery Lifeline

In the non-custodial world, "account recovery" means something completely different. There’s no support desk to call, no password reset form, and certainly no one to email for help. Your only lifeline is your seed phrase.

Often called a recovery phrase, this is a sequence of 12 to 24 words your wallet gives you during setup. This isn't just a password; it's the master key that can recreate all the private keys in your wallet from scratch. Lose your phone? Computer dies? No problem—as long as you have that phrase. You can restore your entire wallet on a brand new device. Our detailed guide explains more about the crucial role of a wallet recovery phrase in self-custody.

Think of your seed phrase as the literal keys to your digital vault. Anyone who finds it can walk in and take everything.

Crucial Takeaway: Let this sink in: with a non-custodial wallet, there is no one to call for help. If you lose your seed phrase, your crypto is gone. Forever. This is the harsh, unforgiving trade-off you make for total control over your money.

Since that phrase is everything, protecting it is your single most important job. Don't ever store it digitally. A screenshot, a text file, or a note in the cloud is just asking for a hacker to find it. The only safe way is old-school: write it down on paper or, even better, etch it into metal. Then, hide it somewhere secure, offline, and private.

Restoring a Wallet with Your Seed Phrase

So, what happens when you actually need to use it? If you get a new phone or need to restore your wallet, the process is simple but demands your full attention.

Here’s how it usually goes:

- Install the Wallet Software: Download the same wallet app (or a compatible one) on your new device.

- Select "Import" or "Restore": Look for an option to restore from a backup, not create a new wallet.

- Enter Your Seed Phrase: This is the critical step. Type each word in the exact order you wrote them down. One typo or swapped word, and it won't work.

- Regain Access: Once you enter it correctly, the wallet uses the phrase to regenerate your private keys, and just like that, your balance reappears.

This entire process gets right to the heart of the custodial vs non custodial debate. Custodial recovery is about trusting a company to help you. Non-custodial recovery is about trusting yourself to be prepared.

User Experience vs. Privacy: Finding Your Balance

When you're picking a wallet, you’re not just deciding where to store your crypto. You're choosing a path that defines how you interact with your assets every day and how much privacy you get to keep. One route is like a guided tour—smooth, easy, and managed by someone else. The other is more like a backcountry hike: you're on your own, but the freedom and privacy are unparalleled.

Custodial wallets are all about making crypto easy. If you’ve ever used an online banking app, you'll feel right at home. They are often built right into exchanges, so everything feels familiar. Transactions are simple, fees are laid out for you, and all the messy blockchain stuff happens behind the scenes.

For anyone just starting out, this is a massive plus. You don't have to sweat the details like managing network fees (gas) or worrying about where to store your private keys. The service takes care of all the technical bits, letting you focus on your trades.

Getting Over the Non-Custodial Learning Curve

Switching to a non-custodial wallet is a different story. The learning curve is steeper because you're in the driver's seat for everything. You initiate the transactions, you set the network fees to make sure they go through on time, and you—and only you—are responsible for keeping your seed phrase safe.

This level of control can feel a bit daunting at first. A tiny mistake, like sending coins to the wrong address or setting a gas fee too low, can't be undone. It’s all on you. But for many people, that's exactly the point. This is what it truly means to "be your own bank."

With a non-custodial wallet, you trade convenience for control. That initial learning phase is the price of admission for true financial sovereignty, putting you in direct command of your digital wealth.

The Big Divide: Privacy

The real dealbreaker for many in the custodial vs non custodial debate boils down to one thing: privacy. Custodial services are almost always regulated companies. That means they have to follow Know Your Customer (KYC) and Anti-Money Laundering (AML) laws, no exceptions.

To use a custodial wallet on an exchange, you’ll have to hand over personal info, including:

- Your full legal name and home address

- A government-issued ID like a driver's license or passport

- Sometimes, even a selfie to prove it’s really you

This ties your real-world identity directly to your crypto wallet and every transaction you make. Your financial activity isn't private—it's tracked, recorded, and can be handed over to government agencies.

On the flip side, non-custodial wallets give you a much higher degree of pseudonymity. You can set one up without providing any personal documents. Your wallet address isn't automatically linked to your name, letting you transact with a layer of privacy that custodial options just can't offer.

This idea of direct control versus third-party oversight isn't unique to crypto. Think about family law and the roles of custodial vs. non-custodial parents. It’s a similar dynamic of responsibility and involvement. In the U.S., for example, custodial fathers account for less than 8% of fathers living with their children, while the non-custodial group is much larger and typically has less direct engagement. You can explore more facts about custodial and non-custodial fathers in the US to see how these ideas play out in other areas of life. The core principle is the same: whether it's managing assets or personal responsibilities, direct control and accountability almost always go together.

Choosing the Right Wallet for Your Needs

The whole custodial vs non custodial debate isn't about crowning one "best" wallet—it’s about finding the one that fits you. The right choice for someone casually buying their first crypto is worlds apart from what a seasoned DeFi power user needs. Your personal goals, how much risk you're comfortable with, and your technical know-how will ultimately point you in the right direction.

To help you decide, let's walk through four common scenarios. Find the one that sounds most like you, and you'll know exactly which path to take on your crypto journey.

The Crypto Beginner Making Your First Purchase

Just dipping your toes in the water? If your goal is to simply buy your first Bitcoin or Ethereum without a major headache, a custodial wallet is your friend. These are the wallets built right into major exchanges, and they’re designed to smooth over the technical bumps that often trip up newcomers. The experience is intentionally simple.

Think of it this way: you’re learning to swim, not building a submarine. A custodial wallet gives you a safe, managed environment with a vital safety net. If you forget your password, you can hit a "reset" button and get help from customer support—a feature that provides incredible peace of mind when you're starting out. You won't have to stress about seed phrases or network fees right away, letting you focus on the basics of buying and selling.

The Long-Term Holder Securing Significant Assets

For the "HODLers"—those in it for the long haul—security is everything. If you've built up a sizable portfolio that you don't plan on touching often, a non-custodial hardware wallet is the undisputed gold standard. These are physical devices that keep your private keys completely offline, making them untouchable by online hackers.

This approach puts you in absolute control. By moving your crypto off an exchange and into your own possession, you cut out the middleman and eliminate counterparty risk. That means you're safe if the exchange gets hacked, goes bust, or decides to freeze withdrawals. Yes, the responsibility for securing your seed phrase falls squarely on your shoulders, but for true long-term security, it's a trade-off you need to make.

The DeFi User Interacting with Web3

If your plan is to dive into Decentralized Finance (DeFi), use decentralized apps (dApps), or mint NFTs, then a non-custodial wallet isn't just an option; it's a requirement. Platforms like Uniswap, Aave, and OpenSea need you to connect your wallet directly to their smart contracts. Custodial wallets can't do this because you don't actually hold the keys.

A non-custodial wallet like MetaMask or Trust Wallet is your passport to the decentralized web. It gives you the power to sign transactions and interact with protocols directly, without asking a third party for permission. That freedom is the entire point of DeFi, making self-custody a fundamental prerequisite.

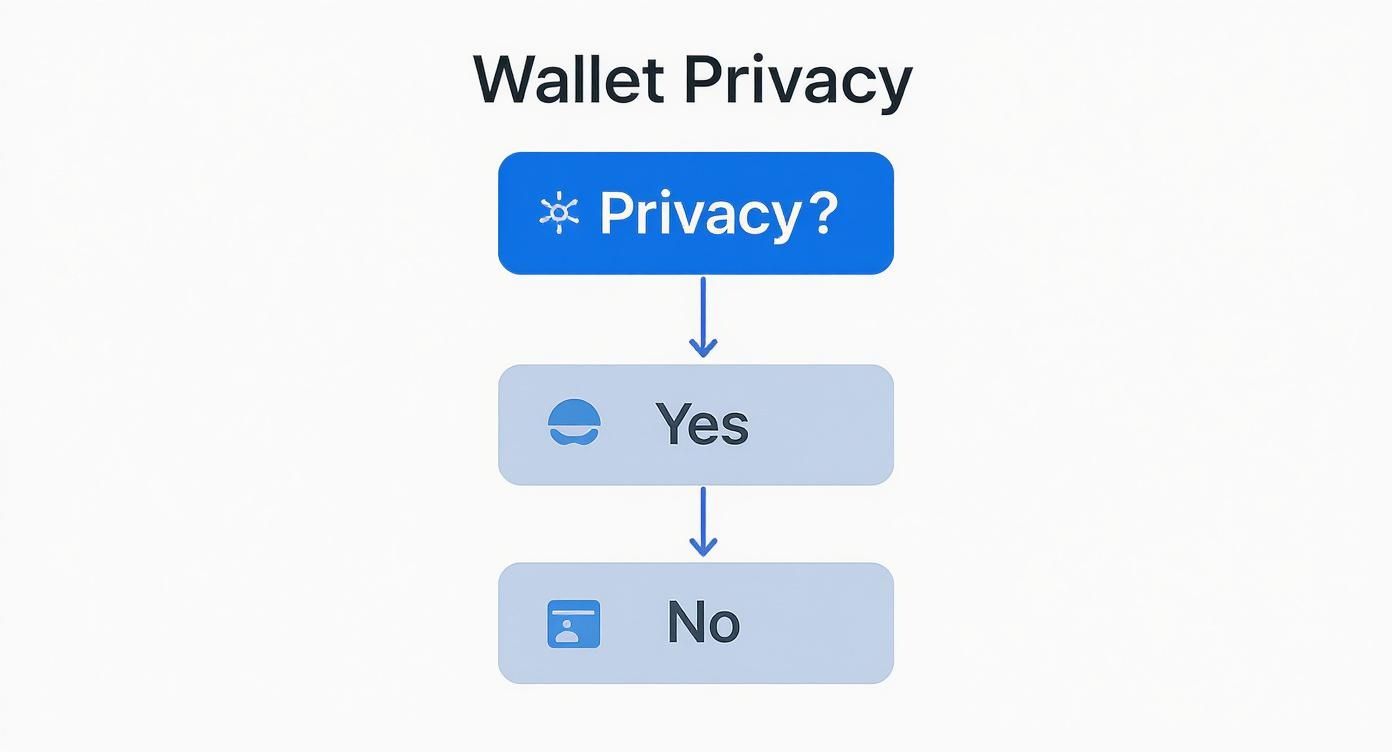

This decision tree breaks down the core question of privacy when picking a wallet.

As the graphic shows, if privacy is your main concern, the road leads straight to non-custodial options. If you're okay with sharing your identity for convenience, custodial services are a perfect match.

The Active Trader Balancing Speed and Security

Active traders live in two worlds: they need the lightning-fast liquidity of an exchange but also the ironclad security of self-custody. This is where a hybrid strategy, using both wallet types, really shines. It lets you get the best of both.

Here’s how it works in practice:

- Custodial Wallet for Trading: Keep your active trading funds on a reputable exchange. This gives you instant access to the market, letting you execute trades immediately without waiting on slow blockchain confirmations or paying high gas fees for every little move.

- Non-Custodial Wallet for Profits: Make it a habit to regularly sweep your profits off the exchange and into your secure, non-custodial wallet. This quarantines your gains from the risks that come with leaving large sums of money on a centralized platform.

This balanced approach cuts down your risk while keeping you efficient. The idea of custody isn't unique to finance; it’s all about balancing responsibilities. For example, U.S. Census Bureau data on family matters shows that among 12.9 million custodial parents, around 80% are mothers. It’s a fascinating parallel that shows how different models of custody exist in society, each with its own responsibilities and outcomes. You can read more about these child support statistics to see how these themes play out in other contexts.

By adopting a hybrid model, active traders can operate with the speed and agility of a custodial platform while safeguarding the bulk of their assets with the sovereign security of a non-custodial wallet.

Frequently Asked Questions

Even after you get the hang of custodial and non-custodial wallets, a few questions always seem to pop up. Let's tackle the most common ones head-on so you can clear up any confusion and move forward with confidence.

Can I Switch from a Custodial to a Non-Custodial Wallet?

Absolutely. It’s a very common step people take when they decide they want total control over their crypto. The process is pretty simple and is the core of what it means to truly own your assets.

All you have to do is start a withdrawal from your custodial wallet (like your account on an exchange). Then, you just paste in the receiving address from your new non-custodial wallet and hit send. That transaction moves your crypto from their control directly into yours.

Are Non-Custodial Wallets Completely Anonymous?

They're pseudonymous, not anonymous. This is a critical point that trips up a lot of people.

Your wallet isn't directly tied to your name or address through a KYC process, that's true. But every single transaction is permanently recorded on the public blockchain. Anyone with the right tools can sometimes trace that activity back to an individual, especially if you ever link that wallet to a centralized service.

True anonymity is almost impossible to achieve. Non-custodial wallets give you a massive privacy boost compared to custodial ones, but they don't make you invisible.

What Happens If My Custodial Exchange Is Hacked?

This is the big one—the primary risk of leaving your funds with a third party. If the platform holding your crypto gets breached, your assets could be stolen.

Now, most big exchanges have put measures in place to deal with this. They often keep a huge chunk of assets in offline cold storage and maintain insurance funds (like Binance’s SAFU fund) or have private policies to reimburse users. Still, reimbursement is not always guaranteed, and even when it is, the process can be incredibly slow and stressful.

What Is the Biggest Mistake People Make with Non-Custodial Wallets?

By far, the most common and devastating mistake is messing up how you handle your seed phrase. This single point of failure is behind countless horror stories of lost fortunes.

The classic blunders include:

- Storing it digitally: Saving it as a screenshot, putting it in a cloud drive, or keeping it in an email is just asking for a hacker to find it.

- Sharing it: No legitimate support person or company will ever ask for your seed phrase. Giving it out is like handing someone the keys to your entire crypto portfolio.

- Losing it: If you lose the physical paper where you wrote it down and your device breaks, that's it. There’s no backup. Your funds are gone for good.

Securing your seed phrase offline is the single most important responsibility you take on with self-custody. The whole custodial vs. non-custodial debate really boils down to that personal responsibility.

If you've lost access to your wallet and are staring at the stressful reality of locked funds, you're not out of options. Wallet Recovery AI specializes in helping individuals securely and discreetly regain control of their digital assets. Using advanced, AI-driven techniques, our team can help with forgotten passwords, corrupted files, and other access barriers across a wide range of wallets. Learn more about our confidential and reliable recovery services.

Leave a Reply