The biggest difference between Coinbase and Coinbase Wallet comes down to one simple concept: custody.

Think of it like this: the main Coinbase platform is a custodial exchange. It holds and manages your crypto for you, kind of like how a bank holds your money. On the flip side, Coinbase Wallet is a non-custodial (or self-custody) wallet. It puts you in complete control of your own private keys and digital assets, making it more like a personal vault.

Understanding the Core Difference: Custody

So, when you're choosing between the two, you're really answering one crucial question: who do you want to be in charge of your crypto? Your answer changes everything—from how you secure your funds and recover your account to what you can actually do with your assets.

While both products come from the same company, they’re built for totally different needs.

Coinbase is the centralized exchange most people know. It's designed to be simple and user-friendly, making it the perfect starting point for beginners. It works just like a traditional financial service where the company handles the heavy lifting of securing your private keys. This custodial approach is convenient—if you forget your password, you can just go through a standard recovery process. It's this ease of use that helped Coinbase attract over 100 million verified users by 2023, as noted by platforms like ZenLedger.

Coinbase Wallet, however, is all about self-sovereignty, a core principle of crypto. It’s a tool that hands you the keys to your own digital kingdom, giving you both the freedom and the responsibility that comes with it.

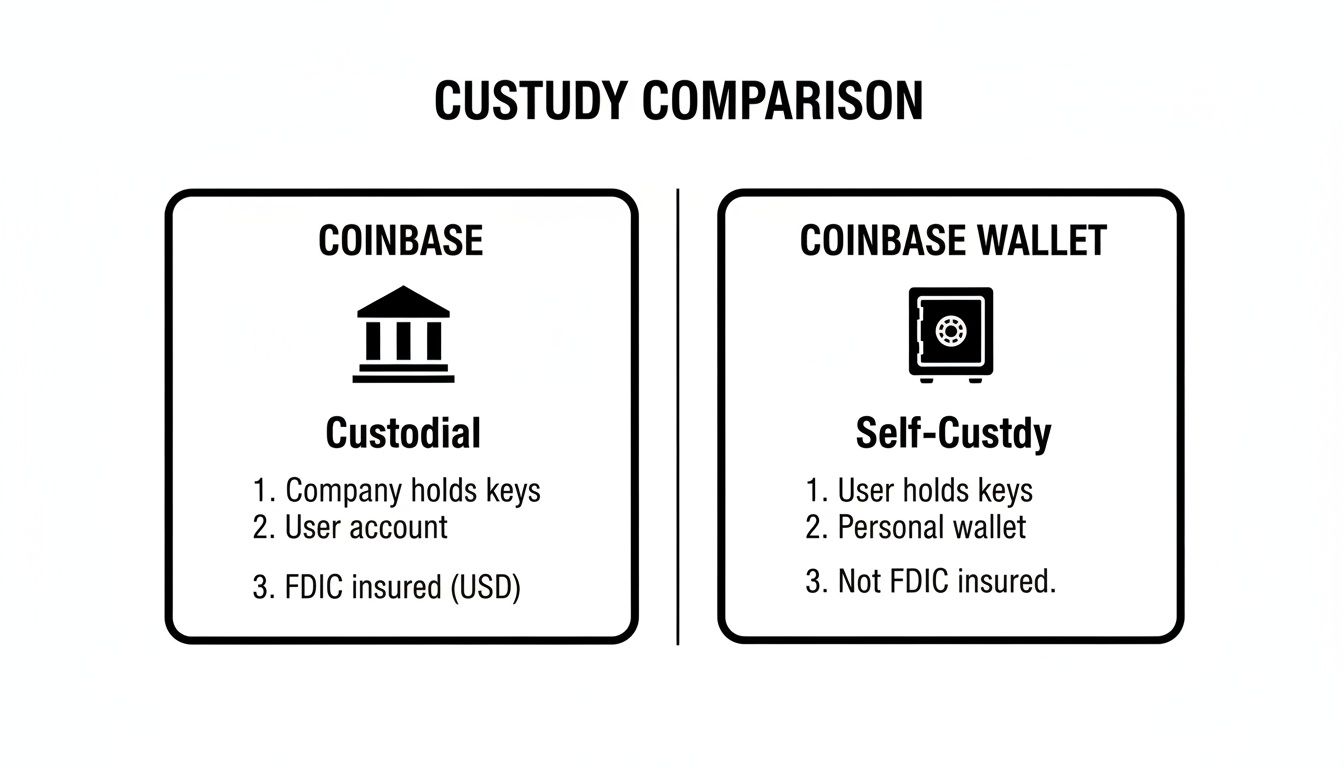

Quick Comparison: Coinbase vs. Coinbase Wallet

To lay it all out, here’s a quick summary of how these two products really differ. This table should help you see the main distinctions at a glance.

| Feature | Coinbase (Exchange) | Coinbase Wallet (Self-Custody) |

|---|---|---|

| Custody Model | Custodial (Coinbase holds keys) | Self-Custody (You hold keys) |

| Primary Use | Buying, selling, and trading crypto with fiat | Interacting with DeFi, NFTs, and dApps |

| Account Recovery | Password reset via customer support | Requires your secret recovery phrase |

| Control | Convenient but less direct control | Full control and responsibility |

Ultimately, this choice defines your experience and what you can do in the crypto world.

The image above does a great job of visualizing the two models. You can see how Coinbase acts as a bank-like custodian, while Coinbase Wallet is more like a personal safe that only you can open. Your decision really comes down to whether you prefer institutional security or total personal control.

Who Really Holds Your Crypto Keys?

The biggest difference between a regular Coinbase account and the Coinbase Wallet comes down to one critical concept: custody. Who actually holds the keys to your crypto? This single detail changes everything—your control, your responsibilities, and how you interact with the digital world.

Think of it like the difference between keeping your money in a bank versus holding cash in a safe at home.

With a standard Coinbase account, you're using a custodial service. In simple terms, Coinbase is the bank. They hold and manage the private keys to your crypto for you. It’s designed for convenience. You get a familiar username and password login, and if you forget them, you can go through a standard account recovery process with their support team.

This setup is great for beginners because it removes the intimidating technical side of securing your own keys. The trade-off? You don't have absolute, direct control over your funds. You're trusting Coinbase to keep them safe.

Taking Control: Self-Custody with Coinbase Wallet

Coinbase Wallet is the complete opposite. It’s built on the principle of self-custody (or non-custodial). When you set up your wallet, it generates a unique 12-word recovery phrase. This phrase is your master key—it's the only thing that can unlock your funds.

Key Takeaway: With Coinbase Wallet, you are your own bank. You have total and exclusive control. But that freedom comes with 100% of the responsibility. If you lose that 12-word phrase, your crypto is gone forever. No one, not even Coinbase, can get it back for you.

This is what decentralization is all about. Your assets live directly on the blockchain, and the only person who can access them is the one holding the keys: you. For a deeper look at how these models work, our guide on custodial and non-custodial wallets breaks it down even further.

Let's make this more concrete:

- Coinbase Account (Custodial): This is like stashing your gold bars in a high-security bank vault. The bank handles all the security, you just need to show your ID (log in) to get access, and they can help you if you lose your vault key (password). You’re trusting their systems.

- Coinbase Wallet (Self-Custody): This is like keeping those gold bars in a personal safe buried in your backyard. You're the only one who knows the combination (your recovery phrase). It gives you unmatched control, but you're also the one responsible for protecting it from thieves and making sure you never forget that combination.

Ultimately, the choice boils down to a trade-off: do you prefer the convenience of a service managing things for you, or the absolute control that comes with being your own bank? Your comfort level with that responsibility is what will guide your decision.

When you're weighing Coinbase against Coinbase Wallet, security and recovery are where the two paths really diverge. They're built on completely opposite philosophies, and your choice boils down to a simple question: do you want a bank-like safety net, or do you want to be your own bank?

This decision directly shapes how your crypto is protected and what happens if you ever get locked out.

The Coinbase Platform: A Digital Fortress

Think of the main Coinbase platform as a fortress, much like a traditional bank. They act as the custodian, meaning they hold and are responsible for protecting your assets. It’s a multi-layered approach that combines their massive, institutional-grade defenses with security measures you control.

On their end, Coinbase keeps over 98% of customer funds in cold storage. This means the assets are completely disconnected from the internet, making them incredibly difficult for hackers to reach.

For your account, they push you to use strong passwords and Two-Factor Authentication (2FA). That extra code from your phone is a crucial barrier that stops someone from getting in, even if they somehow steal your password.

The trade-off? You're trusting Coinbase’s security to hold up. As a massive, well-known exchange, they are a huge target for attackers.

Coinbase Wallet: Your Personal Vault

Coinbase Wallet flips the script entirely. With the Wallet, you are the security. The entire system is built around one thing: your 12-word recovery phrase.

This isn't just a password; it's the master key to all your funds. Anyone who gets their hands on this phrase gets full access to your crypto.

Crucial Insight: Your wallet is only as secure as the piece of paper (or metal) your recovery phrase is written on. The biggest risk isn't a hacker breaking into a server—it's you falling for a phishing scam or misplacing the phrase itself.

The best practice is non-negotiable: write it down, store it in multiple secure offline places, and never, ever type it into a computer or take a picture of it.

What Happens When You Lose Access?

This is where the difference between the two becomes crystal clear. The recovery process for each highlights the core trade-off you're making.

-

Locked out of your Coinbase Account? It’s a familiar process. You’ll go through a password reset flow using your email and prove your identity. Because Coinbase controls the system, their support team can help you get back in, just like a bank would.

-

Lost your Coinbase Wallet Recovery Phrase? This is the tough part. If you lose those 12 words, your funds are almost certainly gone for good. There's no one to call and no "forgot password" button. This is the harsh reality of self-custody and why mastering a secure Coinbase Wallet backup is the most important step you'll take.

At the end of the day, Coinbase gives you a safety net in exchange for control. Coinbase Wallet gives you total sovereignty, but with it comes total responsibility.

Let's get down to the brass tacks: what you can hold, what it costs, and what you can do with your crypto. This is where the practical differences between a main Coinbase account and the Coinbase Wallet really come into focus.

Think of it this way: one is like a carefully curated gallery, and the other is the entire, sprawling art world.

Supported Assets: The Curated Gallery vs. The Open World

The most immediate difference you'll notice is the sheer number of assets you can handle. The main Coinbase platform offers a well-vetted list of cryptocurrencies. It’s extensive, sure, featuring hundreds of the most popular coins, but it's fundamentally a curated environment. Coinbase has a whole process for deciding which assets meet its standards for security, liquidity, and regulatory compliance before they get listed.

Coinbase Wallet, on the other hand, throws the doors wide open. It’s built to support a massive universe of tokens across dozens of blockchains, including Ethereum, Solana, Polygon, Base, and many more. This means you can hold virtually any ERC-20 token you come across, collect NFTs from a niche marketplace, or experiment with brand-new tokens that might never make it onto a big exchange.

The Cost of Doing Business: Fees and Transactions

How you pay for things also tells a completely different story. Each platform has a cost model built for its specific purpose.

When you're on the main Coinbase site or app, you’re paying for the service of trading. Buying, selling, or converting crypto involves a fee structure that typically includes a spread (a small margin built into the price) and a clear transaction fee. These costs are all part of the convenience of using a trusted, centralized exchange that handles everything for you.

Coinbase Wallet is a different beast entirely. Since you're interacting directly with blockchains, you pay network fees, which you'll often hear called "gas." This money doesn't go to Coinbase; it goes to the network validators or miners who process and secure your transaction on the blockchain. Gas fees can change wildly depending on how busy the network is—if everyone is trying to make a transaction at once, the price goes up.

The Bottom Line: With Coinbase, the fees are for their brokerage service. With Coinbase Wallet, the fees are for using the actual blockchain. That’s the core economic split between a centralized platform and a decentralized tool.

On-Chain Actions: Investing vs. Participating

Finally, what can you actually do? The two are worlds apart here. The main Coinbase exchange is built primarily for trading and investing. You can buy some Bitcoin, stake your Ethereum for rewards, or simply hold assets for the long term, but your activities are largely contained within the Coinbase ecosystem.

Coinbase Wallet is your passport to the entire Web3 ecosystem. It unlocks a whole new layer of interaction. With the wallet, you can:

- Dive into Decentralized Apps (dApps): Use lending and borrowing protocols, trade on decentralized exchanges (DEXs), and play blockchain-based games.

- Manage Your NFT Collection: Your wallet acts as your personal gallery, letting you store, display, and manage non-fungible tokens from any platform.

- Have a Say in Governance: Use your tokens to vote on proposals for Decentralized Autonomous Organizations (DAOs), giving you a voice in a project's future.

In short, the main Coinbase platform is where you might acquire the assets. Coinbase Wallet is where you actually put them to work out in the wild world of Web3.

Choosing the right tool for your crypto goals isn't about which one is "better." It's about picking the right one for the job at hand. Your goals, comfort with risk, and technical know-how will ultimately guide your decision.

If you're just starting out, the main Coinbase platform is almost always the best place to begin. It's designed for simplicity and serves as the perfect on-ramp for turning traditional currency (like US dollars) into your first digital assets. Its straightforward interface makes buying, selling, and holding crypto feel familiar and less intimidating.

But if your ambitions extend into the wider world of Web3, you'll find a centralized exchange limiting. This is where Coinbase Wallet comes into its own.

When to Use Each Platform

Your day-to-day crypto activities will determine which tool you should reach for. Let's break down a few common situations to see how Coinbase and Coinbase Wallet differ in practice.

You should use the main Coinbase platform if you want to:

- Buy your first crypto with a bank account or debit card.

- Actively trade cryptocurrencies to take advantage of market shifts.

- Simply hold your assets as a long-term investment with bank-like security.

- Easily cash out your crypto back into fiat currency.

You should use Coinbase Wallet if you want to:

- Interact with decentralized finance (DeFi) protocols to lend, borrow, or earn yield.

- Buy, sell, and manage a collection of NFTs.

- Participate in project governance by voting with your tokens in a DAO.

- Maintain absolute control and privacy over your own funds.

Key Insight: The most effective strategy isn't choosing one over the other—it's using them together. Most experienced crypto users take a hybrid approach, leveraging each platform for its specific strengths.

Use Case Scenarios: Which One Should You Use?

To make it even clearer, here’s a breakdown of which tool to grab based on what you’re trying to accomplish.

| Your Goal | Recommended Tool | Why It's a Good Fit |

|---|---|---|

| Buy Bitcoin for the first time | Coinbase | It's the simplest, most direct way to convert fiat (USD, EUR, etc.) into crypto using familiar payment methods like a bank account or card. |

| Trade between different cryptocurrencies frequently | Coinbase | The centralized exchange offers lower fees and faster execution for high-frequency trading compared to on-chain swaps in a wallet. |

| Store my crypto for the long term and forget about it | Coinbase | Its custodial nature provides bank-grade security and straightforward account recovery if you lose your password. It's a "set it and forget it" solution. |

| Earn interest on my assets through a DeFi lending protocol | Coinbase Wallet | This requires interacting directly with smart contracts, which is only possible from a self-custody wallet that you control. |

| Buy an NFT from an artist on OpenSea | Coinbase Wallet | NFT marketplaces are dApps. You need a wallet to connect, sign transactions, and prove ownership of your digital collectibles. |

| Vote on a proposal for a project I've invested in | Coinbase Wallet | DAOs require you to connect your wallet to verify you hold the project's governance tokens, giving you the right to vote. |

Ultimately, using both tools in tandem provides the most flexibility and power for your entire crypto journey.

The Hybrid Strategy: Combining Both Tools

This combined approach truly offers the best of both worlds. You can use the main Coinbase platform as your secure, regulated bridge to the traditional financial system—it's the easiest way to get dollars into the crypto ecosystem.

Once you’ve bought your assets on Coinbase, you can transfer them to your Coinbase Wallet. This simple move shifts your funds from a custodial account into a self-custody setup where you hold the keys and have total control. From there, the entire Web3 world is open for you to explore, all without giving up the convenience of an easy on-ramp and off-ramp.

Moving Crypto Between Coinbase and Coinbase Wallet

Knowing the difference between your Coinbase account and Coinbase Wallet is the first step. The real magic, though, happens when you start using them together.

Lots of people use a hybrid approach. They treat the main Coinbase platform as their "on-ramp"—the easiest way to buy crypto with dollars—and use Coinbase Wallet as their gateway to the wild world of Web3. To make this work, you have to get good at moving your assets between the two.

Thankfully, Coinbase made this part surprisingly painless. The tight integration between the exchange and the wallet is a huge plus, letting you fund your wallet without the usual nerve-wracking process of copying and pasting long addresses.

How to Transfer from Coinbase to Your Wallet

Think of sending crypto to your wallet as a simple "withdrawal" from your main Coinbase account. The connection between the two apps smooths out the process, but you still need to pay close attention to get it right.

- Open Coinbase Wallet and head over to the "Assets" tab.

- Tap the "Buy or transfer" button to get started.

- You'll see an option to "Buy or transfer from Coinbase." Select it to link up with your main account.

- Pick the exact crypto you want to move, like Ethereum or USDC.

- Enter the amount, review the details, and confirm the transfer.

Heads Up: This is important. Always, always double-check that you're sending your crypto on the correct network. A mistake here, like sending a token on an unsupported chain, could mean your funds are gone for good.

Cashing Out From Your Wallet

When it’s time to convert your crypto back into cash, you just do everything in reverse. Because Coinbase Wallet is non-custodial, it can’t directly connect to your bank account. You'll need to send your assets back to the main Coinbase exchange first.

To do this, you’ll grab your deposit address from the Coinbase platform for whatever crypto you’re sending. Then, open your Coinbase Wallet and kick off a "send" transaction, pasting that address as the destination.

Once the funds land in your exchange account, you can sell them for your local currency and cash out to your bank. It's a two-step dance, but it neatly bridges the gap between decentralized finance and the traditional banking system.

Got Questions? We’ve Got Answers.

Even after a deep dive, a few questions often pop up when comparing the main Coinbase platform and the Coinbase Wallet. Let's clear up some of the most common points of confusion.

Which Is Safer: Coinbase or Coinbase Wallet?

This is a classic "it depends" situation. Neither is automatically "safer" than the other—they just operate on completely different security philosophies.

The main Coinbase platform gives you institutional-grade security, meaning they use things like cold storage and have insurance policies in place. The trade-off? You're trusting them to keep your assets safe.

Coinbase Wallet, on the other hand, puts you in the driver's seat. You hold the keys, which means you eliminate the risk of an exchange hack affecting your funds. But that also means its safety is 100% on you. If you lose your secret recovery phrase, you’re out of luck.

Do I Have to Use Coinbase to Fund the Coinbase Wallet?

Not at all. Think of Coinbase Wallet as its own independent thing. It's a standalone, self-custody tool that can work with or without a main Coinbase account. You can send crypto to it from any other exchange or wallet you own.

Are the Coinbase App and Coinbase Wallet App the Same Thing?

Nope, they're two completely separate apps you'll find in the app store.

- The Coinbase app is your gateway to the centralized exchange for buying, selling, and holding crypto.

- The Coinbase Wallet app is your portal to the decentralized world of Web3, DeFi, and NFTs.

The Bottom Line: Your choice really comes down to what you want to do. For a straightforward way to invest in crypto with a big company's security behind it, the main Coinbase platform is the right call. If you're ready for full control and want to explore everything Web3 has to offer, Coinbase Wallet is built for you.

If you've lost access to your crypto wallet and need expert help, the team at Wallet Recovery AI specializes in securely restoring access to a wide range of wallets. Learn more about our AI-driven recovery services.

Leave a Reply