The real question isn't which one is "safer," but who you trust more to protect your assets: yourself or a regulated company. Coinbase Wallet is built for users who demand absolute self-custody and are prepared for the responsibility that comes with it. On the other hand, the Coinbase Exchange is designed for those who value institutional-grade security and the safety net of account recovery options.

Your answer determines which platform is the right fit.

Coinbase vs. Coinbase Wallet: The Key Security Difference

When you compare the security of Coinbase's exchange platform to its Wallet app, you're not looking at two slightly different products. You're looking at two entirely different philosophies for managing digital assets: custodial vs. non-custodial. Neither is inherently better; they just serve very different needs.

The main Coinbase platform is a custodial service. Think of it like a bank. Coinbase holds your private keys for you, securing them in their "vault." This approach is convenient and provides a critical backstop—if you forget your password, you can go through an identity verification process to get back into your account.

In sharp contrast, Coinbase Wallet is a non-custodial (or self-custody) tool. When you set it up, you're given a unique 12-word recovery phrase. This phrase is your private key, and you are the only one who has it. Coinbase can't see it, can't access it, and certainly can't help you if you lose it. You are your own bank, giving you complete and total control over your crypto. To dig deeper, check out our guide on the difference between Coinbase and Coinbase Wallet.

This single distinction is the crux of the matter. The "safer" option is a direct reflection of your personal risk tolerance.

Core Security Models At a Glance

Let's lay it out side-by-side to make the distinction crystal clear. This table cuts straight to the core differences in how each platform handles security, control, and recovery.

| Attribute | Coinbase Exchange | Coinbase Wallet |

|---|---|---|

| Asset Custody | Custodial: Coinbase holds and secures your private keys. | Non-Custodial: You hold and secure your private keys. |

| Control | You have account access, but Coinbase ultimately controls the keys. | You have 100% control over your keys and the funds they protect. |

| Recovery | Account is recoverable via password resets and ID verification. | Not recoverable by Coinbase; only you have the recovery phrase. |

| Primary Risk | Exchange-level hacks, phishing, and sophisticated SIM swap attacks. | Losing your recovery phrase or falling for social engineering scams. |

| Best For | Beginners, active traders, and users who prioritize convenience. | Long-term holders, DeFi users, and security-conscious individuals. |

The guiding principle of self-custody has always been simple: "Not your keys, not your crypto." Coinbase Wallet embodies this, putting you in the driver's seat. The Coinbase Exchange offers a more traditional, managed approach where you place your trust in a third party.

Ultimately, it comes down to this trade-off: The Coinbase Exchange protects you from personal slip-ups like losing a password but exposes you to platform-level risks. Coinbase Wallet protects you from those platform-level failures but makes you 100% responsible for your own security.

How Self-Custody Security Works on Coinbase Wallet

To really figure out if Coinbase Wallet is safer than the main Coinbase exchange, you first have to get your head around self-custody. It’s a completely different way of thinking about security, one that puts all the control—and all the responsibility—squarely on your shoulders. With Coinbase Wallet, you’re not just a customer; you're the sole guardian of your crypto.

The whole thing is built on one simple, powerful idea: your private keys never, ever leave your device. On the main Coinbase platform, the company holds those keys for you. But with the Wallet, they’re generated and encrypted right on your phone or computer. Coinbase can't see them, touch them, or use them. That means they can't move your funds, freeze your account, or lose your assets for you.

The Role of Your Secret Recovery Phrase

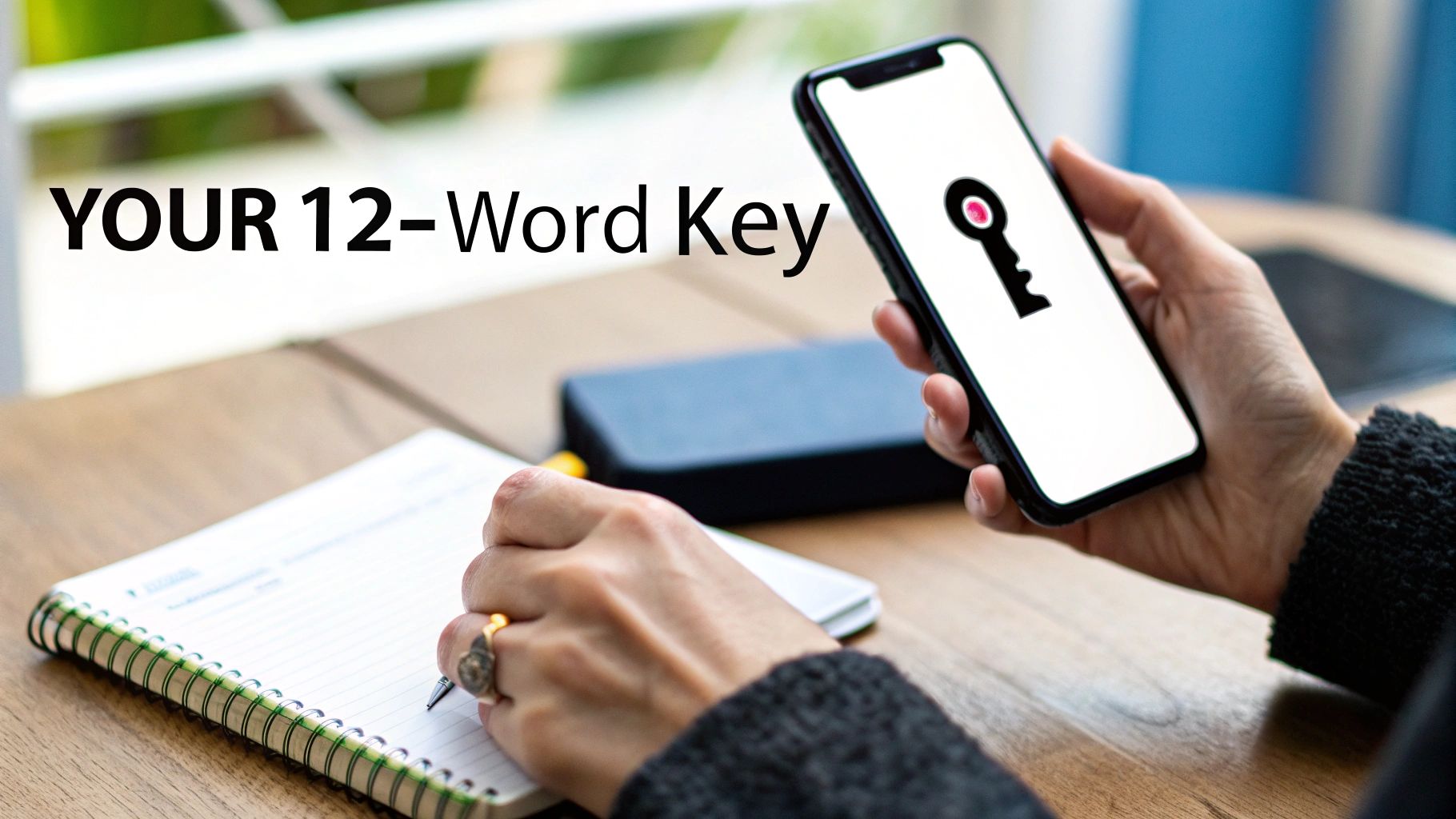

The master key to this whole setup is your 12-word secret recovery phrase. When you first create your Coinbase Wallet, it gives you this unique list of words. This isn't just a password; it's the cryptographic seed that generates all of your private keys.

Think of it as the ultimate backup plan. If your phone gets lost, stolen, or just stops working, this phrase is the only way to get your wallet and your crypto back on a new device.

And this is where the massive weight of responsibility kicks in. Because Coinbase never has this phrase, their support team can't help you if you lose it. If that phrase is gone, your crypto is gone with it. Permanently.

With Coinbase Wallet, you are the vault. The security of your recovery phrase is the security of your entire portfolio. This absolute control is what many users seek when deciding between self-custody and a centralized exchange.

Getting how this self-custody model works is key to understanding its pros and cons. To dig deeper, you can learn more about how Coinbase Wallets work in our detailed guide.

On-Device Encryption and User-Level Threats

Coinbase Wallet does its part by using strong security measures right on your device. Your private keys are encrypted and stashed in a secure enclave, a protected area of your phone's processor built to be tamper-resistant. This makes it incredibly hard for malware to just pull the keys off your device.

But here’s the reality: the biggest threats to a self-custody wallet almost always target the user, not the tech. It’s not about hackers cracking the wallet's code; it's about tricking you into giving up control.

These are the most common traps you'll see:

- Phishing Scams: Fake emails or websites that look like the real deal, designed to fool you into typing in your recovery phrase.

- Malicious Smart Contracts: Shady DeFi apps or NFTs that ask for sweeping permissions to your wallet, letting them drain your funds the moment you approve a transaction.

- Social Engineering: Scammers pretending to be from "support" who talk you into sharing your screen or recovery phrase to "fix" a fake problem.

- Malware: Nasty software like keyloggers that record everything you type, including your precious recovery phrase.

The wallet’s own architecture is rarely the weak link. The self-custody model shifts the entire security burden from the platform to you. In fact, for all verified security incidents, 100% of confirmed cases were traced back to exchange account access issues, phishing, or DeFi risks. Not a single confirmed incident involved a breach of Coinbase Wallet's core self-custody design.

This is the most critical point when asking, "is Coinbase Wallet safer than Coinbase?" The Wallet protects you from massive, exchange-level hacks. But it's completely vulnerable to your own mistakes. Your diligence is the final, and most important, layer of security.

Understanding Coinbase Exchange Security Measures

When you keep your crypto on the main Coinbase platform, you're not holding the keys yourself. Instead, you're trusting your assets to a system built with institutional-grade security, much like a heavily fortified digital bank. This is a custodial model, the polar opposite of the self-custody approach of Coinbase Wallet.

The foundation of Coinbase's security is a simple but powerful concept: cold storage. The exchange keeps the vast majority of customer funds—roughly 98%—completely offline. By disconnecting these assets from the internet, they are effectively walled off from online attackers, neutralizing common threats like hacking and malware. The small fraction left in "hot" wallets is just to keep daily trading liquid, and even that amount is fully insured.

But that robust offline storage is only one part of the equation. The security measures you interact with every day are just as important.

User-Facing Security and Account Protection

Coinbase doesn't mess around with account protection. They enforce several security protocols that work together to create a serious barrier against anyone trying to get into your account.

- Mandatory Two-Factor Authentication (2FA): You simply can't use Coinbase without it. This adds a second layer of verification beyond your password, usually a code from an authenticator app or a physical key. It makes a stolen password far less dangerous.

- Device Verification: Any time you try to log in from a new device, browser, or location, you'll have to prove it's really you. It’s a straightforward way to stop unauthorized logins from unfamiliar places.

- Time-Delayed Withdrawals: If you reset your password or make other big changes, Coinbase might put a temporary hold on withdrawals. It can feel inconvenient, but that delay is a critical safety feature, giving you a window to lock your account if someone else made the change.

On top of these visible protections, there’s a crucial safety net working in the background. For instance, any USD cash balances you hold are covered by FDIC insurance up to $250,000 per person, just like a traditional bank account.

The core value of Coinbase Exchange's security is delegation. You trade the absolute control of self-custody for the convenience and robust safety net of a regulated company that manages risk at an institutional scale.

Institutional Trust and Regulatory Oversight

The platform's security isn't just about tech; it’s also built on a foundation of public trust and regulatory compliance. As a publicly traded company in the U.S., Coinbase has to undergo stringent financial audits and answer to regulators. This forces a high standard of security and transparency.

This commitment to security is a major reason why users trust the platform. In the United States, 84% of experienced crypto traders consider Coinbase secure. That confidence is echoed in Germany, where 73% of traders trust the exchange, and in the UK, where its brand trust surpasses all major competitors combined. These numbers show that the institutional safeguards and regulatory oversight really matter to people. You can find more details on Coinbase's position as a trusted crypto exchange in their research.

Ultimately, the exchange presents a strong case for users who prefer managed security. It’s a system designed to protect you from both external attacks and common mistakes like losing a password, offering a familiar, bank-like experience. The trade-off is giving up direct control of your private keys—one of the most fundamental choices in the crypto world.

Comparing Real-World Security Risks

So, is Coinbase Wallet actually safer than using the main Coinbase exchange? To get a real answer, we have to look past the marketing and dig into the kinds of threats you'll actually face with each.

It's not that one is inherently more dangerous than the other. The risks are just fundamentally different. The right choice for you depends entirely on which set of threats you're better prepared to manage.

With the Coinbase exchange, the danger is all about someone getting access to your account. Since Coinbase holds the crypto for you, an attacker’s goal is to impersonate you and get through the front door. This is a fight to protect your online identity.

With Coinbase Wallet, the threats come for you personally. You are the bank. Scammers focus on tricking you, the guardian of your private keys, into making a mistake. It's less about hacking a system and more about psychological manipulation.

Common Threats to Your Coinbase Exchange Account

When you use the main Coinbase platform, you’re mostly defending against attackers trying to get ahold of your login credentials. These are the most common ways they do it.

- Sophisticated Phishing Attacks: Forget the old, poorly-worded emails. Modern attackers build perfect clones of the Coinbase login page. They'll hit you with an urgent text message or email, rushing you to a fake site where you hand over your username, password, and 2FA code.

- SIM Swap Fraud: This is a nasty one. A scammer tricks your mobile phone company into moving your phone number over to a SIM card they control. As soon as they have your number, they can intercept any 2FA codes sent by SMS, walk right past that security layer, and get into your account.

- Insider Threats and Data Breaches: While not common, it’s impossible to ignore the risk of a breach at the exchange level or a rogue employee. In one incident, criminals reportedly bribed support agents to get customer data, which they then used for targeted social engineering scams. No funds were taken directly from the platform, but it shows how centralized data becomes a honeypot for attackers.

The central risk on the Coinbase Exchange is one of trust. You're trusting Coinbase to secure its infrastructure, while you're responsible for securing the keys to your account—your login details. An attacker just needs to steal those keys.

Common Threats to Your Coinbase Wallet

When you switch to a self-custody wallet like Coinbase Wallet, the entire security perimeter shrinks down to you and your device. Attackers don't have to beat Coinbase's corporate security anymore; they just have to beat you.

- Recovery Phrase Theft: This is the big one, the master key to everything. Malware like keyloggers can silently record your 12-word recovery phrase as you type it. Phishing sites will try to trick you into entering it to "sync" or "re-validate" your wallet. If an attacker gets that phrase, your funds are gone. Instantly and irreversibly.

- Malicious Transaction Signing: A huge and growing threat in the DeFi and NFT world. Scammers trick you into signing what looks like a harmless transaction—maybe for an airdrop or a free mint—but it actually gives a malicious smart contract permission to drain your wallet. They don't even need your keys, just your one-time approval.

- Physical Loss or Damage: Sometimes the simplest risk is the one that gets you. If you jot down your recovery phrase on a piece of paper and that paper gets lost in a move, a fire, or a flood, your crypto is gone for good. There's no customer support line to call. Your backup is your only lifeline.

Let's put these threats side-by-side to make the distinction crystal clear.

| Threat Scenario | Coinbase Exchange Risk | Coinbase Wallet Risk |

|---|---|---|

| Phishing Attack | Attacker steals your login and 2FA. Mitigation: Coinbase's device verification and withdrawal holds can sometimes slow them down. | Attacker tricks you into revealing your recovery phrase. Result: Immediate and total loss of funds. No second chances. |

| Malware on Your Device | A keylogger could grab your password. Mitigation: A strong 2FA method (like a hardware key) makes a stolen password far less of a threat. | A keylogger captures your recovery phrase. Result: Attacker clones your wallet and drains every last asset. |

| Human Error | You forget your password. Mitigation: You can go through Coinbase's identity verification process to recover your account. | You lose your recovery phrase. Result: Your funds are permanently and irretrievably lost. Nobody can help you. |

| Platform-Level Breach | A major hack could hit the exchange's hot wallets or customer database. Mitigation: Coinbase's insurance and cold storage policies are there to limit the damage. | You're basically immune to exchange hacks. Your funds live on the blockchain, totally separate from Coinbase's corporate systems. |

At the end of the day, asking "is Coinbase Wallet safer than Coinbase?" is the wrong question.

The real question is: are you more confident in your ability to secure a password and use 2FA, or in your personal discipline to safeguard a 12-word phrase and spot scams? Your honest answer tells you which environment is safer for you.

What Happens When You Lose Access

It’s one thing to understand a platform’s security on a good day, but the real test comes when something goes wrong. Losing access to your crypto is a frighteningly real possibility, whether you're using the Coinbase Exchange or Coinbase Wallet.

The path to getting back in—or the stark reality that you can't—is where these two services couldn't be more different. This distinction is the absolute core of deciding which one is safer for you. Each recovery process is a direct reflection of its security philosophy: one offers a familiar, centralized safety net, while the other enforces the unforgiving rules of self-sovereignty.

Recovering Your Coinbase Exchange Account

Let's say you lose access to your main Coinbase account. Maybe you forgot your password or your phone with your two-factor authentication (2FA) app is gone. The recovery process here feels much like it would with your bank. It's a structured, multi-step identity verification designed to get you back in control.

You can kick things off by requesting a password reset right from their website. This usually involves:

- Email Verification: A reset link is sent to your registered email, which is the first checkpoint.

- Identity Confirmation: You’ll need to provide personal info and will likely have to upload a government-issued ID, like a driver's license or passport.

- Facial Recognition: To close the loop, you’ll often be asked to take a live selfie or a short video to prove you’re the person in the ID photo.

For anyone who values a backup plan, this process is a huge plus. Because Coinbase is a custodian, they have the authority to verify you are who you say you are and grant you access to the account where they hold your funds. It can be a bit of a process, but that safety net is there.

The ability to recover an account is a cornerstone of custodial services. For most people, this managed process is a critical security feature, protecting them from the permanent loss that a simple mistake can cause.

This is precisely why asking "is Coinbase Wallet safer than Coinbase?" isn't a simple yes or no. For many, the risk of misplacing a password feels far more real than an exchange-wide hack, making the exchange the more practical and safer choice.

The Stark Reality of Coinbase Wallet Recovery

Now, imagine the same scenario with Coinbase Wallet. Your phone is lost, broken, or you just forgot the PIN. You install the app on a new device, and it greets you with a single, uncompromising request: enter your 12-word secret recovery phrase.

There is no "Forgot my phrase" link. There is no customer support line you can call to prove your identity. Coinbase itself has zero record of this phrase and, therefore, has absolutely no way to get into your wallet.

This is the non-negotiable trade-off you make for true self-custody.

- Your Recovery Phrase is Your Only Key: It is the one and only way to restore your crypto. No alternatives exist.

- No Centralized Help Desk: Since Coinbase never holds your keys, they are structurally incapable of helping you. It's not that they won't; they can't.

- Loss is Permanent: If you lose that phrase, your funds are gone. Forever. They'll still exist on the blockchain, but without the key, they are locked away in a vault that no one can ever open again.

This unforgiving nature isn't a design flaw—it's the entire point. When you control your keys, you also bear 100% of the responsibility for securing them. For those who can meticulously manage this, the Wallet offers unparalleled security from outside threats. But for those who can't, it introduces the catastrophic risk of total, irreversible loss from a single point of failure.

If you find yourself in this situation, professional assistance from a service like Wallet Recovery AI might be one of the few avenues left, especially if you have a partial phrase or other digital clues. But honestly, prevention is the only guaranteed solution here.

So, which one is right for you: the main Coinbase exchange or the separate Coinbase Wallet app?

This isn’t about a clear winner. The real question is which model fits your habits, technical confidence, and crypto strategy. The answer to “Is Coinbase Wallet safer than Coinbase?” really comes down to the kind of user you are.

Instead of a simple verdict, let’s look at who each platform is truly built for. This should help you see where you fit.

Choose Coinbase Exchange If You're a Beginner or Active Trader

If you're just dipping your toes into crypto, the main Coinbase platform is the obvious starting point. Its security feels like a familiar online bank account. Forgetting your password isn't a catastrophe—you can recover your account. That safety net is absolutely essential when you're new.

The exchange is also the go-to for active traders. You get seamless access to trading tools, instant liquidity, and no on-chain gas fees for moving funds around inside Coinbase's ecosystem. It’s just a much faster and more efficient environment for frequent buying and selling. For these folks, convenience and institutional security trump the philosophical purity of self-custody every time.

Stick with the Coinbase Exchange if you:

- Value convenience and account recovery over absolute, personal control.

- Are new to cryptocurrency and want a straightforward, user-friendly experience.

- Trade actively and need quick, cheap access to your funds.

- Prefer to let a regulated, publicly-traded company handle the heavy lifting on security.

Choose Coinbase Wallet If You're a Long-Term Investor or DeFi User

Coinbase Wallet is designed for a completely different mindset. It's for people who prioritize total control and are willing to take on the responsibility that comes with it. If you're a long-term investor—a "HODLer"—the Wallet lets you take your assets completely off the exchange, shielding them from any third-party risk.

It's also your passport to the rest of the crypto world. If you want to dive into Decentralized Finance (DeFi), mint NFTs, or play with other web3 apps, the Wallet is non-negotiable. It lets you connect directly to decentralized protocols in a way the centralized exchange just can't. You get full freedom, but you also accept full accountability.

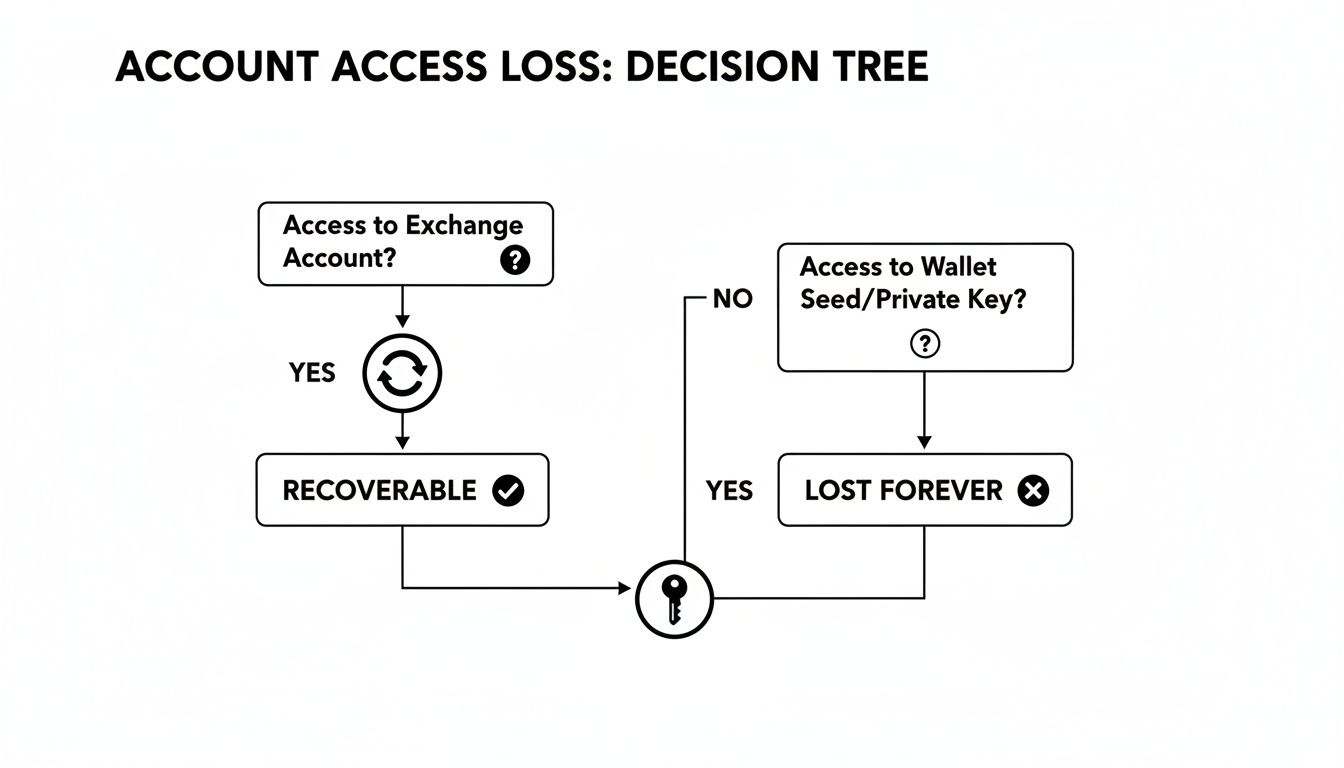

This decision tree shows just how different the stakes are if you lose access. It’s a critical factor to consider.

The diagram makes it crystal clear: with the exchange, there are recovery paths. If you lose your Wallet’s 12-word recovery phrase, your assets are gone. Period.

“Not your keys, not your crypto.” This is the core belief in the blockchain world, and it's the ultimate tie-breaker here. If that statement resonates with you and you’re prepared for what it means, Coinbase Wallet is your tool.

Ultimately, your choice is a reflection of your personal risk tolerance. If the thought of misplacing a secret phrase is more terrifying than an exchange getting hacked, the main Coinbase platform is your safer bet. If you trust yourself more than any company, the Wallet gives you security in its purest form.

A Few Common Questions

When you're trying to figure out the security differences between the main Coinbase platform and the Coinbase Wallet app, a few practical questions always seem to pop up. Getting straight answers is key to deciding where your crypto should live. Let's tackle some of the most common ones.

What Happens If My Phone Gets Stolen?

This is where the two security models really show their differences, and it’s a scenario everyone worries about.

If you’re using the Coinbase exchange app, losing your phone is a massive pain, but it’s not a financial disaster. You can just grab another device, log into your account, change your password, and kill the session on your old phone. Since Coinbase is holding the keys, your funds are safe on their servers, assuming your login credentials weren't also compromised.

Now, for Coinbase Wallet users, the situation is a bit more intense, but you're not helpless if you’ve done your homework. The thief can't get into your funds without your PIN or biometrics. Your first and only priority should be to grab your 12-word recovery phrase and restore your wallet on a new, secure device. Once you're in, immediately send every last asset to a completely new wallet with a fresh recovery phrase. Consider the old one burned.

Can I Connect My Coinbase Account to My Wallet?

Yep, you can link your main Coinbase account directly to your Coinbase Wallet. It’s actually a pretty slick integration designed to make life easier. You can buy crypto on the exchange and then zap it over to your self-custody wallet without much fuss. It's a simple way to move funds into a space where you're the one in charge.

Just be crystal clear on this: linking them doesn't merge their security. Your exchange account is still custodial, and your Wallet is still non-custodial. A hacker getting into your Coinbase.com account doesn't give them your Wallet's recovery phrase, and losing your recovery phrase doesn't give them access to your exchange account.

Are DeFi Apps Safe To Use With Coinbase Wallet?

Dipping into DeFi adds a whole new layer of risk that has nothing to do with the wallet's own security. When you connect your Coinbase Wallet to a decentralized application, you're usually asked to sign a transaction or approve a smart contract to let it do something.

Your wallet can be a fortress, but it can't stop you from willingly signing a malicious contract that drains your funds. The responsibility is entirely on you to double- and triple-check the legitimacy of any DeFi protocol you interact with. Scammers are experts at tricking people into signing contracts that look innocent but are designed to give them permission to empty your wallet.

If you've lost access to your wallet because of a forgotten password, a misplaced recovery phrase, or some other technical nightmare, don't assume your funds are gone forever. Wallet Recovery AI uses specialized, AI-powered services to help people get back into their accounts securely. Learn more at https://walletrecovery.ai.

Leave a Reply