When it comes to your crypto, the single most important decision you'll make boils down to one question: who holds the keys? The answer splits the world of digital wallets into two distinct camps: custodial and non-custodial. This isn't just a technical detail—it fundamentally defines your security, your freedom, and your responsibility.

A custodial wallet is where a third party, like a crypto exchange, holds your private keys for you. In contrast, a non-custodial wallet (often called a self-custody wallet) puts you in complete and exclusive control of your keys. Everything else flows from this one critical difference.

Understanding Custodial and Non-Custodial Wallets

Choosing between these two models is the first real fork in the road for anyone getting serious about crypto. It dictates your entire relationship with your digital assets and how you plug into the wider blockchain world.

The easiest way to think about it is with a traditional banking analogy. A custodial wallet is like your checking account. You trust a bank to hold your money, and in exchange, you get convenience. If you forget your online banking password, you can call them up, verify your identity, and get back in. This familiarity and support make it the go-to for many beginners.

A non-custodial wallet, on the other hand, makes you the bank. You are the only person responsible for safeguarding the private keys that prove you own your funds. This embodies the core ethos of decentralization summed up by the famous phrase: "not your keys, not your coins." While it gives you absolute control, it also means there's no 1-800 number to call if you lose your credentials.

The trade-off is simple but profound: custodial wallets offer convenience but require you to trust a third party. Non-custodial wallets give you total control but demand total personal responsibility.

Grasping this dynamic is absolutely essential. It affects everything, from how you'd recover a lost account to how exposed your assets are to things like exchange hacks or freezes. To make the right call for your situation, it helps to see the core differences side-by-side.

Key Differences at a Glance

This table breaks down the fundamental differences between custodial and non-custodial wallets. It's a quick reference to help you weigh the pros and cons based on what matters most to you.

| Attribute | Custodial Wallet | Non-Custodial Wallet |

|---|---|---|

| Private Key Control | Held by a third party (e.g., exchange) | Held exclusively by the user |

| Security Responsibility | The service provider is responsible | The user is solely responsible |

| Ease of Use | High, similar to online banking | Moderate, requires some learning |

| Account Recovery | Possible via password reset/support | Impossible if seed phrase is lost |

| Counterparty Risk | High (e.g., exchange hacks, insolvency) | None |

Ultimately, the choice comes down to a personal risk assessment. Do you trust an external company to secure your assets, or do you trust yourself more? As you'll see, the best approach often involves using both for different purposes.

The Critical Role of Private Keys in Asset Control

Before we dive deep into the pros and cons, we need to get one thing straight: the private key. This isn't just another password. It’s a long string of characters that gives you the absolute, undeniable power to spend your crypto. Whoever holds the key, holds the coins. It's that simple.

This is where the famous crypto mantra, "not your keys, not your coins," comes from. It’s a stark reminder that in the world of digital assets, possession of the private key is the only thing that truly matters. And this is precisely where custodial and non-custodial wallets go their separate ways, fundamentally changing how you control and secure your funds.

Custodial Wallets and Counterparty Risk

When you use a custodial wallet, like the one you get on a major crypto exchange, you're not actually holding your private keys. The exchange is. They’re acting like a bank, holding your assets on your behalf. This simple fact introduces something called counterparty risk—the very real danger that the third party you trust will fail you.

So, what does this risk look like in the real world?

- Hacks and Breaches: Exchanges are massive honeypots for hackers. A successful breach could mean your assets are stolen, and there’s often little you can do about it.

- Insolvency: If the exchange goes bankrupt (and many have), your funds can get tied up in legal proceedings for years, or you might never see them again.

- Account Freezes: As regulated businesses, exchanges can and will freeze your account. A government request, a suspicion of wrongdoing, or even an internal mistake can lock you out of your own money.

In a crisis—whether it's an exchange collapse or a regulatory crackdown—the distinction becomes painfully clear. Custodial users must wait for permission to access their funds, while non-custodial users retain full, uninterrupted control.

Ultimately, this model forces you to trust the custodian's security measures, financial stability, and ethics. Your access to your money depends entirely on them.

Non-Custodial Wallets and Self-Sovereignty

A non-custodial wallet puts you in the driver's seat. You, and only you, hold the private keys. This gives you self-sovereignty—complete, uncensorable control over your assets. No company can freeze your account, no bank can go under with your funds, and no hacker can breach a central server to steal your keys. This is the very essence of decentralization.

Of course, this total freedom comes with total responsibility. The safety of your crypto rests squarely on your shoulders. Your private keys are typically managed through a seed phrase (also called a recovery phrase), which is a list of 12 to 24 words that acts as the master key to your entire wallet.

Lose that phrase, and your crypto is gone. Forever. There’s no "forgot password" link, no customer service to call. If you're new to this concept, our detailed guide on the wallet seed phrase is a must-read.

The choice between custodial and non-custodial isn't just a technical one. It's a philosophical decision about who you trust more: a centralized institution or yourself.

Security, Recovery, and Where It All Goes Wrong

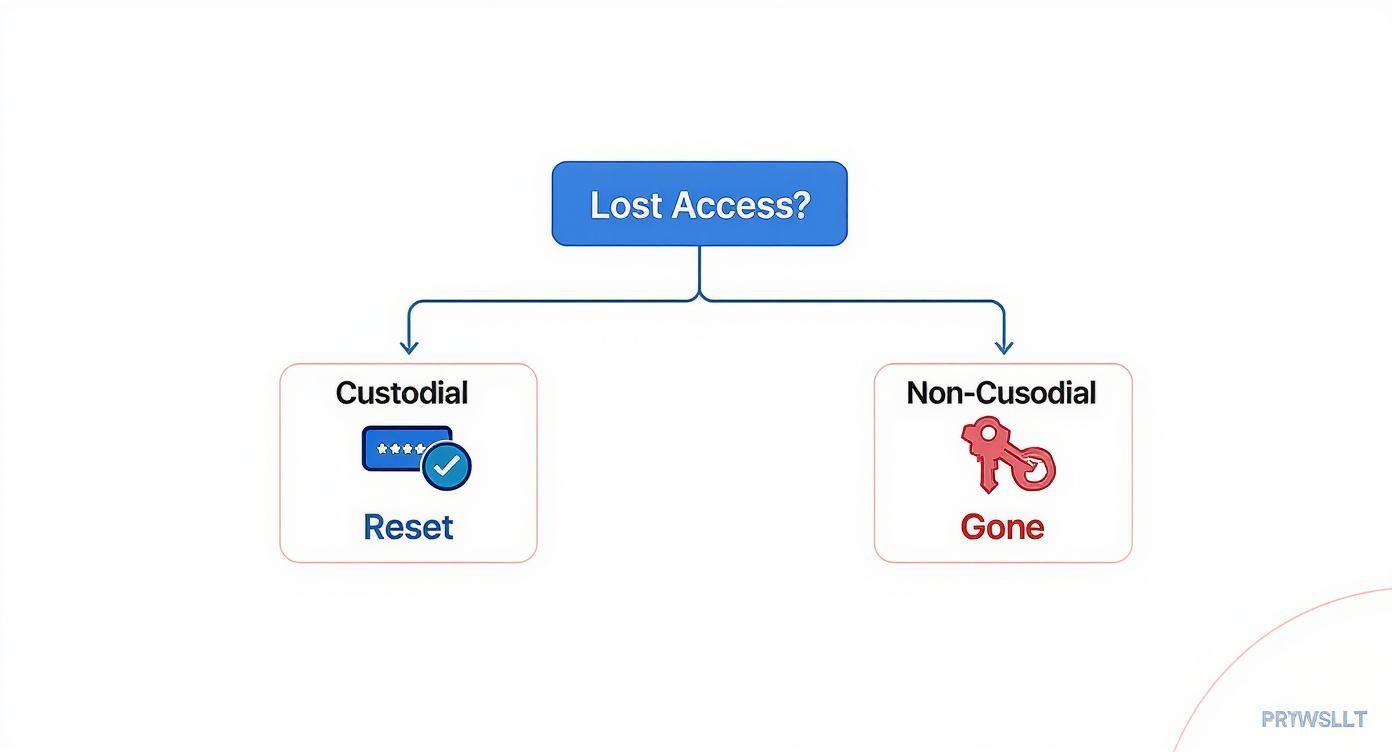

When you get down to it, the real difference between custodial and non-custodial wallets boils down to security and what happens when you lose access. These two paths couldn't be more different, and the trade-offs become crystal clear when things inevitably go sideways.

Custodial services, like the big-name exchanges, operate like digital fortresses. They pour resources into enterprise-grade security, keeping the lion's share of funds in cold storage—specialized hardware that's completely offline and safe from hackers. Many even use advanced setups like multi-party computation (MPC) and have insurance funds to cover their users if the worst happens.

But here's the catch: that fortress is also a massive, glittering target. While your personal account login might be safe, the entire platform is a honeypot for the most sophisticated hacking groups in the world. If they find a way in, it doesn't matter how good your password is. Your funds are at risk.

The Unforgiving Reality of Losing Access

The moment you can't log in is when you truly understand the choice you've made. Forgetting your credentials triggers two completely different experiences, highlighting the core tension between convenience and absolute control.

Custodial Recovery: The Familiar Lifeline

- The Scenario: You forgot your exchange password. Simple as that.

- The Process: You hit the "Forgot Password" link, get an email, and probably have to prove you're you with an ID.

- The Outcome: You're back in. It’s a process we all know from online banking. It’s straightforward, reassuring, and it just works.

Non-Custodial Recovery: The Point of No Return

- The Scenario: Your laptop dies, and that 12-word seed phrase you meant to write down is gone with it.

- The Process: There isn't one. There’s no support number to call, no reset button, no one to ask for help. That seed phrase was your one and only key.

- The Outcome: Your crypto is gone. Forever. It’s a brutal, unforgiving system with zero room for error.

This isn’t a question of which one is "better." It's about which risk you’re willing to own. Do you trust a company's security and its customer support, or do you trust yourself to be your own bank, knowing there’s no one to bail you out?

The custodial model shields you from your own mistakes but exposes you to the company's risks. The non-custodial model shields you from the company's risks but makes your own mistakes catastrophic.

Becoming Your Own Head of Security

Going non-custodial means you've just promoted yourself. You are now the one in charge of security, and the threats shift from a massive exchange hack to something much more personal. Your sole mission is to protect that seed phrase like it's a block of gold. This means storing it offline, never taking a picture of it, and keeping it safe from fire, flood, or theft.

This is why hardware wallets like Ledger or Trezor are so popular. They act as a vault for your private keys, keeping them totally separate from your internet-connected devices where malware lurks. But even a hardware wallet can't protect you from a clever phishing scam designed to trick you into typing out your seed phrase or approving a malicious transaction.

In the non-custodial world, security isn't a feature—it's a full-time job. It requires constant vigilance and a healthy dose of paranoia.

4. Choosing the Right Wallet for the Job

The whole custodial vs. non-custodial debate isn't about finding one "best" wallet. It’s about picking the right tool for a specific task. What you plan to do with your crypto—your goals, your comfort with risk—should dictate your choice. Getting this right from the start is the key to keeping your assets safe and your experience smooth.

For most people just getting started, a custodial wallet on a big exchange makes sense. If all you're doing is buying some crypto with dollars or euros, an exchange wallet is the most straightforward path. The same goes for active traders. They need instant access and fast execution, which is exactly what custodial platforms are built for, since trades happen off-chain and don't require network confirmations.

Matching the Wallet to the Mission

But as your holdings grow or your interests expand, that simple approach starts to look a bit risky. Different activities call for different tools, and this is where non-custodial wallets really come into their own. They offer specialized security and features built for specific purposes.

Think about it in these real-world terms:

- Dipping into DeFi: Want to interact with decentralized finance (DeFi) protocols, use lending platforms, or join a DAO? A non-custodial software wallet like MetaMask is non-negotiable. It's your digital passport, letting you connect directly to these platforms and approve transactions yourself.

- Daily Spending: For smaller, on-the-go purchases, a non-custodial mobile wallet strikes the right balance. It keeps your keys on your phone, giving you full control for everyday use without putting your entire stash at risk.

- Long-Term HODLing: When you’re securing a serious amount of crypto for the long haul, nothing comes close to a hardware wallet. Devices from companies like Ledger or Trezor keep your private keys totally offline, making them immune to hacks, malware, and other online threats.

This flowchart drives home the critical difference in what happens when you lose access—a major factor in your decision.

As you can see, the trade-off is clear. A custodial service gives you a familiar password reset option. With a non-custodial wallet, if you lose your seed phrase, there's no one to call for help.

Building a Smart Wallet Strategy

Any smart crypto strategy eventually involves using both custodial and non-custodial wallets together. It’s common practice to keep a small amount on an exchange for quick trades while locking down the majority of your assets in an offline hardware wallet. For anyone serious about long-term security, taking a look at the best cold storage wallets is a logical next step.

Your wallet strategy shouldn't be static. It needs to adapt. Map your activities—trading, long-term investing, exploring DeFi—to the type of wallet that gives you the right blend of security, convenience, and control for that specific task.

This mindset moves you from abstract ideas to a practical plan. Instead of asking "which wallet is best?", you start asking, "which wallet is best for what I need to do right now?". By segmenting your crypto based on its purpose, you dramatically reduce your risk while getting the most out of what the ecosystem has to offer.

Here's the rewritten section, designed to sound like an experienced human expert and match the provided examples.

Custody and the Law: Who Really Owns Your Crypto?

Choosing between a custodial and a non-custodial wallet isn't just a technical decision—it's a legal one. When you go with a custodial service, you're essentially stepping into the same regulated world as traditional banking.

These platforms, like major exchanges, have no choice but to follow strict Know Your Customer (KYC) and Anti-Money Laundering (AML) laws. That means you'll be handing over your ID and personal information, creating a paper trail that connects your real-world identity directly to your crypto. It's their way of staying compliant, but it comes at the expense of your privacy.

Non-custodial wallets, on the other hand, exist completely outside of that system. Since you're the only one holding the keys, there’s no company in the middle to enforce KYC. This setup gives you a much stronger sense of privacy because your identity isn't automatically tied to your on-chain activity.

When Things Get Complicated: Bankruptcy, Seizures, and Divorce

The real test of ownership comes when legal issues pop up. Think bankruptcy, a government seizure, or even divorce proceedings. With a custodial wallet, your assets are technically held in someone else's name, which can get messy fast. A court can order your funds frozen, and if the exchange itself goes bankrupt, your crypto becomes part of their liabilities. Getting it back could be a long, painful, and uncertain process.

The legal relationship is a bit like family law. There are roughly 12.9 million custodial parents in the United States who have legal responsibility for their children. They have day-to-day control, but their rights and duties are strictly defined by law—just like a crypto custodian’s responsibilities are defined by their terms of service. You can learn more about these legal parallels at Grow Law.

A custodial arrangement, whether for a child or for crypto, establishes a legal framework where a third party holds something of value on behalf of another. This fundamentally changes how ownership and control are treated under the law.

With a non-custodial wallet, the legal picture is crystal clear. You hold the private keys, so you have direct, undisputed ownership of your assets. Unless there's an extreme situation, no one can freeze or seize your funds without your consent.

This self-sovereignty is your best defense against the risks of a third party failing or facing legal trouble. It's why people who truly value censorship resistance and direct financial control almost always choose to be their own bank. The legal clarity is one of the biggest benefits.

Common Questions About Crypto Wallets

Diving into the world of crypto wallets always brings up a few practical questions. It doesn't matter if you're buying your first Bitcoin or you're a seasoned pro refining your security setup—getting straight answers is key to managing your funds safely. Let’s tackle some of the most common things people ask about custodial and non-custodial wallets.

Think of these as the direct, no-fluff answers you need to understand the tradeoffs and make decisions that actually fit your goals.

Which Wallet Is Best for a Beginner?

For most people just starting out, a custodial wallet on a big, reputable exchange is the way to go. It works a lot like a normal online bank account, which means you don't have to immediately deal with the stress of managing your own private keys or seed phrase. This lets you get comfortable with the basics of buying, selling, and trading in a more forgiving environment.

The big win here is the safety net. Forget your password? No problem, you can just go through a standard account recovery process. But as you learn more and your holdings grow, the smart move is to transfer your long-term investments to a non-custodial wallet. That's how you get full control and sidestep the risks that come with leaving your crypto in someone else's hands.

Can My Crypto Be Stolen from a Custodial Wallet?

Absolutely. Theft is a very real risk. The top-tier exchanges pour millions into security, but their centralized nature makes them a juicy target for hackers. A breach can put user funds at risk, though many of the biggest platforms now have insurance to soften the blow.

But it's not just about hackers. You also have to worry about counterparty risk. This is a fancy way of saying you could lose access if the exchange goes bankrupt, gets hit with regulatory action, or just decides to freeze your account. The real danger of the custodial model isn’t necessarily your own security habits, but the fact that you’re putting your trust in a company to not mess up.

The crucial distinction is this: in a custodial setup, you are trusting the provider's security. With a non-custodial wallet, you are responsible for your own, making the difference between custodial and non custodial a matter of where you place your trust.

What Is a Seed Phrase and Why Is It So Important?

A seed phrase (you'll also hear it called a recovery phrase) is a list of 12 to 24 words that acts as the master key to your non-custodial wallet. It's the only thing that can restore your access to your crypto if your phone gets stolen, your laptop dies, or you lose your hardware device.

I can't overstate how critical this is. Anyone who gets their hands on your seed phrase has complete control of your crypto and can drain your accounts in an instant. This is why you have to be almost paranoid about protecting it.

- Store it offline: Never, ever save it as a text file, a photo in your camera roll, or in a password manager. Write it down on paper or, even better, etch it into a metal plate.

- Never share it: No legitimate support agent, developer, or company will ever ask for your seed phrase. Ever. If they do, it's a scam.

- Be vigilant: Don't even think about typing it into a website or app unless you are 100% certain you're restoring your wallet on a trusted device.

In the non-custodial world, if you lose that phrase, you lose your crypto. Forever. There is no customer support line to call, which really drives home the "be your own bank" responsibility.

If you've lost access to your crypto wallet due to a forgotten password or other issues, professional help may be available. Wallet Recovery AI offers specialized, AI-enhanced services to help you regain control of your assets securely and confidentially. Learn more and start your recovery process at https://walletrecovery.ai.

Leave a Reply