The biggest difference boils down to a simple question: who holds your keys?

Think of Coinbase, the exchange, as your crypto bank. They hold and manage your assets for you, which is known as a custodial model. Coinbase Wallet, on the other hand, puts you in complete control. It’s a non-custodial wallet, meaning you—and only you—are the keeper of your private keys.

Custody: The Core of the Comparison

This single distinction in asset custody is the most important thing to understand. It’s the fork in the road that determines everything else, from security and responsibility to the features each platform offers. One is built for convenience, mirroring traditional finance, while the other is built for self-sovereignty and direct control over your digital life.

Let’s break that down.

- Coinbase (The Exchange) is a custodial service. They handle the complex stuff—like managing private keys—behind the scenes. This is great for beginners because if you forget your password, you can recover your account through their support, just like you would with your bank.

- Coinbase Wallet (The App) is a non-custodial (or self-custody) wallet. You are given a 12-word recovery phrase that acts as your master key. This gives you absolute control, but it also comes with absolute responsibility. If you lose that phrase, your funds are gone. Period.

For a deeper dive into these models, our guide on the differences between custodial and non-custodial wallets provides more detail.

Coinbase vs. Coinbase Wallet At a Glance

To make it even clearer, here’s a quick table breaking down the essential differences. This should help you figure out which one is the right fit for you.

| Feature | Coinbase (Exchange) | Coinbase Wallet (App) |

|---|---|---|

| Asset Custody | Custodial (Coinbase holds keys) | Non-Custodial (You hold keys) |

| Primary Use Case | Buying, selling, and trading crypto | Interacting with dApps, DeFi, and NFTs |

| Security Responsibility | Primarily on Coinbase | Solely on the user |

| Recovery Process | Password reset via identity verification | Requires your 12-word recovery phrase |

| Ideal User | Beginners, traders, and passive investors | Experienced users, DeFi explorers, NFT collectors |

This table neatly sums it up: the Coinbase exchange is for trading and investing in a familiar, managed environment. Coinbase Wallet is your passport to the wild, open world of Web3, where you are your own bank.

Understanding Who Really Controls Your Crypto

The biggest difference between Coinbase and Coinbase Wallet boils down to one critical concept: custody. Who actually holds the keys to your digital assets? This single detail shapes your entire experience, from security and responsibility to the freedom you have on-chain. One approach is built for convenience, the other for total self-sovereignty.

Using the main Coinbase platform is a custodial relationship. Think of it like your bank account—Coinbase holds and manages the private keys for you. It’s an incredibly straightforward model, which is why it’s a go-to for beginners.

If you lose your password, you just go through a standard account recovery process. But that convenience comes with a trade-off: you're trusting a third party to keep your funds safe. While Coinbase has a stellar security reputation, you are ultimately relying on their systems to stay online and secure.

The Trade-Off: Convenience vs. Control

The Coinbase exchange's custodial model provides institutional-grade security that most people couldn't set up themselves. For example, 98% of customer assets are kept in offline cold storage, and USD cash balances are FDIC-insured up to $250,000. That’s a massive safety net against large-scale hacks.

The catch is you’re exposed to platform risk. If the exchange has a major outage or faces regulatory action, your access could be frozen. You're trading a bit of control for professional-grade security and ease of use.

Key Takeaway: With Coinbase, you own the assets, but you don't hold the keys. This is the heart of the crypto mantra, "Not your keys, not your coins."

Taking Full Control with Coinbase Wallet

Coinbase Wallet is the polar opposite. It’s non-custodial, which is just another way of saying self-custody. When you create a wallet, you're given a unique 12-word recovery phrase. This phrase is the master key to your crypto.

This setup gives you absolute, undeniable ownership. Only you can access your funds. This freedom lets you dive straight into the decentralized web—dApps, DeFi, and NFTs—with no one in the middle. We cover the technical side of this in our guide on how Coinbase Wallets work.

But with great power comes great responsibility. Since Coinbase never sees your recovery phrase, their support team can’t help you if you lose it. Your wallet's security is 100% on you. The safety of your assets depends entirely on your ability to protect that 12-word phrase from being lost, stolen, or damaged.

Comparing Features for Investors and Web3 Explorers

Once you get past the fundamental idea of who holds the keys, the practical differences between Coinbase and Coinbase Wallet really come into focus. It all boils down to what you’re trying to do. One is a polished marketplace built for investing, while the other is your passport to the wild, decentralized internet.

Think of the main Coinbase platform as your on-ramp. Its job is to make it incredibly simple to buy, sell, and manage popular cryptocurrencies using regular money like US dollars or Euros. For anyone just getting their feet wet in crypto, it’s the perfect place to start.

Coinbase Wallet, on the other hand, is built for getting your hands dirty. It doesn't let you buy crypto directly with cash inside the app (though you can link it to your main Coinbase account to do so). Instead, all its features are geared toward interacting with the sprawling Web3 ecosystem.

Trading and Investing Capabilities

The Coinbase exchange is a classic centralized marketplace designed with the investor in mind. It features a curated list of over 250+ coins and tokens, giving you access to both established players and promising new projects. The whole experience is clean and intuitive—setting up recurring buys or just tracking your portfolio is a breeze.

For instance, if you want to automatically invest $100 in Bitcoin every month, you can set that up on Coinbase in about a minute. The user interface feels familiar, and your transaction history is laid out clearly, which is a lifesaver when it comes to things like tax season.

Coinbase Wallet is a different beast entirely. It gives you access to a practically infinite number of tokens. By connecting to decentralized exchanges (DEXs) like Uniswap, you can trade thousands upon thousands of assets, including brand-new tokens that haven't hit the major exchanges yet. For anyone hunting for those early, ground-floor opportunities, this is a massive advantage.

Key Insight: Coinbase gives you a curated, easy-to-use trading experience for major cryptocurrencies. Coinbase Wallet throws open the doors to the entire decentralized market, letting you trade almost any token you can find on its supported networks.

Exploring the Decentralized Web (Web3)

This is where Coinbase Wallet really pulls away from its exchange counterpart. The wallet comes with a built-in dApp browser, which is essentially your secure gateway to the world of decentralized finance (DeFi), NFTs, and blockchain gaming.

With Coinbase Wallet, you can dive right in and:

- Use DeFi Protocols: You can lend out your assets on platforms like Aave to earn interest or add them to a liquidity pool on a DEX to earn trading fees.

- Manage Your NFTs: It’s a secure vault for viewing and managing your collection of non-fungible tokens, whether they're on Ethereum, Polygon, or another network.

- Jump Between Blockchains: The wallet isn't tied to just one network. It supports multiple chains like Ethereum, Solana, Polygon, and Avalanche, so you can explore different ecosystems without juggling a dozen different wallets.

The main Coinbase platform barely scratches the surface of these activities. Sure, it has its own NFT marketplace and lets you stake certain assets, but it always acts as the middleman. With the wallet, you’re interacting directly and without permission. That hands-on control is the whole point of the self-custody model that defines Coinbase Wallet.

A Practical Breakdown of Fees and Costs

Let's talk about the money side of things. How Coinbase and Coinbase Wallet handle fees is one of the clearest ways to see the difference between them. They operate on two completely different financial models, which really gets to the heart of the custodial vs. non-custodial debate.

One charges you for convenience and easy market access. The other simply passes along the built-in costs of actually using a blockchain.

The main Coinbase exchange has a fee structure with a few moving parts. When you buy or sell crypto, you're paying more than just the market price. First, Coinbase adds a spread, which is basically their margin—usually around 0.5%—between the market price and what they quote you. Then, they add a separate transaction fee on top, which changes depending on how much you're trading and how you're paying.

Think of it this way: buying $100 of Bitcoin with your bank account will have both the spread and that transaction fee tacked on. Your total cost ends up being a bit higher than the $100 you intended to spend. These fees are how Coinbase covers its own security, operations, and, of course, turns a profit. If you want to move your crypto out to an external wallet, you'll also pay a network fee, which Coinbase estimates for you.

How Coinbase Wallet Fees Work

Coinbase Wallet, on the other hand, plays by a totally different set of rules. The app itself is free. Coinbase doesn't charge you a dime for downloading it or for holding your assets in it. The only costs you'll ever run into are network fees, which you’ve probably heard called gas fees. These are unavoidable for any transaction that happens on a blockchain.

Crucially, these fees don't go to Coinbase. They go directly to the miners or validators who are doing the computational work to process and secure your transaction on the network, whether that’s Ethereum, Polygon, or Solana.

Key Takeaway: With Coinbase, you pay platform fees for the service of buying, selling, and safekeeping. With Coinbase Wallet, you only pay the non-negotiable network fees required to interact directly with a blockchain.

Comparing Real-World Cost Scenarios

So, how does this actually look in practice? The costs on each platform are really designed for different activities.

-

Buying Crypto with Fiat: If you're just looking to buy crypto with US dollars, it's almost always simpler and cheaper to do it on the main Coinbase exchange. This is especially true for larger, one-time purchases, as you sidestep multiple on-chain transactions.

-

Frequent DeFi Interactions: Now, if your goal is to swap tokens on decentralized exchanges, lend out your assets, or mint NFTs, Coinbase Wallet is where you want to be. You'll only pay the direct gas fee for each on-chain action, completely avoiding the layered platform fees that a centralized service would have to pass on.

Ultimately, the network fees on Coinbase Wallet are wild cards. They change constantly based on how congested the blockchain is. An Ethereum transaction could cost you $50 or more during peak demand, but at a quiet time, it might only be a few bucks. This volatility is just part of the deal when you use blockchains directly, whereas Coinbase's platform fees are much more predictable. This is a fundamental difference in how you'll experience costs with each product.

What Happens When You Lose Your Password or Keys?

We’ve all felt that heart-stopping moment when a password just won’t work. But how that panic plays out is worlds apart when comparing the main Coinbase exchange and the Coinbase Wallet app. This is where the whole "custodial vs. self-custody" debate gets very, very real.

One is an annoying but fixable problem. The other can be absolutely catastrophic.

Forgetting your password on the main Coinbase platform is an inconvenience, not a disaster. Think of Coinbase as your crypto bank—they hold your assets, but they also hold your identity on file. Because of this, they have a way to verify you're the rightful owner.

The recovery process is exactly what you'd expect from a modern online service. You’ll click a "forgot password" link, jump through a few hoops to prove who you are (usually with an email and a government-issued ID), and you’ll get back into your account. It's a familiar safety net.

The Coinbase Wallet—Your Responsibility, Your Keys

Coinbase Wallet is a completely different beast. During setup, you're given a 12-word secret recovery phrase. Let's be crystal clear: this is not a password. It is the master key to every single asset controlled by that wallet.

You won't find a "Forgot My Recovery Phrase" button anywhere. That’s because Coinbase never sees it, never stores it, and has absolutely zero access to it. This is the very definition of self-custody—you have total control, which means you also have total responsibility.

The Hard Truth: If you lose that 12-word phrase, your crypto is gone. Forever. No one—not even Coinbase support—can get it back for you.

This single point underscores the immense weight of managing your own keys. You gain incredible freedom and eliminate the risk of an exchange getting hacked, but you also become the one and only person responsible for keeping your funds safe.

Comparing Recovery Scenarios

To really grasp what's the difference between Coinbase and Coinbase Wallet when things go wrong, let’s walk through a couple of common scenarios.

-

Scenario 1: You Forget Your Password

- On Coinbase: You go through their standard account recovery. You click "Forgot Password," follow the steps, maybe upload a quick selfie with your driver's license, and you're back in business within a few hours. Your funds were safe and sound the entire time.

- On Coinbase Wallet: Forgetting the password for the app itself (the one you use to unlock it on your phone) is no big deal. You can just delete the app, reinstall it, and use your 12-word recovery phrase to restore everything. That phrase is your ultimate key.

-

Scenario 2: You Lose the Master Key

- On Coinbase: This situation doesn't really exist. You don't have a single "master key." As long as you can prove your identity, you can regain access to your account.

- On Coinbase Wallet: This is the worst-case scenario. If that 12-word phrase is lost in a fire, stolen, or you simply can't find where you wrote it down, the crypto in that wallet is permanently inaccessible. This is a fundamental, unchangeable rule of how blockchains work.

For those in the devastating position of having lost their phrase, specialized services like Wallet Recovery AI can sometimes offer a last-ditch effort, but success is never guaranteed. The only surefire strategy is prevention. Write down your recovery phrase, store it offline in multiple secure locations, and never, ever share it. This is the single most important thing you can do as a Coinbase Wallet user.

Which Platform Is Right for Your Crypto Goals?

Choosing between the main Coinbase exchange and Coinbase Wallet really comes down to what you want to do in the crypto space. This isn't about which one is "better" in a general sense, but which tool is the right one for the job you have in mind. One acts like a familiar bank, while the other is your passport to the wild, open world of the decentralized web.

For most beginners, long-term investors, or anyone who just wants a simple, no-fuss experience, the main Coinbase platform is the obvious place to start. It’s built to feel like an online brokerage account, completely hiding the complex mechanics of the blockchain. If your main goal is buying some Bitcoin or Ethereum with dollars and letting it sit, Coinbase offers a secure, insured, and incredibly straightforward path.

For the Active Web3 Explorer

On the flip side, if you're drawn to the buzzing, fast-moving world of Web3, Coinbase Wallet is an absolute must-have. It’s designed for people who want to do things with their crypto, not just hold it. The wallet is your key to interacting directly with decentralized applications (dApps), snapping up NFTs, and diving into thousands of tokens you won't find on centralized exchanges.

This is the platform for you if you’re itching to get into:

- DeFi Participation: Earning yield by lending your crypto on protocols like Aave or providing liquidity to decentralized exchanges.

- NFT Collecting: Securely storing, displaying, and managing your digital art and collectibles from various blockchains.

- Self-Sovereignty: Taking full, personal control of your private keys, living by the crypto mantra of "not your keys, not your coins."

The decision really boils down to convenience versus control. Coinbase gives you the convenience of a managed financial service, while Coinbase Wallet gives you total control over your digital assets and identity.

Making the Final Decision

In practice, the smartest approach often involves using both platforms in tandem. You can use the main Coinbase exchange as your easy on-ramp to buy crypto with fiat currency. From there, you can seamlessly send those assets over to your Coinbase Wallet for secure, long-term storage or to jump into the wider Web3 ecosystem. This hybrid strategy gives you the best of both worlds: convenience for buying and total control for everything else.

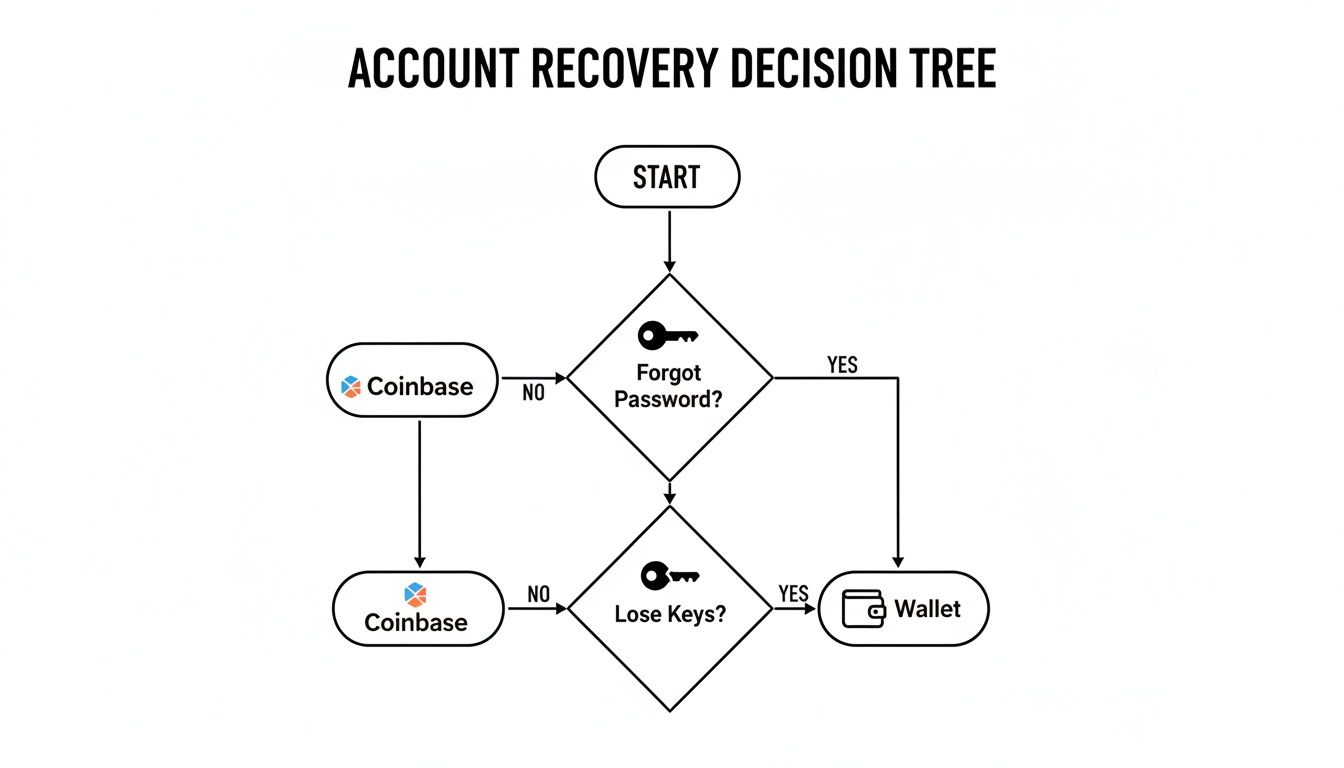

The flowchart below perfectly illustrates the most critical difference between the two: account recovery. Seeing this often makes the right choice crystal clear.

As you can see, forgetting a password on Coinbase is a fixable problem with a standard recovery process. But if you lose the private keys to your Coinbase Wallet, the responsibility—and the risk—is 100% on you. Understanding what's the difference between Coinbase and Coinbase Wallet in a crisis like that will help you pick the platform that truly fits your risk tolerance and crypto ambitions.

If you've lost access to a non-custodial wallet and need help, specialized services might be your only option. Wallet Recovery AI uses advanced methods to help users get back into their wallets securely and privately. You can learn more about how it works at https://walletrecovery.ai.

Leave a Reply